Question: HEDGING TRANSACTION EXPOSURE A U.S. based MNC has just signed a contract with a British company that calls for the U.S. MNC to provide the

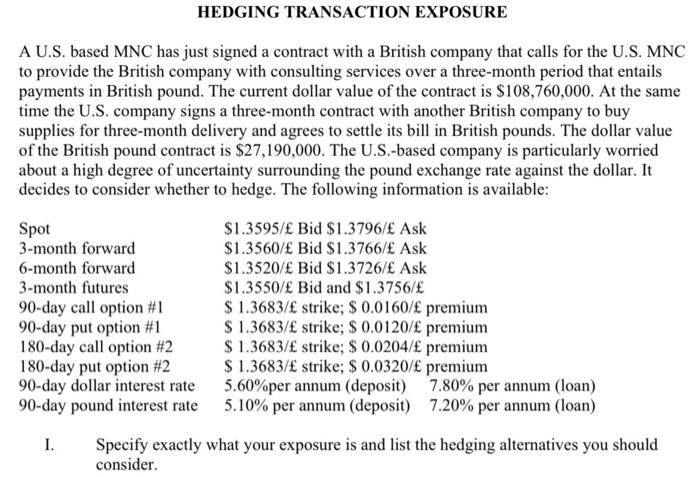

HEDGING TRANSACTION EXPOSURE A U.S. based MNC has just signed a contract with a British company that calls for the U.S. MNC to provide the British company with consulting services over a three-month period that entails payments in British pound. The current dollar value of the contract is $108,760,000. At the same time the U.S. company signs a three-month contract with another British company to buy supplies for three-month delivery and agrees to settle its bill in British pounds. The dollar value of the British pound contract is $27,190,000. The U.S.-based company is particularly worried about a high degree of uncertainty surrounding the pound exchange rate against the dollar. It decides to consider whether to hedge. The following information is available: Spot 3-month forward 6-month forward 3-month futures 90-day call option #1 90-day put option #1 180-day call option #2 180-day put option #2 90-day dollar interest rate 90-day pound interest rate $1.3595/ Bid $1.3796/ Ask $1.3560/ Bid $1.3766/ Ask $1.3520/ Bid $1.3726/ Ask $1.3550/ Bid and $1.3756/ $ 1.3683/ strike; $ 0.0160/ premium $ 1.3683/ strike; $ 0.0120/ premium $ 1.3683/ strike; $ 0.0204/ premium $ 1.3683/ strike; $ 0.0320/ premium 5.60%per annum (deposit) 7.80% per annum (loan) 5.10% per annum (deposit) 7.20% per annum (loan) 1. Specify exactly what your exposure is and list the hedging alternatives you should consider. HEDGING TRANSACTION EXPOSURE A U.S. based MNC has just signed a contract with a British company that calls for the U.S. MNC to provide the British company with consulting services over a three-month period that entails payments in British pound. The current dollar value of the contract is $108,760,000. At the same time the U.S. company signs a three-month contract with another British company to buy supplies for three-month delivery and agrees to settle its bill in British pounds. The dollar value of the British pound contract is $27,190,000. The U.S.-based company is particularly worried about a high degree of uncertainty surrounding the pound exchange rate against the dollar. It decides to consider whether to hedge. The following information is available: Spot 3-month forward 6-month forward 3-month futures 90-day call option #1 90-day put option #1 180-day call option #2 180-day put option #2 90-day dollar interest rate 90-day pound interest rate $1.3595/ Bid $1.3796/ Ask $1.3560/ Bid $1.3766/ Ask $1.3520/ Bid $1.3726/ Ask $1.3550/ Bid and $1.3756/ $ 1.3683/ strike; $ 0.0160/ premium $ 1.3683/ strike; $ 0.0120/ premium $ 1.3683/ strike; $ 0.0204/ premium $ 1.3683/ strike; $ 0.0320/ premium 5.60%per annum (deposit) 7.80% per annum (loan) 5.10% per annum (deposit) 7.20% per annum (loan) 1. Specify exactly what your exposure is and list the hedging alternatives you should consider

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts