Question: . . Heading 4 Headings Heading 6 Heading 7 T Normal No Space Paragraph Styles TO d. 100 USD Brian Tack sold a put option

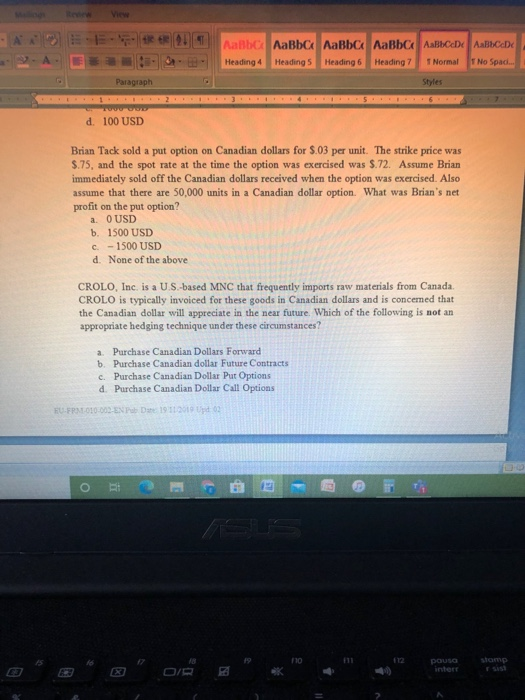

. . Heading 4 Headings Heading 6 Heading 7 T Normal No Space Paragraph Styles TO d. 100 USD Brian Tack sold a put option on Canadian dollars for $.03 per unit. The strike price was $.75, and the spot rate at the time the option was exercised was $.72. Assume Brian immediately sold off the Canadian dollars received when the option was exercised. Also assume that there are 50,000 units in a Canadian dollar option. What was Brian's net profit on the put option? a. 0USD b. 1500 USD c. -1500 USD d. None of the above CROLO, Inc. is a U.S.-based MNC that frequently imports raw materials from Canada. CROLO is typically invoiced for these goods in Canadian dollars and is concerned that the Canadian dollar will appreciate in the near future. Which of the following is not an appropriate hedging technique under these circumstances? a. Purchase Canadian Dollars Forward b. Purchase Canadian dollar Future Contracts c. Purchase Canadian Dollar Put Options d. Purchase Canadian Dollar Call Options FU-FRM 010 COD END 1911201902 O ET 10 12 stamp 8 pouso inter OR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts