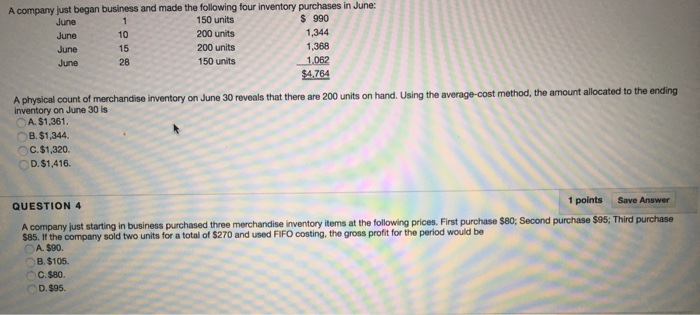

Question: Having trouble with these two, would appreciate some help. Thanks! A company just began business and made the following four inventory purchases in June: June

A company just began business and made the following four inventory purchases in June: June 1 150 units $ 990 June 10 200 units 1, 344 June 15 200 units 1, 368 June 28 150 units 1, 062 $4, 764 A physical count of merchandise inventory on Juno 30 reveals that there are 200 units on hand. Using the average-cost method, the amount allocated to the ending inventory on June 30 is $1, 361. $1, 344 $1, 320. $1, 416. A company just starting in business purchased three merchandise inventory items at the following prices. First purchase $80; Second purchase $95; Third purchase $85. If the company sold two units for n total of $270 and used FIFO costing, the gross profit for the period would be $90. $105. $80. $95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts