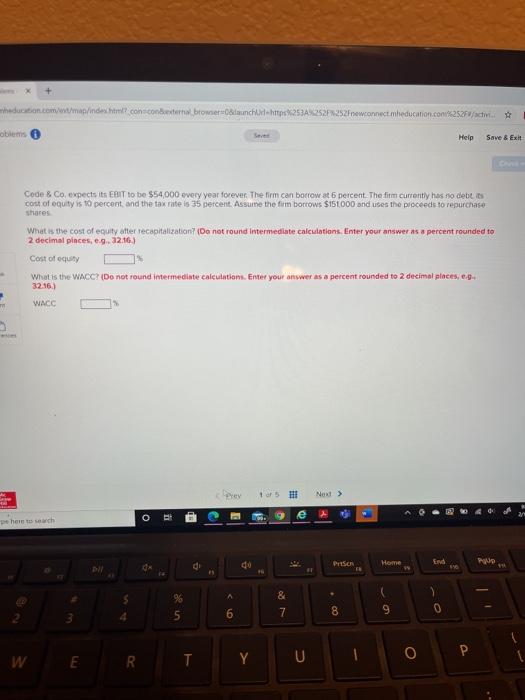

Question: hedin.com/map/index.html?cocon bromelaunchidht253A%252F%252Fwconnect education.com 252Fsti oblems Help Save & Exht Code & Co, expects its EBIT to be $54,000 every year forever. The firm can borrow

hedin.com/map/index.html?cocon bromelaunchidht253A%252F%252Fwconnect education.com 252Fsti oblems Help Save & Exht Code & Co, expects its EBIT to be $54,000 every year forever. The firm can borrow at 6 percent. The firm currently has no debit cost of equity is 10 percent and the tax rate is 35 percent. Assume the firm borrows $15.000 and uses the proceeds to repurchase shares What is the cost of equity after recapitalization (Do not Intermediate calculations. Enter your answer is a percent rounded to 2 decimal pinces, eg 32.16.) Cost of equity What is the WACC (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, es- 32.16) WACC ey 1 o5 H Next > e O po home to such du Puuson Home Poup DI 346 de A & 7 8 9 6 0 W U E R. hedin.com/map/index.html?cocon bromelaunchidht253A%252F%252Fwconnect education.com 252Fsti oblems Help Save & Exht Code & Co, expects its EBIT to be $54,000 every year forever. The firm can borrow at 6 percent. The firm currently has no debit cost of equity is 10 percent and the tax rate is 35 percent. Assume the firm borrows $15.000 and uses the proceeds to repurchase shares What is the cost of equity after recapitalization (Do not Intermediate calculations. Enter your answer is a percent rounded to 2 decimal pinces, eg 32.16.) Cost of equity What is the WACC (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, es- 32.16) WACC ey 1 o5 H Next > e O po home to such du Puuson Home Poup DI 346 de A & 7 8 9 6 0 W U E R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts