Question: Having a difficult time with these simple questions. What order should i proceed with when it comes to finding COGS inder Fifo and Lifo FIFO

Having a difficult time with these simple questions. What order should i proceed with when it comes to finding COGS inder Fifo and Lifo

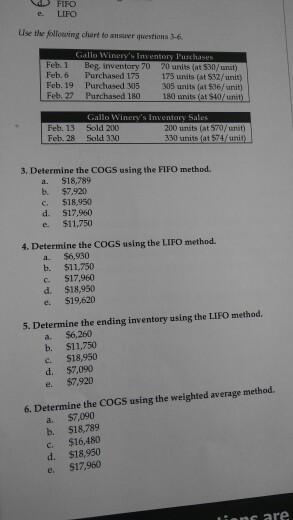

FIFO e. LIFO Use the following chert to answer questions 3-6. Feb. 1 Feb. 6 Beg, inventory 70 Purchased 70 units (at 530/unut) 175 175 units (at 532/unit) Feb. 19 Purchased 305 305 units (at 536/ unit) Feb. 27 Purchased 180 180 units (at $40/unithi Feb. 13 Feb. 28 Sold 200 Sold 330 200 units (at 570/unit) 330 units (at 574/unit) 3. Determine the COGS using the FIFO method. a. $18,789 b. $7,920 c. $18,950 d. $17,960 e $11,750 4. Determine the COGS using the LIFO method. a $6,930 b. $11,750 c. $17,960 d. $18,950 e. $19,620 5. Determine the ending inventory using the LIFO method. a. $6,260 b. $11,750 c. $18,950 d. $7,090 e. $7,92 6. Determine the COGS using the weighted average method. a. $7,090 b. $18,789 c. $16,480 d. $18,950 e. $17,960 are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts