Question: heck my work mode : This shows what is correct or incorrect for the work you hove completed so far. It does not indicate completion.

heck my work mode : This shows what is correct or incorrect for the work you hove completed so far. It does not indicate completion.

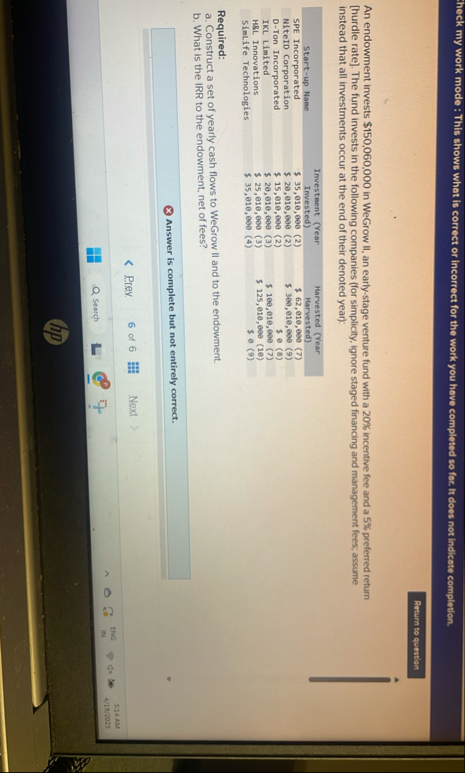

An endowment invests $ in WeGrow II an earlystage venture fund with a incentive fee and a preferred return hurdle rate The fund invests in the following companies for simplicity, ignore staged financing and management fees; assume instead that all investments occur at the end of their denoted year:

tableStartup Name,Investment Year InvestedHarvested Year HarvestedSPE Incorporated,$ $ NiteID Corporation,$ $ DTon Incorporated,$ $ IKL Limited,$ table$ $HSL Innovations,$ SimLife Technologies,$

Required:

a Construct a set of yearly cash flows to WeGrow II and to the endowment.

b What is the IRR to the endowment, net of fees?

Answer is complete but not entirely correct.

Prey

of

Next

AM

ENG

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock