Question: Having issues with 17-19. How do I do the math to find the answers? The table below presents schedules A and B. One of them

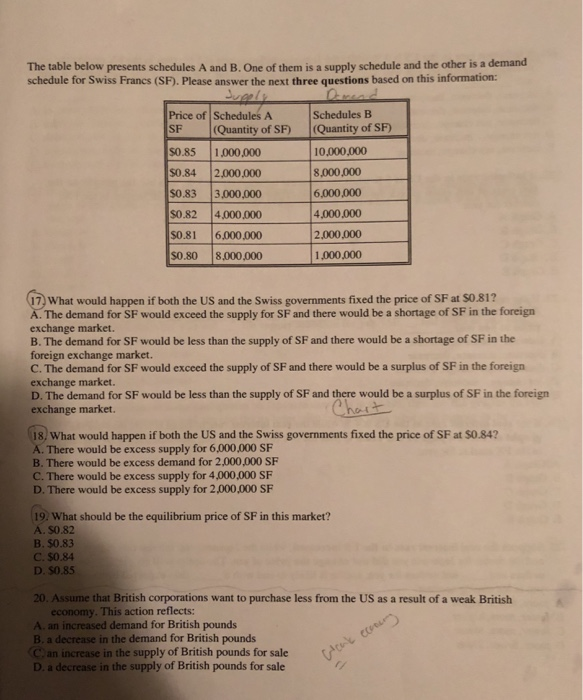

The table below presents schedules A and B. One of them is a supply schedule and the other is a demand schedule for Swiss Francs (SF). Please answer the next three questions based on this information: Price of Schedules A SF (Quantity of SF) (Quantity of SF) S0.85 1,000,000 S0.84 2000.000 0.83 3,000,000 $0.82 4,000,000 $0.81 6,000,000 S0.80 8,000,000 Schedules B 10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 1,000,000 7 What would happen if both the US and the Swiss governments fixed the price of SF at $0.81? The demand for SF would exceed the supply for SF and there would be a shortage of SF in the foreign exchange market. B. The demand for SF would be less than the supply of SF and there would be a shortage of SF in the foreign exchange market. C. The demand for SF would exceed the supply of SF and there would be a surplus of SF in the foreign exchange market. D. The demand for SF would be less than the supply of SF and there would be a surplus of SF in the foreign exchange market. 18/ What would happen if both the US and the Swiss governments fixed the price of SF at $0.84? A. There would be excess supply for 6,000,000 SF B. There would be excess demand for 2,000,000 SF C. There would be excess supply for 4,000,000 SF D. There would be excess supply for 2,000,000 SF 19. What should be the equilibrium price of SF in this market? A. $0.82 B. $0.83 C. $0.84 D. 50.85 20. Assume that British corporations want to purchase less from the US as a result of a weak British economy. This action reflects: A. an increased demand for British pounds B. a decrease in the demand for British pounds C an increase in the supply of British pounds for sale D a decrease in the supply of British pounds for sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts