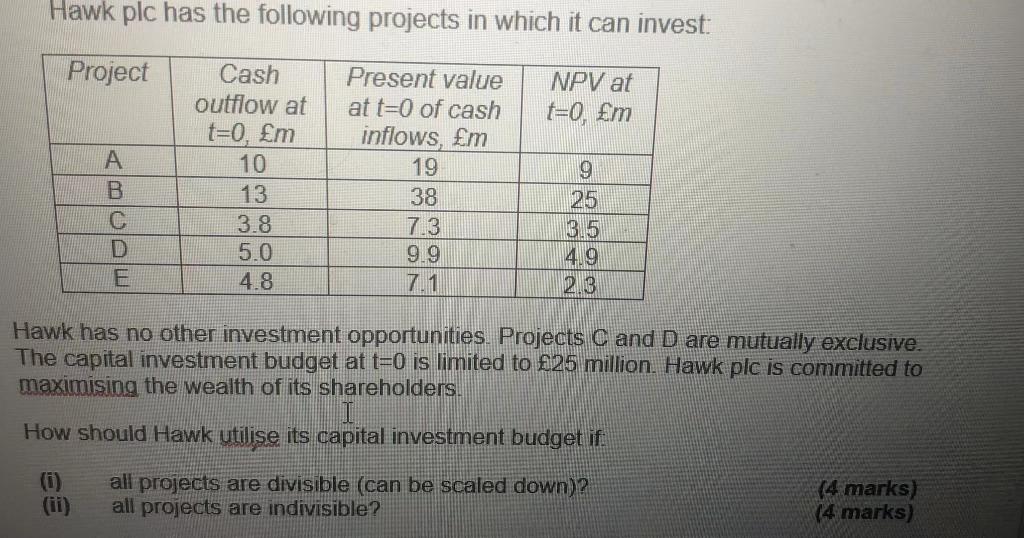

Question: Hawk plc has the following projects in which it can invest: Project NPV at =0, m A Cash outflow at t=0, m 10 13 3.8

Hawk plc has the following projects in which it can invest: Project NPV at =0, m A Cash outflow at t=0, m 10 13 3.8 5.0 4.8 Present value at t=0 of cash inflows, m 19 38 7.3 9.9 7.1 MOOD 9 25 3.5 4.9 2.3 Hawk has no other investment opportunities. Projects C and D are mutually exclusive. The capital investment budget at t=0 is limited to 25 million Hawk plc is committed to maximising the wealth of its shareholders. How should Hawk utilise its capital investment budget if (1) all projects are divisible (can be scaled down)? all projects are indivisible? (4 marks) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock