Question: Heading a Heading 4 2. Multiple compounding periods: Find the present value of $3,500 under each of the following rates and periods. a. 8.9% compounded

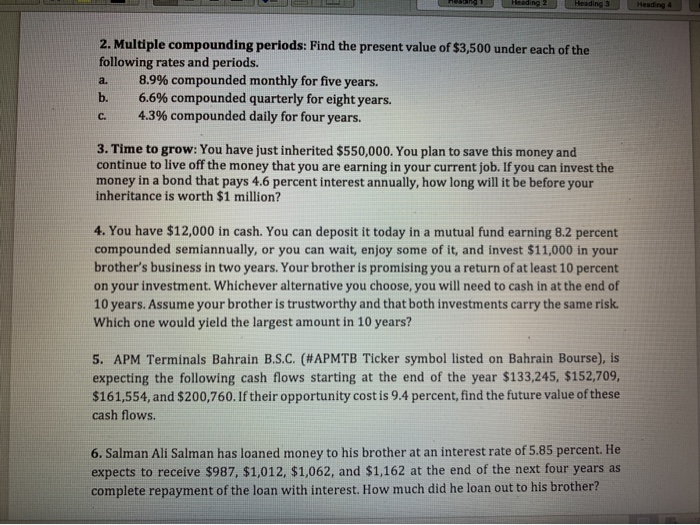

Heading a Heading 4 2. Multiple compounding periods: Find the present value of $3,500 under each of the following rates and periods. a. 8.9% compounded monthly for five years. b. 6.6% compounded quarterly for eight years. 4.3% compounded daily for four years. c. 3. Time to grow: You have just inherited $550,000. You plan to save this money and continue to live off the money that you are earning in your current job. If you can invest the money in a bond that pays 4.6 percent interest annually, how long will it be before your inheritance is worth $1 million? 4. You have $12,000 in cash. You can deposit it today in a mutual fund earning 8.2 percent compounded semiannually, or you can wait, enjoy some of it, and invest $11,000 in your brother's business in two years. Your brother is promising you a return of at least 10 percent on your investment. Whichever alternative you choose, you will need to cash in at the end of 10 years. Assume your brother is trustworthy and that both investments carry the same risk. Which one would yield the largest amount in 10 years? 5. APM Terminals Bahrain B.S.C. (#APMTB Ticker symbol listed on Bahrain Bourse), is expecting the following cash flows starting at the end of the year $133,245, $152,709, $161,554, and $200,760. If their opportunity cost is 9.4 percent, find the future value of these cash flows. 6. Salman Ali Salman has loaned money to his brother at an interest rate of 5.85 percent. He expects to receive $987, $1,012, $1,062, and $1,162 at the end of the next four years as complete repayment of the loan with interest. How much did he loan out to his brother

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts