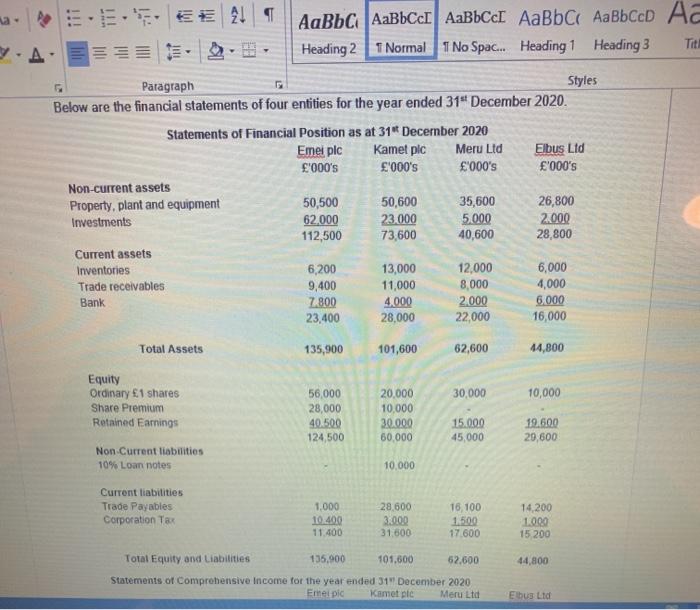

Question: . | . Heading 2 T Normal 1 No Spac... Heading 1 Heading 3 Tit! 6 Paragraph Styles Below are the financial statements of four

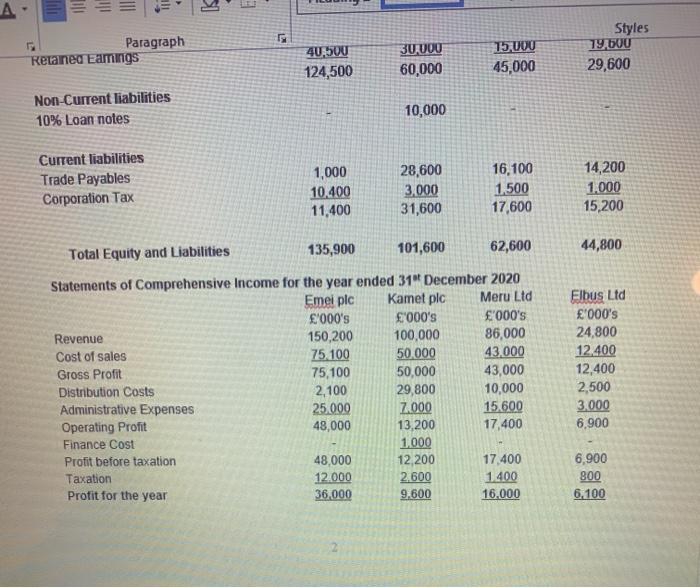

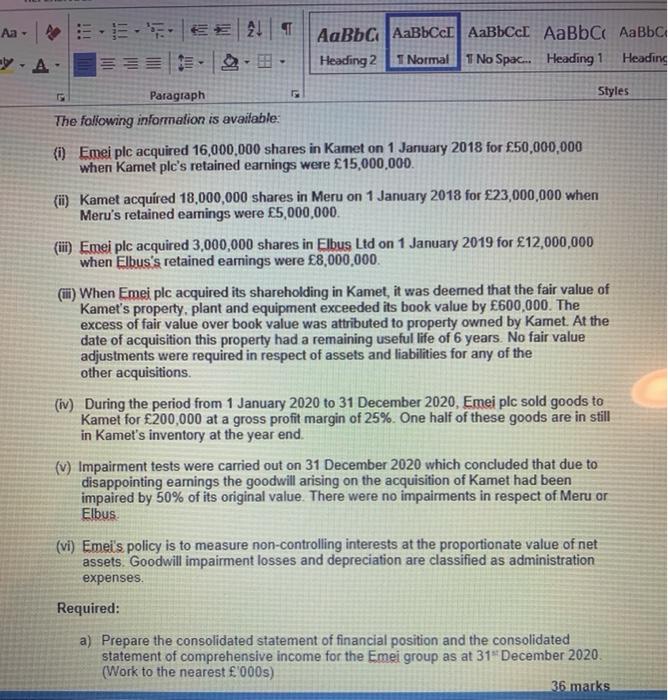

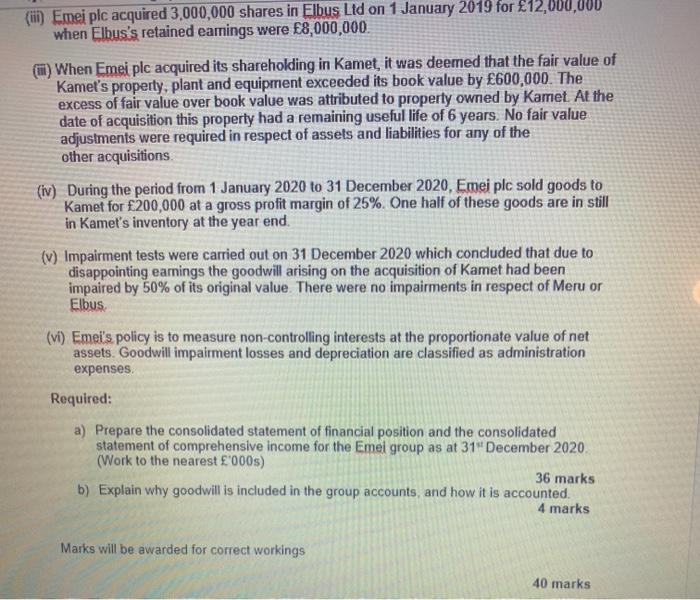

. | . Heading 2 T Normal 1 No Spac... Heading 1 Heading 3 Tit! 6 Paragraph Styles Below are the financial statements of four entities for the year ended 31" December 2020. Statements of Financial Position as at 31 December 2020 Emei plc Kamet plc Meru Ltd Elbus Ltd '000's '000's 000's '000's Non-current assets Property, plant and equipment 50,500 50,600 35,600 26,800 Investments 62.000 23.000 5.000 2.000 112,500 73,600 40,600 28,800 Current assets Inventories 6,200 13,000 12,000 6,000 Trade receivables 9,400 11,000 8,000 4,000 Bank 7.800 4.000 2.000 6.000 23,400 28,000 22,000 16,000 Total Assets 135,900 101,600 62,600 44,800 30,000 10,000 Equity Ordinary 1 shares Share Premium Retained Earnings 56,000 28,000 40.500 124 20,000 10,000 30.000 60.000 19.600 15.000 45,000 Non Current liabilities 10% Loan notes 10.000 Current liabilities Trade Payables Corporation Tax 1.000 10.400 11.400 28.600 3.000 31.600 16.100 1.500 17.600 14.200 1.000 15 200 44.800 Total Equity and Liabilities 135,900 101.600 62,600 Statements of Comprehensive Income for the year ended 31 December 2020 Emel pic Kamet plc Meru Ltd E bug Ltd IS E Paragraph Retained Eamings 40.500 124,500 30.000 60,000 15 000 45,000 Styles 79,600 29,600 Non-Current liabilities 10% Loan notes 10,000 Current liabilities Trade Payables Corporation Tax 1,000 10,400 11,400 28,600 3.000 31,600 16.100 1,500 17,600 14,200 1.000 15,200 135,900 101,600 62,600 Total Equity and Liabilities 44,800 Statements of Comprehensive Income for the year ended 31 December 2020 Emei plc Kamet plc Meru Ltd '000's 000's '000's Revenue 150,200 100,000 86,000 Cost of sales 75 100 50.000 43.000 Gross Profit 75,100 50,000 43,000 Distribution Costs 2,100 29,800 10,000 Administrative Expenses 25.000 7.000 15.600 Operating Profit 48,000 13,200 17,400 Finance Cost 1.000 Profit before taxation 48,000 12,200 17.400 Taxation 12.000 2.600 1400 Profit for the year 36.000 9.600 16.000 Elbus Ltd '000's 24,800 12.400 12,400 2,500 3.000 6.900 6,900 800 6.100 Aa- E.EE ALT AaBb AaBbcc AaBbcc AaBb C AaBbc Heading 2 T Normal 1 No Spac... Heading 1 Heading A. Styles Paragraph The following information is available: (1) Emei plc acquired 16,000,000 shares in Kamet on 1 January 2018 for 50,000,000 when Kamet plc's retained earnings were 15,000,000. (i) Kamet acquired 18,000,000 shares in Meru on 1 January 2018 for 23,000,000 when Meru's retained earnings were 5,000,000 (iii) Emei plc acquired 3,000,000 shares in Elbus Ltd on 1 January 2019 for 12,000,000 when Elbus's retained eamings were 8,000,000 (ili) When Emei plc acquired its shareholding in Kamet, it was deemed that the fair value of Kamet's property, plant and equipment exceeded its book value by 600,000. The excess of fair value over book value was attributed to property owned by Kamet. At the date of acquisition this property had a remaining useful life of 6 years. No fair value adjustments were required in respect of assets and liabilities for any of the other acquisitions (iv) During the period from 1 January 2020 to 31 December 2020, Emei plc sold goods to Kamet for 200,000 at a gross profit margin of 25%. One half of these goods are in still in Kamet's inventory at the year end. (V) Impairment tests were carried out on 31 December 2020 which concluded that due to disappointing earnings the goodwill arising on the acquisition of Kamet had been impaired by 50% of its original value. There were no impairments in respect of Meru or Elbus. (vi) Emei's policy is to measure non-controlling interests at the proportionate value of net assets. Goodwill impairment losses and depreciation are classified as administration expenses. Required: a) Prepare the consolidated statement of financial position and the consolidated statement of comprehensive income for the Emei group as at 31December 2020 (Work to the nearest '000s) 36 marks (ii) Emei plc acquired 3,000,000 shares in Elbus Ltd on 1 January 2019 for 12,000,000 when Elbus's retained earings were 8,000,000 (i) When Emei plc acquired its shareholding in Kamet, it was deemed that the fair value of Kamet's property, plant and equipment exceeded its book value by 600,000. The excess of fair value over book value was attributed to property owned by Kamet. At the date of acquisition this property had a remaining useful life of 6 years. No fair value adjustments were required in respect of assets and liabilities for any of the other acquisitions (iv) During the period from 1 January 2020 to 31 December 2020, Emei plc sold goods to Kamet for 200,000 at a gross profit margin of 25%. One half of these goods are in still in Kamet's inventory at the year end. (v) Impairment tests were carried out on 31 December 2020 which concluded that due to disappointing earings the goodwill arising on the acquisition of Kamet had been impaired by 50% of its original value. There were no impairments in respect of Meru or Elbus. (vi) Emel's policy is to measure non-controlling interests at the proportionate value of net assets. Goodwill impairment losses and depreciation are classified as administration expenses Required: a) Prepare the consolidated statement of financial position and the consolidated statement of comprehensive income for the Emel group as at 31 December 2020. (Work to the nearest '000s) 36 marks b) Explain why goodwill is included in the group accounts, and how it is accounted. 4 marks Marks will be awarded for correct workings 40 marks . | . Heading 2 T Normal 1 No Spac... Heading 1 Heading 3 Tit! 6 Paragraph Styles Below are the financial statements of four entities for the year ended 31" December 2020. Statements of Financial Position as at 31 December 2020 Emei plc Kamet plc Meru Ltd Elbus Ltd '000's '000's 000's '000's Non-current assets Property, plant and equipment 50,500 50,600 35,600 26,800 Investments 62.000 23.000 5.000 2.000 112,500 73,600 40,600 28,800 Current assets Inventories 6,200 13,000 12,000 6,000 Trade receivables 9,400 11,000 8,000 4,000 Bank 7.800 4.000 2.000 6.000 23,400 28,000 22,000 16,000 Total Assets 135,900 101,600 62,600 44,800 30,000 10,000 Equity Ordinary 1 shares Share Premium Retained Earnings 56,000 28,000 40.500 124 20,000 10,000 30.000 60.000 19.600 15.000 45,000 Non Current liabilities 10% Loan notes 10.000 Current liabilities Trade Payables Corporation Tax 1.000 10.400 11.400 28.600 3.000 31.600 16.100 1.500 17.600 14.200 1.000 15 200 44.800 Total Equity and Liabilities 135,900 101.600 62,600 Statements of Comprehensive Income for the year ended 31 December 2020 Emel pic Kamet plc Meru Ltd E bug Ltd IS E Paragraph Retained Eamings 40.500 124,500 30.000 60,000 15 000 45,000 Styles 79,600 29,600 Non-Current liabilities 10% Loan notes 10,000 Current liabilities Trade Payables Corporation Tax 1,000 10,400 11,400 28,600 3.000 31,600 16.100 1,500 17,600 14,200 1.000 15,200 135,900 101,600 62,600 Total Equity and Liabilities 44,800 Statements of Comprehensive Income for the year ended 31 December 2020 Emei plc Kamet plc Meru Ltd '000's 000's '000's Revenue 150,200 100,000 86,000 Cost of sales 75 100 50.000 43.000 Gross Profit 75,100 50,000 43,000 Distribution Costs 2,100 29,800 10,000 Administrative Expenses 25.000 7.000 15.600 Operating Profit 48,000 13,200 17,400 Finance Cost 1.000 Profit before taxation 48,000 12,200 17.400 Taxation 12.000 2.600 1400 Profit for the year 36.000 9.600 16.000 Elbus Ltd '000's 24,800 12.400 12,400 2,500 3.000 6.900 6,900 800 6.100 Aa- E.EE ALT AaBb AaBbcc AaBbcc AaBb C AaBbc Heading 2 T Normal 1 No Spac... Heading 1 Heading A. Styles Paragraph The following information is available: (1) Emei plc acquired 16,000,000 shares in Kamet on 1 January 2018 for 50,000,000 when Kamet plc's retained earnings were 15,000,000. (i) Kamet acquired 18,000,000 shares in Meru on 1 January 2018 for 23,000,000 when Meru's retained earnings were 5,000,000 (iii) Emei plc acquired 3,000,000 shares in Elbus Ltd on 1 January 2019 for 12,000,000 when Elbus's retained eamings were 8,000,000 (ili) When Emei plc acquired its shareholding in Kamet, it was deemed that the fair value of Kamet's property, plant and equipment exceeded its book value by 600,000. The excess of fair value over book value was attributed to property owned by Kamet. At the date of acquisition this property had a remaining useful life of 6 years. No fair value adjustments were required in respect of assets and liabilities for any of the other acquisitions (iv) During the period from 1 January 2020 to 31 December 2020, Emei plc sold goods to Kamet for 200,000 at a gross profit margin of 25%. One half of these goods are in still in Kamet's inventory at the year end. (V) Impairment tests were carried out on 31 December 2020 which concluded that due to disappointing earnings the goodwill arising on the acquisition of Kamet had been impaired by 50% of its original value. There were no impairments in respect of Meru or Elbus. (vi) Emei's policy is to measure non-controlling interests at the proportionate value of net assets. Goodwill impairment losses and depreciation are classified as administration expenses. Required: a) Prepare the consolidated statement of financial position and the consolidated statement of comprehensive income for the Emei group as at 31December 2020 (Work to the nearest '000s) 36 marks (ii) Emei plc acquired 3,000,000 shares in Elbus Ltd on 1 January 2019 for 12,000,000 when Elbus's retained earings were 8,000,000 (i) When Emei plc acquired its shareholding in Kamet, it was deemed that the fair value of Kamet's property, plant and equipment exceeded its book value by 600,000. The excess of fair value over book value was attributed to property owned by Kamet. At the date of acquisition this property had a remaining useful life of 6 years. No fair value adjustments were required in respect of assets and liabilities for any of the other acquisitions (iv) During the period from 1 January 2020 to 31 December 2020, Emei plc sold goods to Kamet for 200,000 at a gross profit margin of 25%. One half of these goods are in still in Kamet's inventory at the year end. (v) Impairment tests were carried out on 31 December 2020 which concluded that due to disappointing earings the goodwill arising on the acquisition of Kamet had been impaired by 50% of its original value. There were no impairments in respect of Meru or Elbus. (vi) Emel's policy is to measure non-controlling interests at the proportionate value of net assets. Goodwill impairment losses and depreciation are classified as administration expenses Required: a) Prepare the consolidated statement of financial position and the consolidated statement of comprehensive income for the Emel group as at 31 December 2020. (Work to the nearest '000s) 36 marks b) Explain why goodwill is included in the group accounts, and how it is accounted. 4 marks Marks will be awarded for correct workings 40 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts