Question: having a hard understanding this . please help Save Assume that Crave Coffee Shop completed the following periodic inventory transactions for a line of merchandise

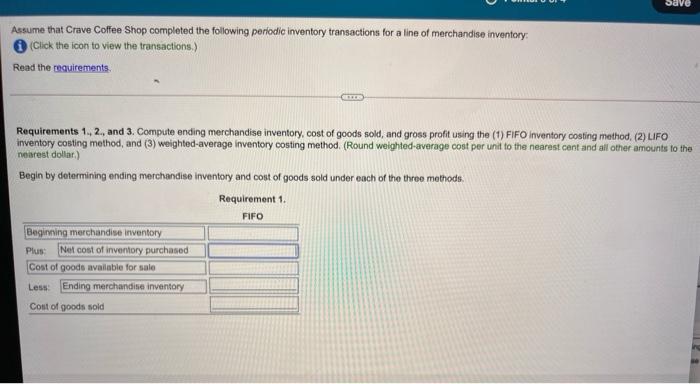

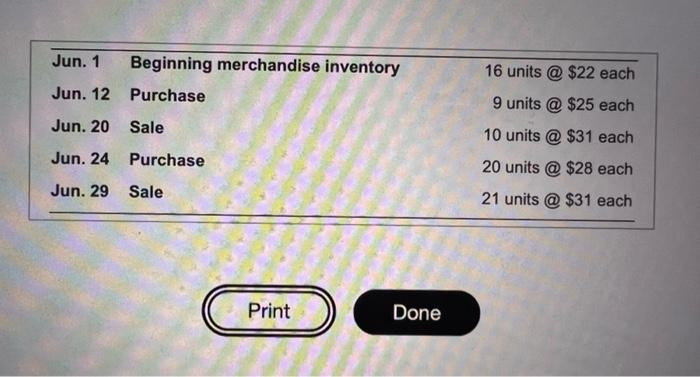

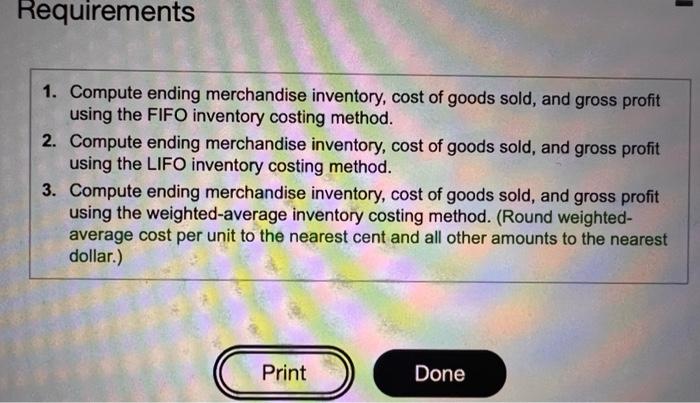

Save Assume that Crave Coffee Shop completed the following periodic inventory transactions for a line of merchandise inventory: (Click the icon to view the transactions.) Read the requirements CE Requirements 1., 2., and 3. Compute ending merchandise inventory, cost of goods sold, and gross profit using the (1) FIFO inventory costing method. (2) LIFO inventory costing method, and (3) weighted average inventory costing method. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar) Begin by determining ending merchandise Inventory and cost of goods sold under each of the three methods. Requirement 1. FIFO Beginning merchandise inventory Plus Netcost of inventory purchased Cost of goods available for sale Less Ending merchandise inventory Cost of goods sold Jun. 1 Beginning merchandise inventory Jun. 12 Purchase Jun. 20 Sale 16 units @ $22 each 9 units @ $25 each 10 units @ $31 each 20 units @ $28 each 21 units @ $31 each Jun. 24 Purchase Jun. 29 Sale Print Done Requirements 1. Compute ending merchandise inventory, cost of goods sold, and gross profit using the FIFO inventory costing method. 2. Compute ending merchandise inventory, cost of goods sold, and gross profit using the LIFO inventory costing method. 3. Compute ending merchandise inventory, cost of goods sold, and gross profit using the weighted average inventory costing method. (Round weighted- average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts