Question: Having trouble with these, Can someone please help! Exercise 8-1 (Algo) Schedule of Expected Cash Collections [LO8-2] Silver Company makes a product that is very

![Schedule of Expected Cash Collections [LO8-2] Silver Company makes a product that](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717e995df127_3736717e995696cb.jpg)

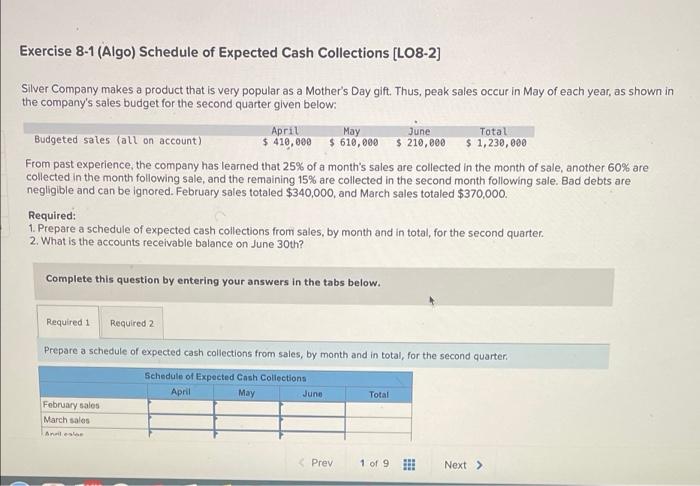

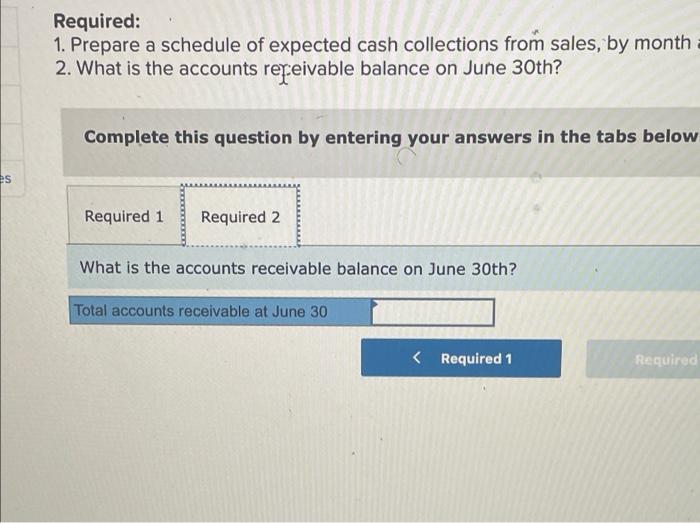

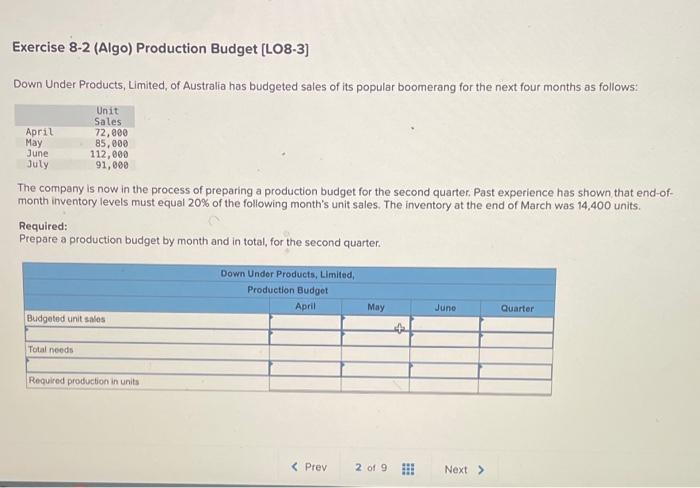

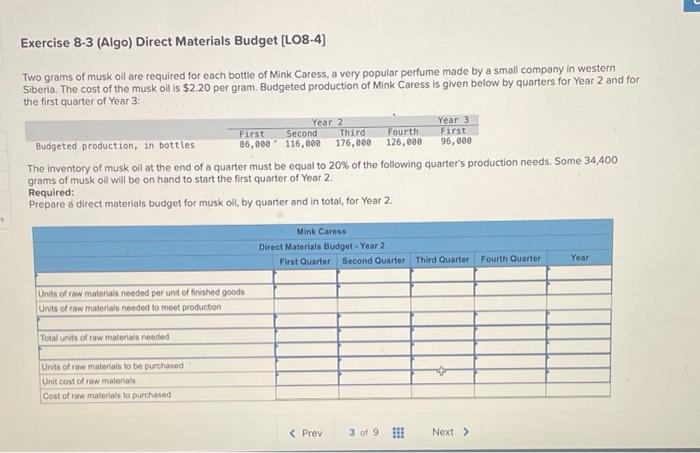

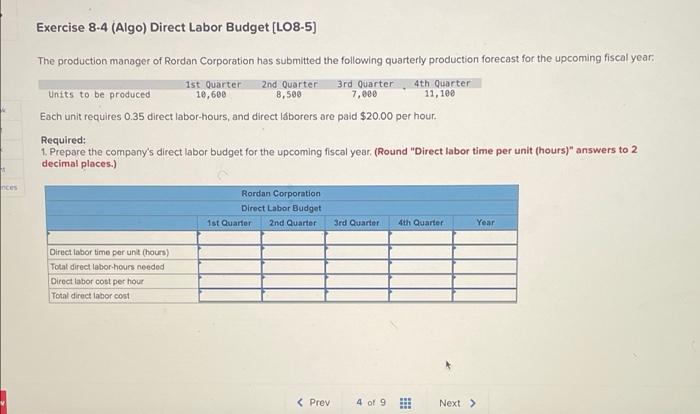

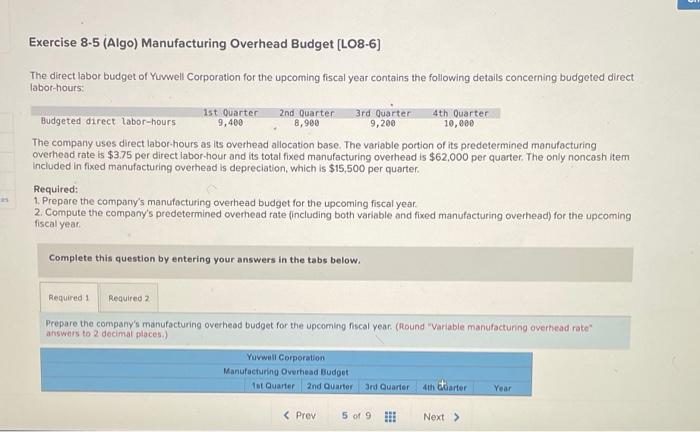

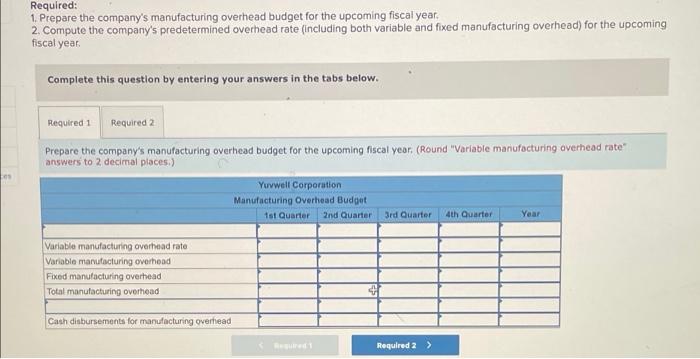

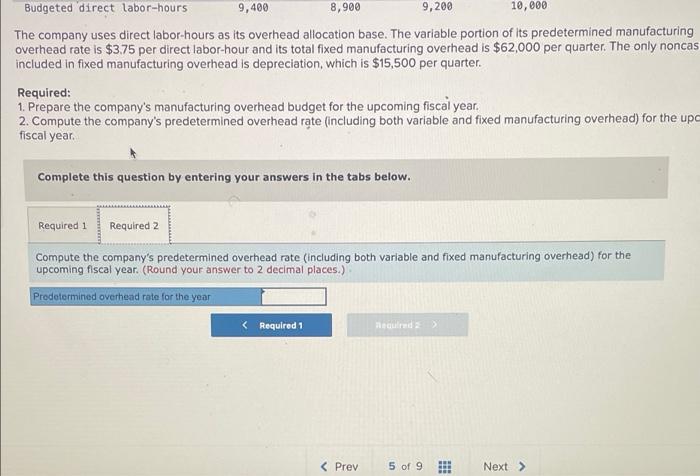

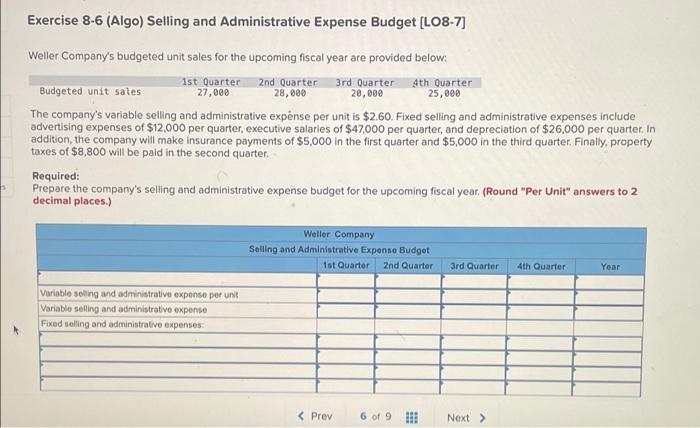

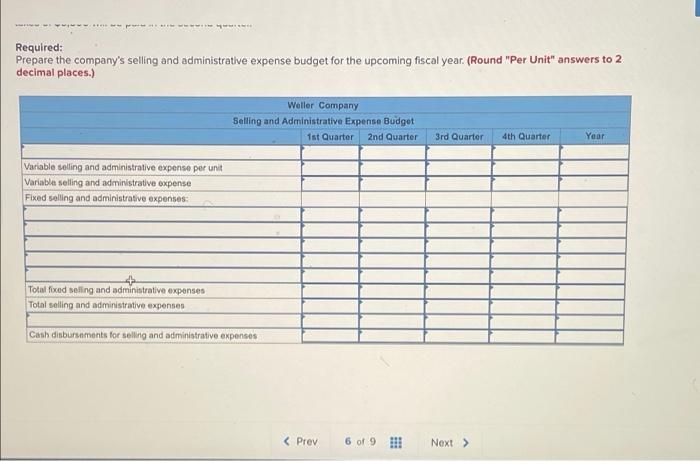

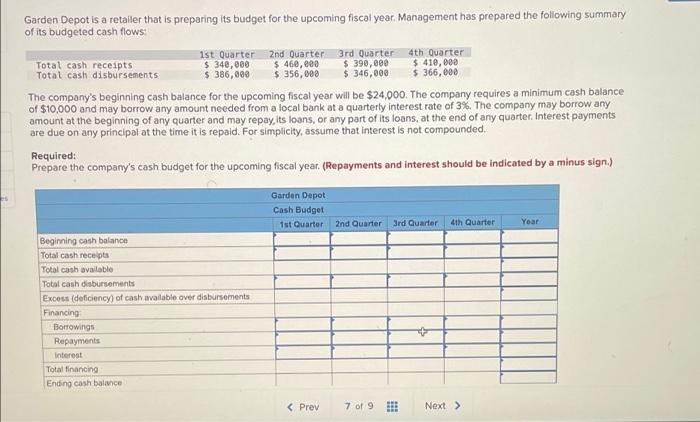

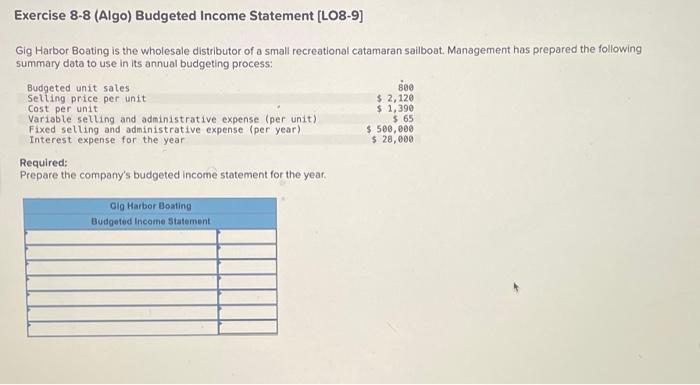

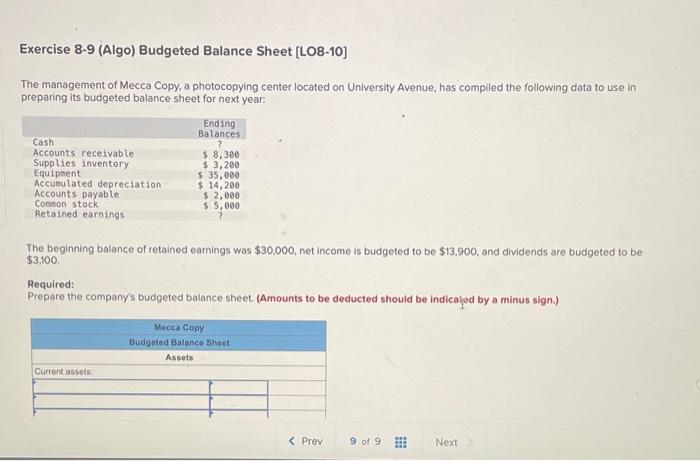

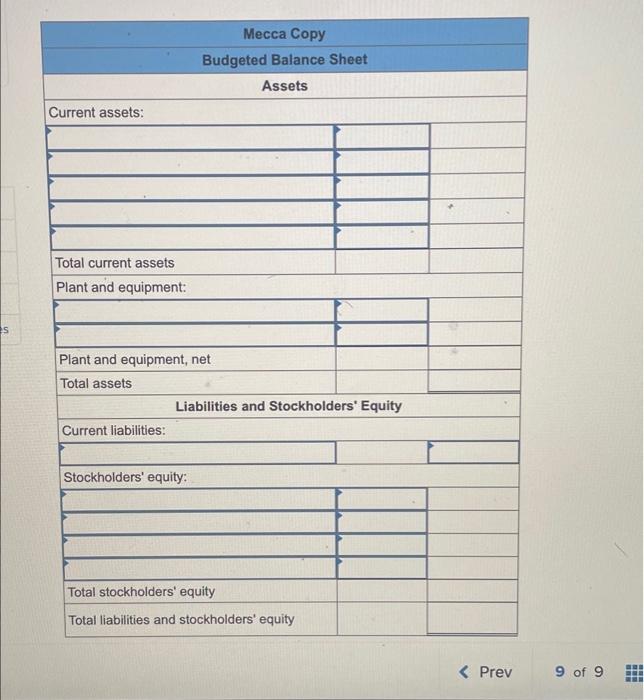

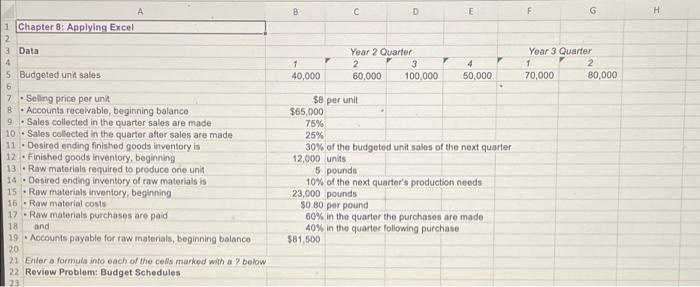

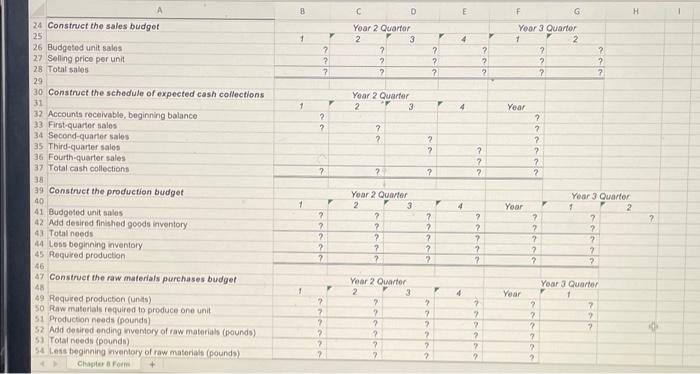

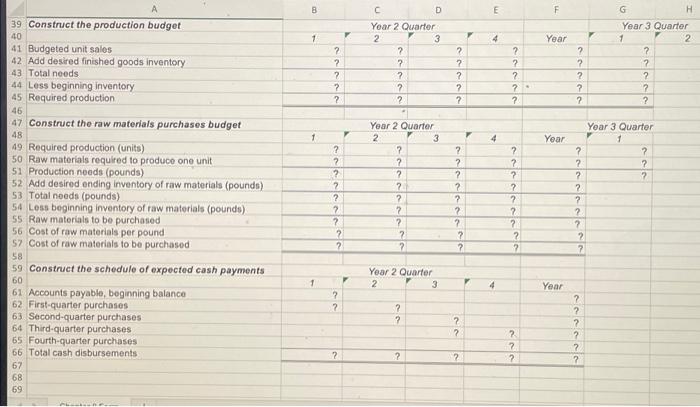

Exercise 8-1 (Algo) Schedule of Expected Cash Collections [LO8-2] Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur in May of each year, as shown in the company's sales budget for the second quarter given below: April May June Total Budgeted sales (all on account) $ 410,000 $610,000 $ 210,000 $ 1,230,000 From past experience, the company has learned that 25% of a month's sales are collected in the month of sale, another 60% are collected in the month following sale, and the remaining 15% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $340,000, and March sales totaled $370,000. Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter Schedule of Expected Cash Collections April May June Total February sales March sales Anal Prev 1 of 9 Next > negligible and can be ignored. February sales totaled $340,000, and March Sales to Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th? Complete this question by entering your answers in the tabs below. Required 1 Required 2 nces Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. Schedule of Expected Cash Collections April May June Total February sales March sales April sales May sales June sales Total cash collections Required 2 > Required: 1. Prepare a schedule of expected cash collections from sales, by month = 2. What is the accounts receivable balance on June 30th? Complete this question by entering your answers in the tabs below es Required 1 Required 2 What is the accounts receivable balance on June 30th? Total accounts receivable at June 30 Exercise 8-3 (Algo) Direct Materials Budget (LO8-4) Two grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberio. The cost of the musk oil is $2.20 per gram, Budgeted production of Mink Caress is given below by quarters for Year 2 and for the first quarter of Year 3: Year 2 Year 3 First Second Third Fourth First Budgeted production, in bottles 36,000 116,000 176,000 126,000 96,000 The inventory of muskoll at the end of a quarter must be equal to 20% of the following quarter's production needs. Some 34,400 grams of musk oil will be on hand to start the first quarter of Year 2 Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2. Mink Caress Direct Materials Budget - Year 2 First Quarter Second Quarter Third Quarter Fourth Quarter Year Units of raw materials needed per unit of finished goods Units of raw materiais needed to meet production Total units of raw materials needed Units of raw materials to be purchased Unit cost of raw materials Cost of raw materials to purchased Exercise 8-4 (Algo) Direct Labor Budget [LO8-5) The production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter units to be produced 10,600 8,500 7,000 11,100 Each unit requires 0.35 direct labor-hours, and direct laborers are paid $20.00 per hour. Required: 1. Prepare the company's direct labor budget for the upcoming fiscal year. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) inces Rordan Corporation Direct Labor Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Total direct labor cost Exercise 8-5 (Algo) Manufacturing Overhead Budget (L08-6) 9,400 10,000 The direct labor budget of Yuwwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Budgeted direct labor-hours 8,900 9,200 The company uses direct labor hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $3.75 per direct labor-hour and its total fixed manufacturing overhead is $62,000 per quarter. The only noncosh item Included in fixed manufacturing overhead is depreciation, which is $15,500 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year Complete this question by entering your answers in the tabs below. Required Required 2 Prepare the company's manufacturing overhead budget for the upcoming facal year. (Round "Variable manufacturing overhead rate" answers to 2 decimal places) Yuvwell Corporation Manufacturing Overhead Budget 1st Quarter 2nd Quarter 3rd Quarter din carter Year Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year, 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's manufacturing overhead budget for the upcoming fiscal year. (Round "Variable manufacturing overhead rate" answers to 2 decimal places.) Yuvwell Corporation Manufacturing Overhead Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Variable manufacturing overhead rate Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Cash disbursements for manufacturing overhead Required 2 > Budgeted direct labor-hours 9,400 8,900 9,200 10,000 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $3.75 per direct labor-hour and its total fixed manufacturing overhead is $62,000 per quarter. The only noncas included in fixed manufacturing overhead is depreciation, which is $15,500 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upc fiscal year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. (Round your answer to 2 decimal places.) Prodetermined overhead rate for the year BE Exercise 8-6 (Algo) Selling and Administrative Expense Budget (LO8-7) Weller Company's budgeted unit sales for the upcoming fiscal year are provided below: Ist Quarter 2nd Quarter 3rd Quarter Ath Quarter Budgeted unit sales 27,000 28,000 20,000 25,000 The company's variable selling and administrative expense per unit is $2.60. Fixed selling and administrative expenses include advertising expenses of $12,000 per quarter, executive salaries of $47,000 per quarter, and depreciation of $26,000 per quarter. In addition, the company will make insurance payments of $5,000 in the first quarter and $5,000 in the third quarter. Finally, property taxes of $8,800 will be paid in the second quarter. Required: Prepare the company's selling and administrative expense budget for the upcoming fiscal year. (Round "Per Unit" answers to 2 decimal places.) Weller Company Selling and Administrative Expense Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Variable selling and administrative expenso per unit Variable selling and administrative expense Fixed selling and administrative expenses Required: Prepare the company's selling and administrative expense budget for the upcoming fiscal year. (Round "Per Unit" answers to 2 decimal places.) Woller Company Selling and Administrative Expense Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Variable selling and administrative expense per unit Variable selling and administrative expense Fixed selling and administrative expenses + Total fixed selling and administrative expenses Total selling and administrative expenses Cash disbursements for selling and administrative expenses Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total cash receipts $ 340,000 $ 460,000 $ 390,000 $ 410,000 Total cash disbursements $ 386,000 $ 356,000 $ 346,000 $366,000 The company's beginning cash balance for the upcoming fiscal year will be $24,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay, its loans, or any part of its loons, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments and interest should be indicated by a minus sign) Garden Depot Cash Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Beginning cash balance Total cash receipts Total cash available Total cash disbursements Excos (deficiency) of cash available over disbursements Financing Borrowings Repayments Interest Total financing Ending cash balance Exercise 8-8 (Algo) Budgeted Income Statement [LO8-9) Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales 800 Selling price per unit $ 2,120 Cost per unit $ 1,390 Variable selling and administrative expense (per unit) Fixed selling and administrative expense (per year) $ 500,000 Interest expense for the year $ 28,000 Required: Prepare the company's budgeted income statement for the year. $ 65 Gig Harbor Boating Budgeted Income Statement Exercise 8-9 (Algo) Budgeted Balance Sheet [LO8-10) The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year Ending Balances Cash 7 Accounts receivable $ 8,300 Supplies inventory $ 3,200 Equipment $ 35,000 Accumulated depreciation $ 14,200 Accounts payable $ 2,000 Common stock $5,000 Retained earnings The beginning balance of retained earnings was $30,000, net Income is budgeted to be $13,900, and dividends are budgeted to be $3,100 Required: Prepare the company's budgeted balance sheet. (Amounts to be deducted should be indicaged by a minus sign.) Mecca Copy Budgeted Balance Sheet Assets Current assets A B D E F G I 1 Year 2 Quarter 2 3 60,000 100,000 Year 3 Quarter 1 2 70,000 80,000 4 50,000 40,000 1 Chapter 8: Applying Excel 2 3 Data 4 5 Budgeted unit sales 6 7 Soling price per unit 8. Accounts receivable, beginning balance 9. Sales collected in the quarter sales are made 10. Sales collected in the quarter after sales are made 11. Desired ending finished goods inventory is 12 . Finished goods inventory, beginning 13 Raw materials required to produce one unit 14. Desired ending inventory of raw materials is 15 Raw materials inventory, beginning 16 - Raw material costs 17. Raw materials purchases are paid 18 and 19 Accounts payable for raw materials, beginning balance 20 21 Enter a formule into each of the cells marked with a below 22 Review Problem: Budget Schedules 23 $8 per unit $65,000 75% 25% 30% of the budgeted unit solos of the next quarter 12.000 units 5 pounds 10% of the next quarter's production needs 23,000 pounds $0.80 por pound 60% in the quarter the purchases are made 40% in the quarter following purchase $81,500 8 D E F G H 1 4 2 ? ? Year 2 Quarter 2 3 2 ? 2 ? 2 ? 2 2 2 Year 3 Quarter 1 2 2 2 ? 2 2 2 Year 2 Quarter 2 3 1 4 Year 2 ? 3 2 2 ? 2 2 2 2 ? 2 ? ? ? ? ? 24 Construct the sales budget 25 26 Budgeted unit salos 27 Selling price per unit 28 Total sales 29 30 Construct the schedule of expected cash collections 31 32 Accounts receivable, beginning balance 33 First quarter sales 34 Second quarter sales 35 Third-quarter sales 36 Fourth quarter sales 37 Total cash collections 38 39 Construct the production budget 40 41 Budgeted unit salos 42. Add desired finished goods inventory 41 Total needs 44 Loss beginning inventory 45 Required production 46 47 Construct the raw materials purchases budget 48 49 Required production (units) 50 Raw materials required to produce one unit 51 Production needs (pounds) 52 Add desired ending inventory of raw materials (pounds) 51 Total needs (pounds) 54 Less beginning viventory of raw materials (pounds) Chapter Form 4 Year Year 3 Quarter 2 7 2 ? Yoar 2 Quarter 2 3 2 ? ? ? 7 2 2 2 ? 2 2 2 ? ? 2 ? 2 7 ? 2 ? 2 ? 2 ? 2 2 Year 2 Quarto 2 3 Year 3 Quarter F 4 Year ? 2 ? ? 2 2 2 2 ? 2 ? 2 7 2 2 ? ? 7 ? 2 2 2 2 2 2 2 2 2 8 0 C D w F G H F 1 4 Year ? ? ? 2 ? Year 2 Quarter 2 3 2 ? ? ? 2 2 ? 2 ? ? ? ? 2 ? ? ? 2 ? ? 2 Year 3 Quarter 1 2 ? ? ? 2 ? 1 F 4 Year 39 Construct the production budget 40 41 Budgeted unit salos 42 Add desired finished goods inventory 43 Total needs 44 Less beginning inventory 45 Required production 46 47 Construct the raw materials purchases budget 48 49 Required production (units) 50 Raw materials required to produce one unit 51 Production needs (pounds) 52 Add desired ending inventory of raw materials (pounds) 53 Total needs (pounds) 54 Loss beginning inventory of raw materials (pounds) 55 Raw materials to be purchased 56 of raw materials per pound 57 Cost of raw materials to be purchased 58 59 Construct the schedule of expected cash payments 61 Accounts payablo, beginning balance 62 First quarter purchases 63 Second-quarter purchases 64 Third-quarter purchases 65 Fourth-quarter purchases 66 Total cash disbursements 62 68 69 ? ? 2 2 2 7 ? ? 2 Year 2 Quarter 2 3 ? ? ? ? ? ? ? 2 2 2 2 ? ? ? 2 ? ? 2 ? ? ? ? ? 2 2 2 ? Year 3 Quarter 1 ? ? 2 ? 2 ? ? 2 2 2 2 ? 60 Year 2 Quarter 2 3 1 4 Year 2 ? ? ? ? ? 2 ? ? ? ? ? ? 7 2 ? ? 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts