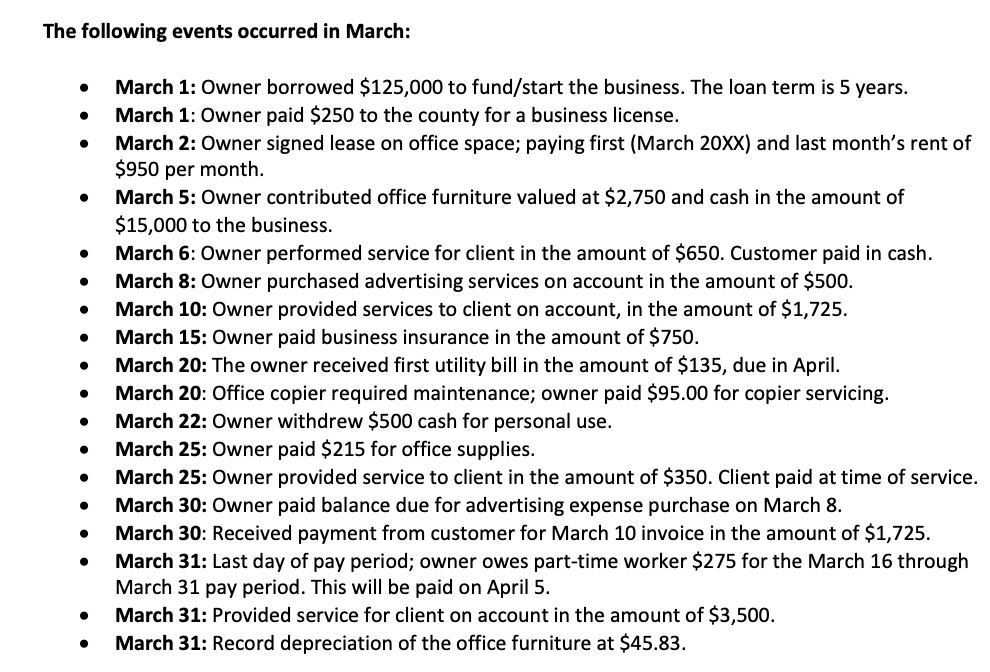

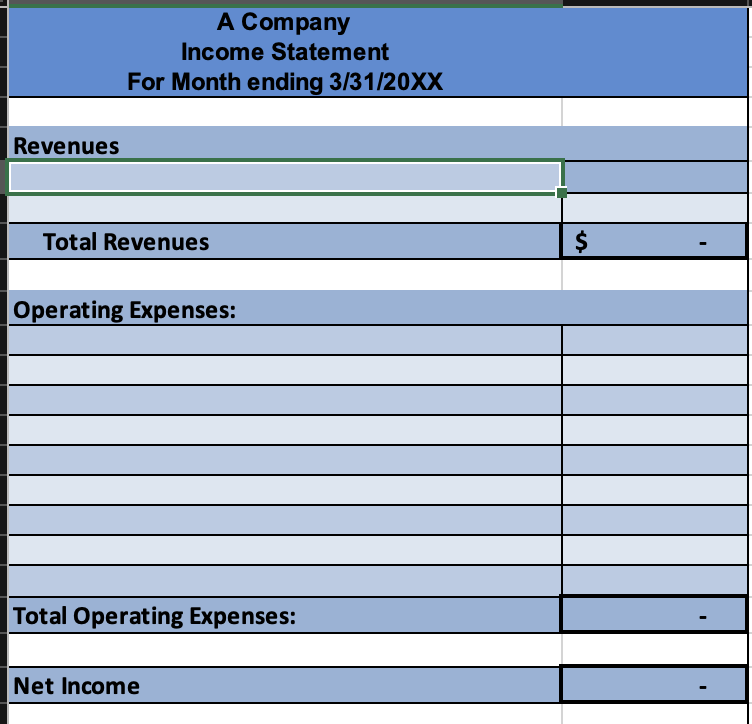

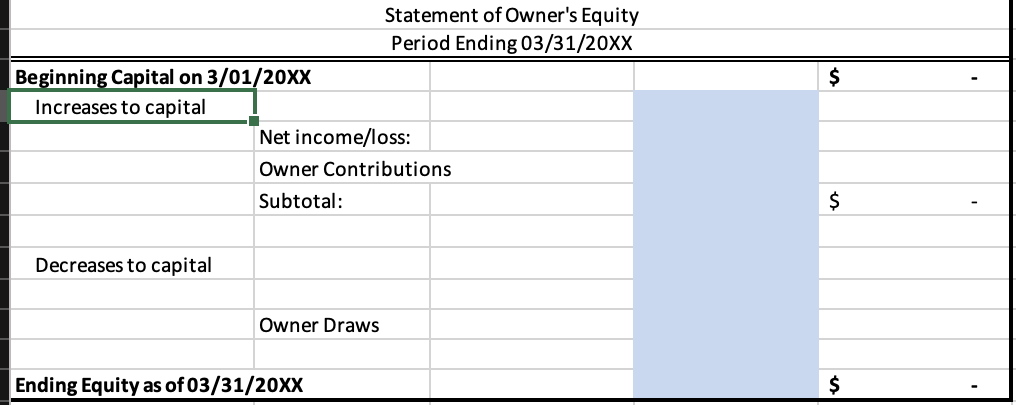

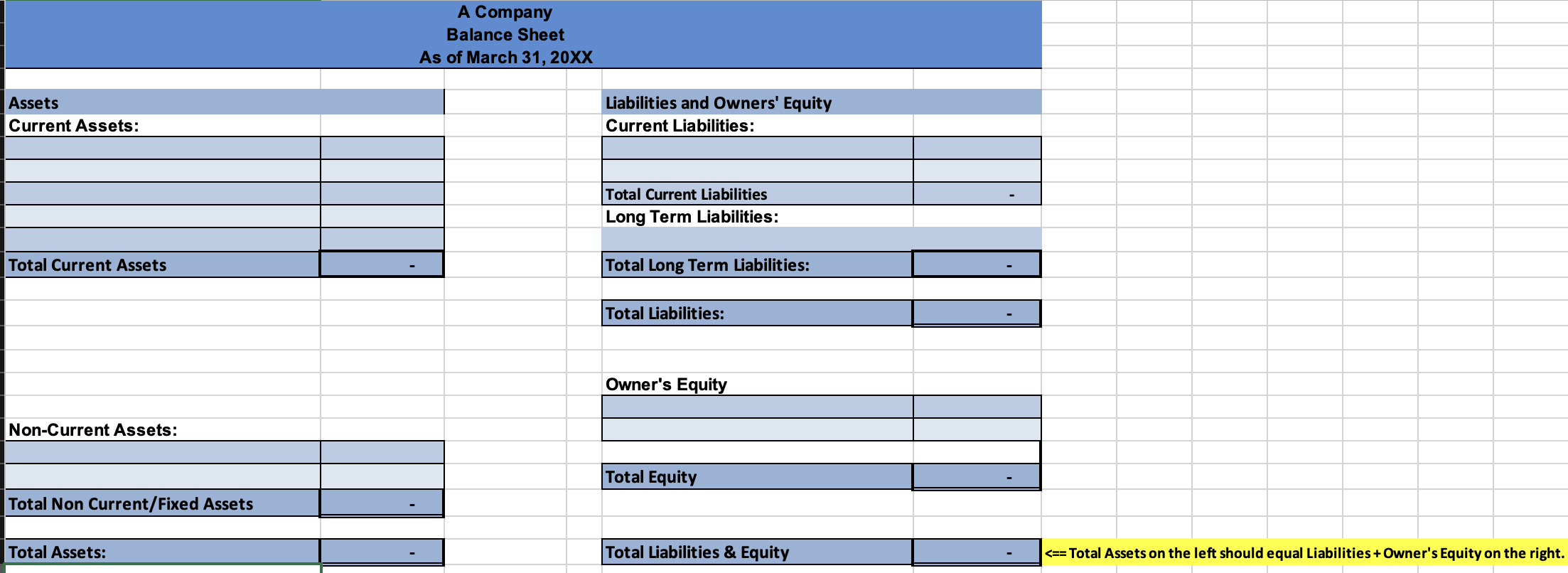

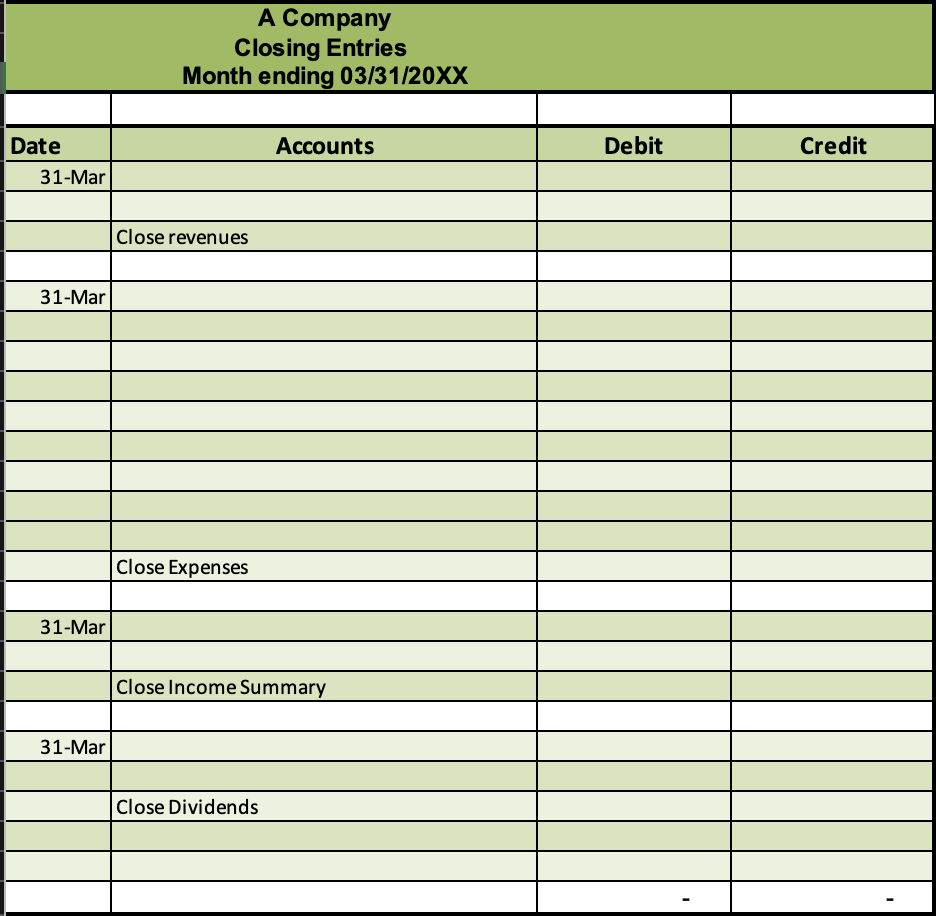

Question: Having a hard time using this example to fill these in. The following events occurred in March: March 1: Owner borrowed $125,000 to fund/start the

Having a hard time using this example to fill these in.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock