Question: Having trouble preparing adjusting and closing entries for this question It has been several years since Macon CPAs opened for business. The company has grown,

Having trouble preparing adjusting and closing entries for this question

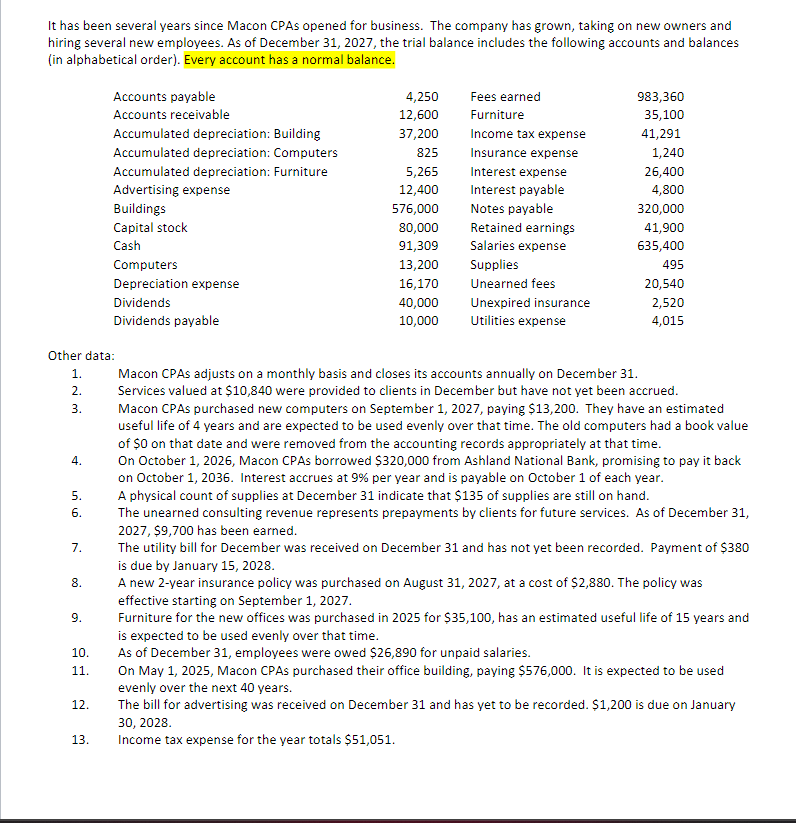

It has been several years since Macon CPAs opened for business. The company has grown, taking on new owners and hiring several new employees. As of December 31,2027, the trial balance includes the following accounts and balances (in alphabetical order). Every account has a normal balance. Other data: 1. Macon CPAs adjusts on a monthly basis and closes its accounts annually on December 31 . 2. Services valued at $10,840 were provided to clients in December but have not yet been accrued. 3. Macon CPAs purchased new computers on September 1,2027, paying $13,200. They have an estimated useful life of 4 years and are expected to be used evenly over that time. The old computers had a book value of $0 on that date and were removed from the accounting records appropriately at that time. 4. On October 1, 2026, Macon CPAs borrowed $320,000 from Ashland National Bank, promising to pay it back on October 1, 2036. Interest accrues at 9% per year and is payable on October 1 of each year. 5. A physical count of supplies at December 31 indicate that $135 of supplies are still on hand. 6. The unearned consulting revenue represents prepayments by clients for future services. As of December 31 , 2027,$9,700 has been earned. 7. The utility bill for December was received on December 31 and has not yet been recorded. Payment of $380 is due by January 15,2028. 8. A new 2-year insurance policy was purchased on August 31, 2027, at a cost of $2,880. The policy was effective starting on September 1,2027. 9. Furniture for the new offices was purchased in 2025 for $35,100, has an estimated useful life of 15 years and is expected to be used evenly over that time. 10. As of December 31, employees were owed $26,890 for unpaid salaries. 11. On May 1, 2025, Macon CPAs purchased their office building, paying $576,000. It is expected to be used evenly over the next 40 years. 12. The bill for advertising was received on December 31 and has yet to be recorded. $1,200 is due on January 30,2028. 13. Income tax expense for the year totals $51,051

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts