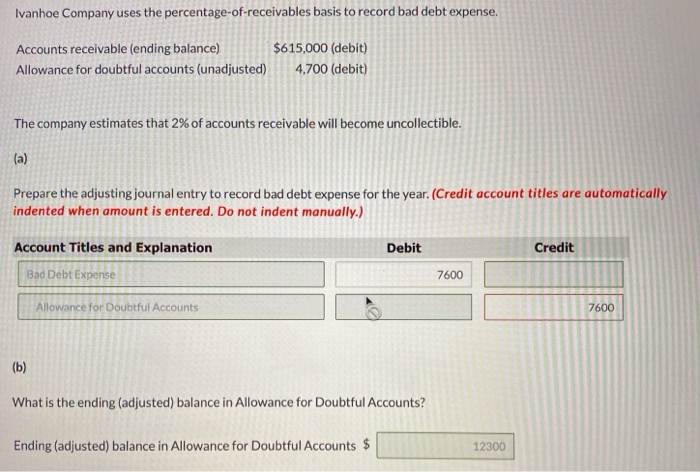

Question: having teouble with this table. been sruck for a minute now any help would be appreciated! Ivanhoe Company uses the percentage-of-receivables basis to record bad

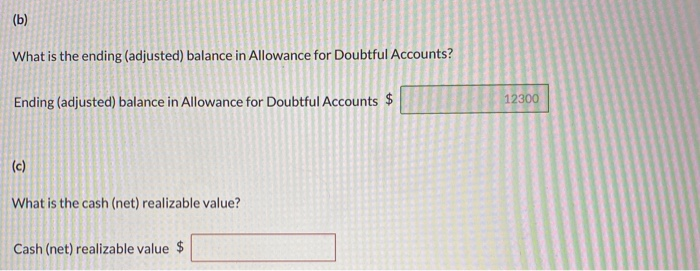

Ivanhoe Company uses the percentage-of-receivables basis to record bad debt expense. Accounts receivable (ending balance) $615,000 (debit) Allowance for doubtful accounts (unadjusted) 4,700 (debit) The company estimates that 2% of accounts receivable will become uncollectible. (a) Prepare the adjusting journal entry to record bad debt expense for the year. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Account Titles and Explanation Bad Debt Expense Allowance for Doubtful Accounts 7600 What is the ending (adjusted) balance in Allowance for Doubtful Accounts? Ending (adjusted) balance in Allowance for Doubtful Accounts $ 12300 ubtful A What is the ending (adjusted) balance in Allowance for Do Ending (adjusted) balance in Allowance for Doubtful Accounts What is the cash (net) realizable value? Cash (net) realizable value $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts