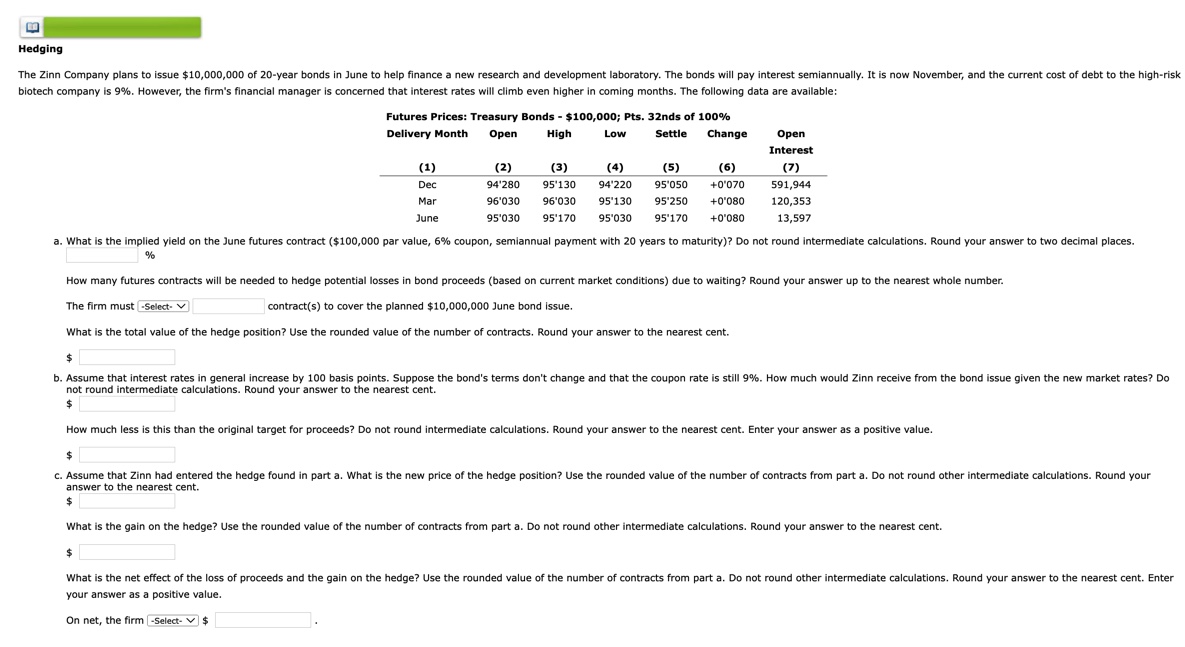

Question: Hedging biotech company is ( 9 % ) . However, the firm's financial manager is concerned that interest rates will climb even

Hedging biotech company is However, the firm's financial manager is concerned that interest rates will climb even higher in coming months. The following data are available: How many futures contracts will be needed to hedge potential losses in bond proceeds based on current market conditions due to waiting? Round your answer up to the nearest whole number. The firm must Selectcontracts to cover the planned $ June bond issue. What is the total value of the hedge position? Use the rounded value of the number of contracts. Round your answer to the nearest cent. $ not round intermediate calculations. Round your answer to the nearest cent. $ How much less is this than the original target for proceeds? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ answer to the nearest cent. $ What is the gain on the hedge? Use the rounded value of the number of contracts from part a Do not round other intermediate calculations. Round your answer to the nearest cent. $ your answer as a positive value. On net, the firm

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock