Question: Having issues with question C and Question F, since following the right procedure of the sample answer however keep getting the wrong answer, could you

Having issues with question C and Question F, since following the right procedure of the sample answer however keep getting the wrong answer, could you please finish the remaining question thank you so much. Really appreciate, and please rounded to two decimal places for C and F.

Having issues with question C and Question F, since following the right procedure of the sample answer however keep getting the wrong answer, could you please finish the remaining question thank you so much. Really appreciate, and please rounded to two decimal places for C and F.

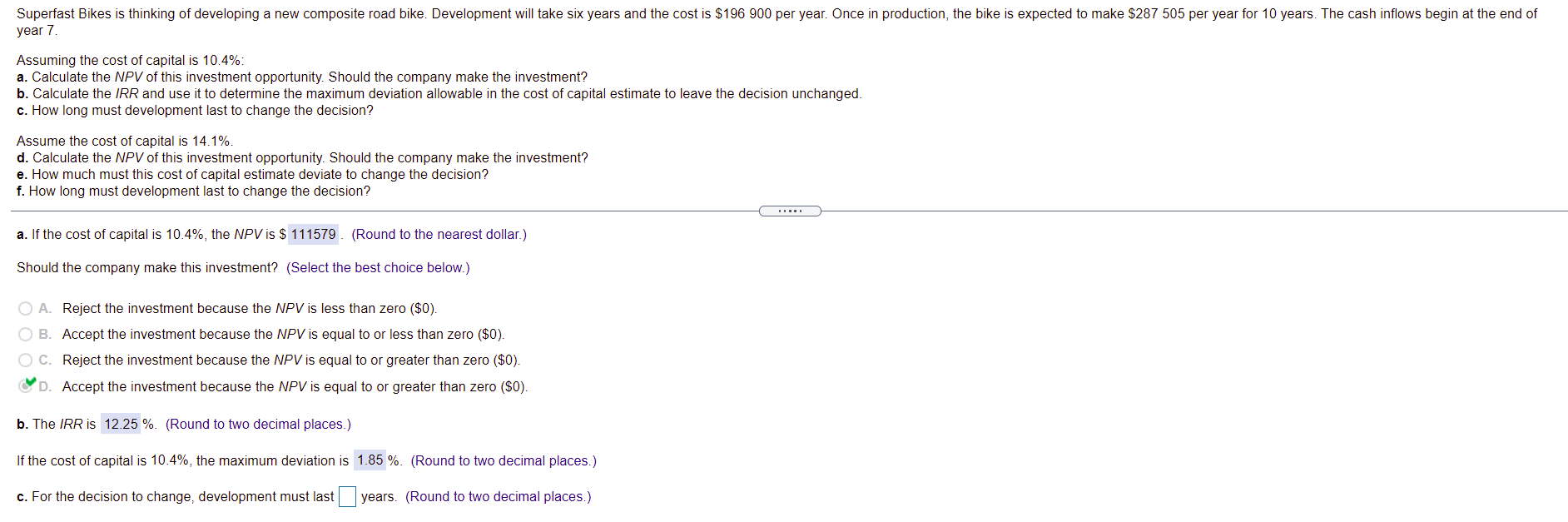

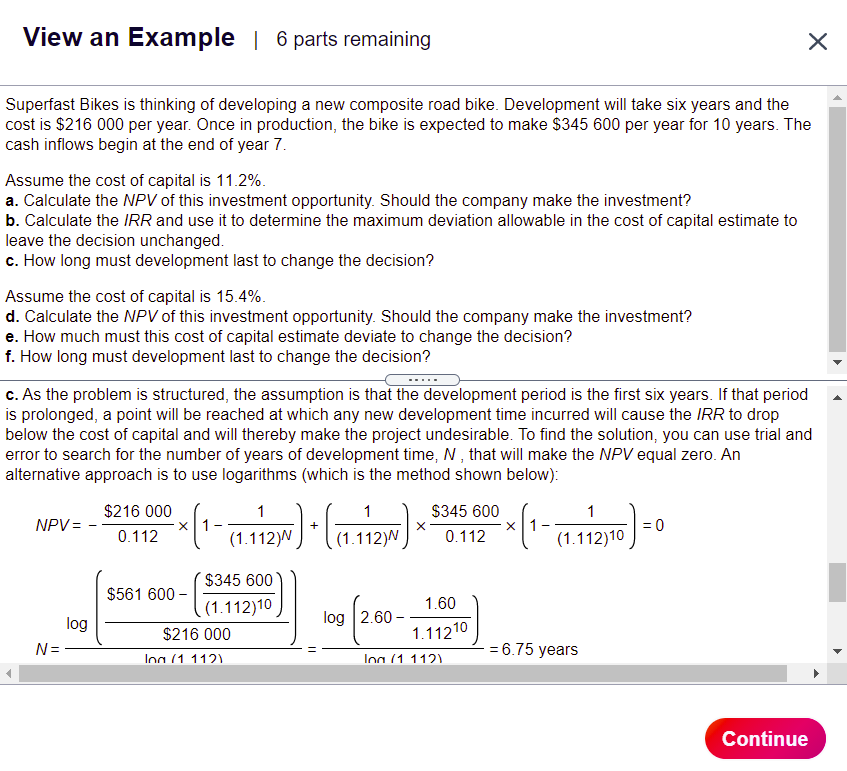

Superfast Bikes is thinking of developing a new composite road bike. Development will take six years and the cost is $196 900 per year. Once in production, the bike is expected to make $287 505 per year for 10 years. The cash inflows begin at the end of year 7 Assuming the cost of capital is 10.4%. a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. c. How long must development last to change the decision? Assume the cost of capital is 14.1%. d. Calculate the NPV of this investment opportunity. Should the company make the investment? e. How much must this cost of capital estimate deviate to change the decision? f. How long must development last to change the decision? a. If the cost of capital is 10.4%, the NPV is $ 111579. (Round to the nearest dollar.) Should the company make this investment? (Select the best choice below.) O A. Reject the investment because the NPV is less than zero ($0). OB. Accept the investment because the NPV is equal to or less than zero ($0). O C. Reject the investment because the NPV is equal to or greater than zero ($0). CD. Accept the investment because the NPV is equal to or greater than zero ($0). b. The IRR is 12.25 %. (Round to two decimal places.) If the cost of capital is 10.4%, the maximum deviation is 1.85 %. (Round to two decimal places.) c. For the decision to change, development must last years. (Round to two decimal places.) View an Example | 6 parts remaining Superfast Bikes is thinking of developing a new composite road bike. Development will take six years and the cost is $216 000 per year. Once in production, the bike is expected to make $345 600 per year for 10 years. The cash inflows begin at the end of year 7. Assume the cost of capital is 11.2%. a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. c. How long must development last to change the decision? Assume the cost of capital is 15.4%. d. Calculate the NPV of this investment opportunity. Should the company make the investment? e. How much must this cost of capital estimate deviate to change the decision? f. How long must development last to change the decision? c. As the problem is structured, the assumption is that the development period is the first six years. If that period is prolonged, a point will be reached at which any new development time incurred will cause the IRR to drop below the cost of capital and will thereby make the project undesirable. To find the solution, you can use trial and error to search for the number of years of development time, N, that will make the NPV equal zero. An alternative approach is to use logarithms (which is the method shown below): $216 000 1 1 $345 600 1 NPV = X1 x 1 = 0 0.112 (1.112)N (1.112)N 0.112 (1.112) 10 ( -- 4,1270) ( -- 10.12%). Cat (1.1123) - Sony (9.13 $345 600 $561 600 (1.112)10 $216 000 1.60 log 2.60 log N= 1.11210 - 6.75 years loa (1 1121 Ion (1 112) Continue Superfast Bikes is thinking of developing a new composite road bike. Development will take six years and the cost is $196 900 per year. Once in production, the bike is expected to make $287 505 per year for 10 years. The cash inflows begin at the end of year 7 Assuming the cost of capital is 10.4%. a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. c. How long must development last to change the decision? Assume the cost of capital is 14.1%. d. Calculate the NPV of this investment opportunity. Should the company make the investment? e. How much must this cost of capital estimate deviate to change the decision? f. How long must development last to change the decision? a. If the cost of capital is 10.4%, the NPV is $ 111579. (Round to the nearest dollar.) Should the company make this investment? (Select the best choice below.) O A. Reject the investment because the NPV is less than zero ($0). OB. Accept the investment because the NPV is equal to or less than zero ($0). O C. Reject the investment because the NPV is equal to or greater than zero ($0). CD. Accept the investment because the NPV is equal to or greater than zero ($0). b. The IRR is 12.25 %. (Round to two decimal places.) If the cost of capital is 10.4%, the maximum deviation is 1.85 %. (Round to two decimal places.) c. For the decision to change, development must last years. (Round to two decimal places.) View an Example | 6 parts remaining Superfast Bikes is thinking of developing a new composite road bike. Development will take six years and the cost is $216 000 per year. Once in production, the bike is expected to make $345 600 per year for 10 years. The cash inflows begin at the end of year 7. Assume the cost of capital is 11.2%. a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. c. How long must development last to change the decision? Assume the cost of capital is 15.4%. d. Calculate the NPV of this investment opportunity. Should the company make the investment? e. How much must this cost of capital estimate deviate to change the decision? f. How long must development last to change the decision? c. As the problem is structured, the assumption is that the development period is the first six years. If that period is prolonged, a point will be reached at which any new development time incurred will cause the IRR to drop below the cost of capital and will thereby make the project undesirable. To find the solution, you can use trial and error to search for the number of years of development time, N, that will make the NPV equal zero. An alternative approach is to use logarithms (which is the method shown below): $216 000 1 1 $345 600 1 NPV = X1 x 1 = 0 0.112 (1.112)N (1.112)N 0.112 (1.112) 10 ( -- 4,1270) ( -- 10.12%). Cat (1.1123) - Sony (9.13 $345 600 $561 600 (1.112)10 $216 000 1.60 log 2.60 log N= 1.11210 - 6.75 years loa (1 1121 Ion (1 112) Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts