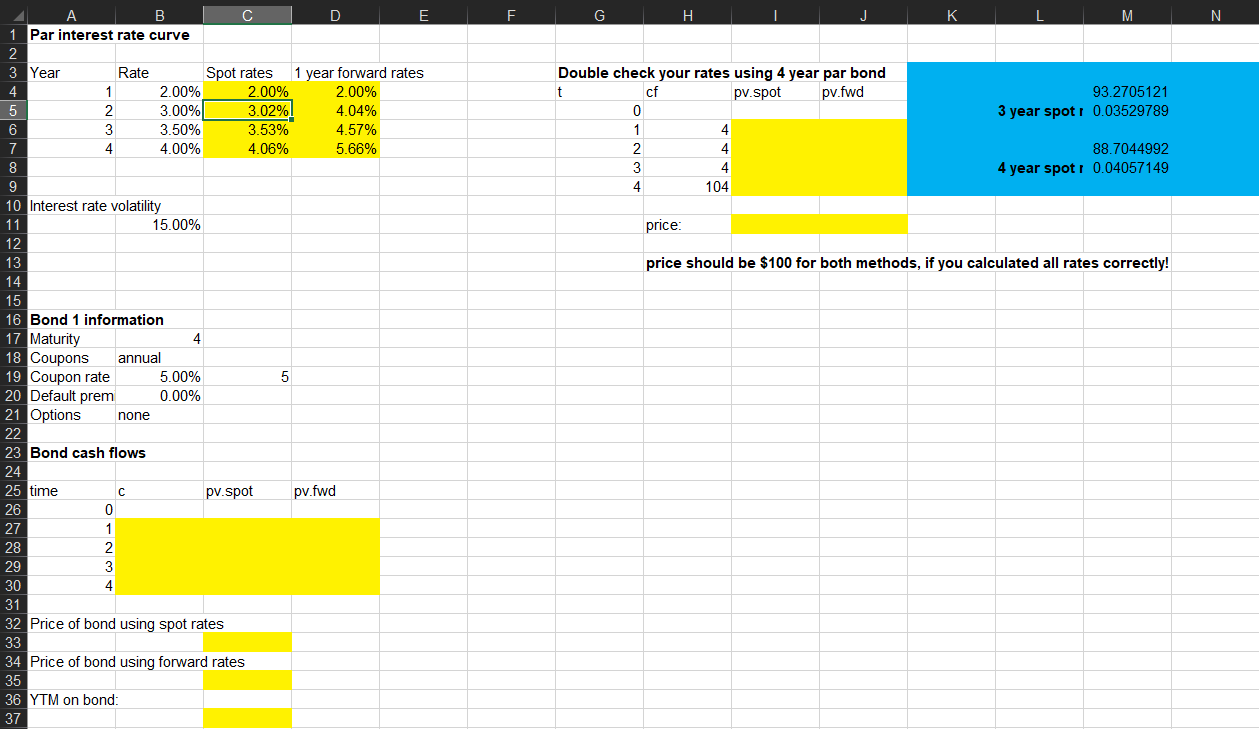

Question: Having issues finding out how to fill out the bond cash flows section. F G . J K L M N 93.2705121 3 year spot

Having issues finding out how to fill out the bond cash flows section.

F G . J K L M N 93.2705121 3 year spot 0.03529789 Double check your rates using 4 year par bond t cf pv.spot pv.fwd 0 1 4 2 4 3 4 4 104 88.7044992 4 year spotr 0.04057149 price: price should be $100 for both methods, if you calculated all rates correctly! A B D E 1 Par interest rate curve 2 3 Year Rate Spot rates 1 year forward rates 4 1 2.00% 2.00% 2.00% 5 2 3.00% 3.02% 4.04% 6 3 3.50% 3.53% 4.57% 7 4 4.00% 4.06% 5.66% 8 9 10 Interest rate volatility 11 15.00% 12 13 14 15 16 Bond 1 information 17 Maturity 4 18 Coupons annual 19 Coupon rate 5.00% 5 20 Default prem 0.00% 21 Options none 22 23 Bond cash flows 24 25 time pv.spot pv.fwd 26 0 27 1 28 2 29 3 30 4 31 32 Price of bond using spot rates 33 34 Price of bond using forward rates 35 36 YTM on bond: 37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts