Question: Having trouble figuring out how to do this problem? 3-15 supplies expense accounts at December 31, after adjusting operations, are shown in the following entries

Having trouble figuring out how to do this problem? 3-15

3-15

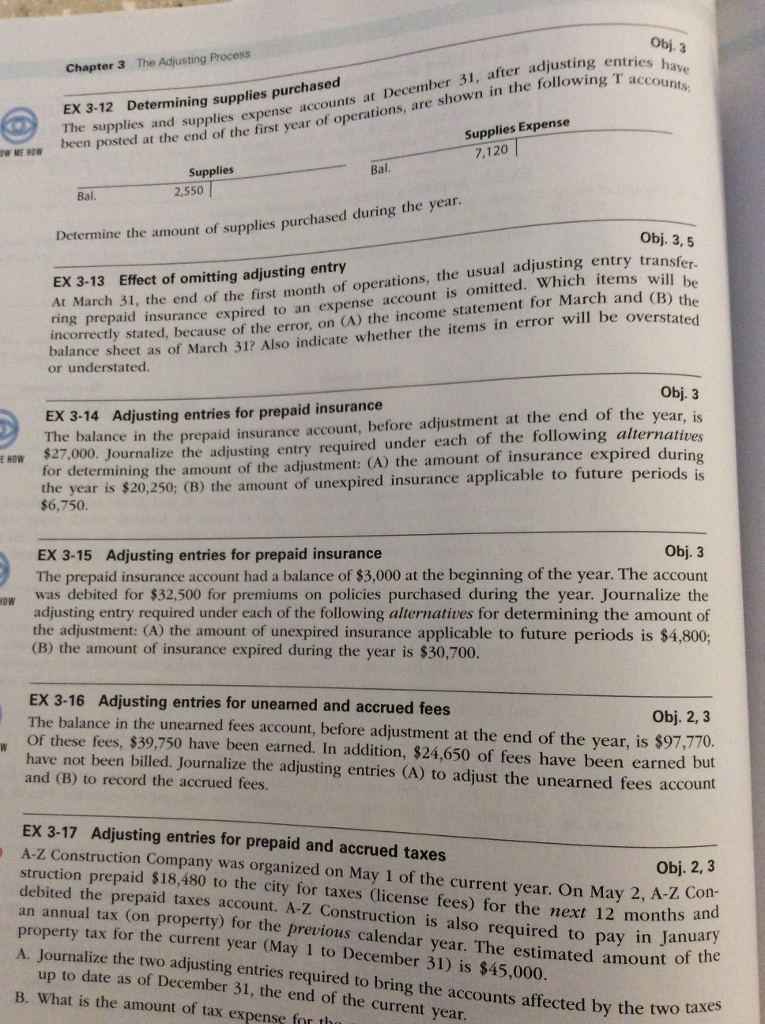

supplies expense accounts at December 31, after adjusting operations, are shown in the following entries have T accounts Chapter 3 The Adjusting Process EX 3-12 Determining supplies purchased The supplies and supplies ex been posted at the end of the first year of Supplies Expense W ME HOW 7,120 Supplies 2,550 Bal. Determine the amount of supplies purchased during the year EX 3-13 Effect of omitting adjusting entry At March 31, the end of the first month of operations, the usual adjusting entry trans Ob prepaid insurance expired to an expense account is omitted. Which items will ed, because of the error, on (A) the income statement for March and (B) t incorrectly stat balance sheet as or understated. of March 31? Also indicate whether the items in error will be ov EX 3-14 Adjusting entries for prepaid insurance The balance in the prepaid insurance account, before adjustment at the end of the year, is $27,000. Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (A) the amount of insurance expired durin EOW year is $20,250, (B) the amount of unexpired insurance applicable to future periods is $6,750 Obj. 3 EX 3-15 Adjusting entries for prepaid insurance The prepaid insurance account had a balance of $3,000 at the beginning of the year. The account s debited for $32,500 for premiums on policies purchased during the year. Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (A) the amount of unexpired insurance applicable to future periods is $4,800 wa (B) the amount of insurance expired during the year is $30,700 EX 3-16 Adjusting entries for unearned and accrued fees The balance in the unearned fees account, before adjustment at the end of the year, is $97,770 Of these fees, $39,750 have been earned. In addition, $24,650 of fees have been earned but have not been billed. Journalize the adjusting entries (A) to adjust the unearned fees account and (B) to record the accrued fees. Obj. 2, 3 x 3-17 Adjusting entries for prepaid and accrued taxes A-Z Construction Company was organized on May 1 of the current year. On May 2 ction prepaid $18,480 to the city for taxes (license fees) for the next 12 months a debited the prepaid taxes account. A-Z Construction is also required to pay in Janua n annual tax Con property) for the previous calendar year. The estimated amount o property tax for the current year (May 1 to December 31) is $45,000 A. Journalize the two adjusting entries required to bring the accounts affected by the two taxes Obj. 2, 3 , A-Z Con stru up to date as of December 31, the end of the current year B. What is the amount of tax expense for th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts