Question: Heading 2 Heading Heading Question 13 Steve has a home office for his sole proprietorship. His net income before considering the home office deduction is

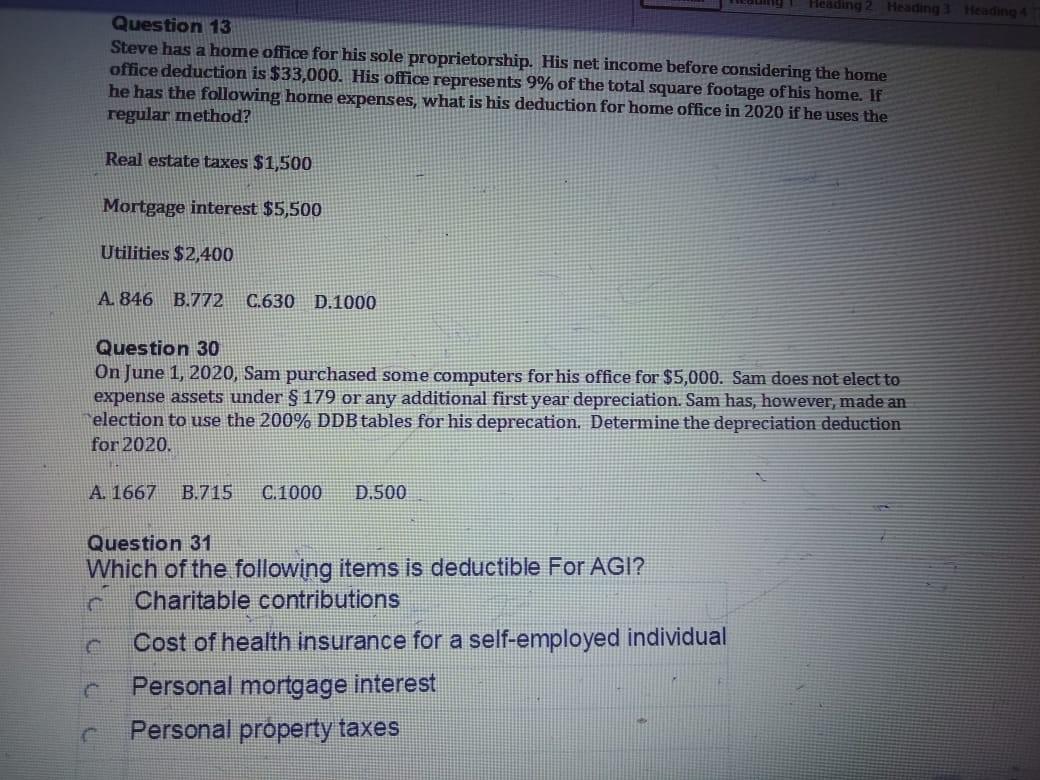

Heading 2 Heading Heading Question 13 Steve has a home office for his sole proprietorship. His net income before considering the home office deduction is $33,000. His office represents 9% of the total square footage of his home. If he has the following home expenses, what is his deduction for home office in 2020 if he uses the regular method? Real estate taxes $1,500 Mortgage interest $5,500 Utilities $2,400 A. 846 B.772 C.630 D.1000 Question 30 On June 1, 2020, Sam purchased some computers for his office for $5,000. Sam does not elect to expense assets under $ 179 or any additional first year depreciation. Sam has, however, made an election to use the 200% DDB tables for his deprecation. Determine the depreciation deduction for 2020. A. 1667 B.715 C.1000 D.500 Question 31 Which of the following items is deductible For AGI? Charitable contributions Cost of health insurance for a self-employed individual Personal mortgage interest Personal property taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts