Question: having issues computing 4c... Bill Board must choose between two bonds: Bond A pays $90 annual interest with semiannual payment and has a market value

having issues computing 4c...

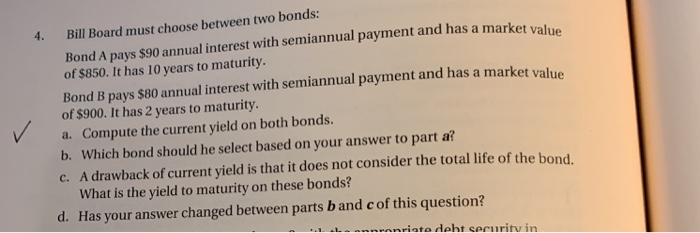

Bill Board must choose between two bonds: Bond A pays $90 annual interest with semiannual payment and has a market value of $850. It has 10 years to maturity Bond B pays $80 annual interest with semiannual payment and has a market value of $900. It has 2 years to maturity a. Compute the current yield on both bonds. b. Which bond should he select based on your answer to part a? c. A drawback of current yield is that it does not consider the total life of the bond What is the yield to maturity on these bonds? d. Has your answer changed between parts b and cof this question? 4

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock