Question: he following statement is FALSE? bility ratios show the combined effects of liquidity, asset management, bt management on a firm's operating results. ick ratio measures

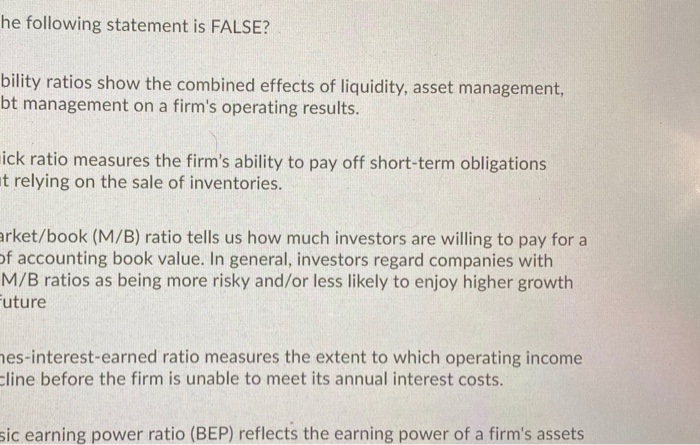

he following statement is FALSE? bility ratios show the combined effects of liquidity, asset management, bt management on a firm's operating results. ick ratio measures the firm's ability to pay off short-term obligations ut relying on the sale of inventories. arket/book (M/B) ratio tells us how much investors are willing to pay for a of accounting book value. In general, investors regard companies with M/B ratios as being more risky and/or less likely to enjoy higher growth future hes-interest-earned ratio measures the extent to which operating income line before the firm is unable to meet its annual interest costs. sic earning power ratio (BEP) reflects the earning power of a firm's assets he following statement is FALSE? bility ratios show the combined effects of liquidity, asset management, bt management on a firm's operating results. ick ratio measures the firm's ability to pay off short-term obligations ut relying on the sale of inventories. arket/book (M/B) ratio tells us how much investors are willing to pay for a of accounting book value. In general, investors regard companies with M/B ratios as being more risky and/or less likely to enjoy higher growth future hes-interest-earned ratio measures the extent to which operating income line before the firm is unable to meet its annual interest costs. sic earning power ratio (BEP) reflects the earning power of a firm's assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts