Question: Helg Word File Edit View Insert Format Font Tools Table Window In a periodic inventory system.docx . Q- Search in Document Review Home Layout Font

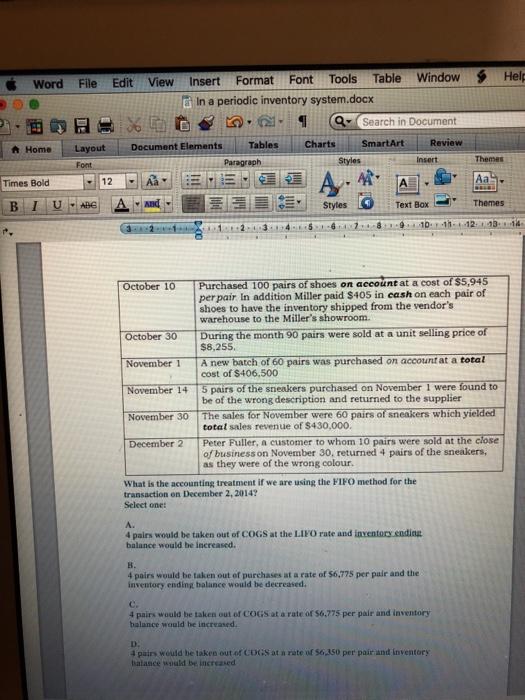

Helg Word File Edit View Insert Format Font Tools Table Window In a periodic inventory system.docx . Q- Search in Document Review Home Layout Font 12 Document Elements Tables Paragraph Charts SmartArt Styles Insert Themes Times Bold A U And ABE Styles Text Box Themes 12:13 October 10 Purchased 100 prirs of shoes on account at a cost of $5.945 per pair In addition Miller paid $405 in cash on each pair of shoes to have the inventory shipped from the vendor's warehouse to the Miller's showroom October 30 During the month 90 pairs were sold at a unit selling price of $8,255 November 1 A new batch of 60 pairs was purchased on account at a total cost of $406,500 November 14 5 pairs of the sneakers purchased on November 1 were found to be of the wrong description and returned to the supplier November 30 The sales for November were 60 pairs of sneakers which yielded total sales revenue of $430,000. December 2 Peter Fuller, a customer to whom 10 pairs were sold at the close of business on November 30, returned 4 pairs of the sneakers, as they were of the wrong colour What is the accounting treatment if we are using the FIFO method for the transaction on December 2, 2014? Select one: A. 4 pairs would be taken out of COGS at the LIYO rate and inventory ending balance would be increased B. 4 pairs would be taken out of purchases at a rate of $6.775 per pair and the inventory ending balance would be decreased. C. 4 pairs would be taken out of COGS at a rate of 56,775 per pair and inventory balance would he increased D 4 pairs would be taken out of COGS at a rate of 56,250 per pair and Inventory Batance be increased Helg Word File Edit View Insert Format Font Tools Table Window In a periodic inventory system.docx . Q- Search in Document Review Home Layout Font 12 Document Elements Tables Paragraph Charts SmartArt Styles Insert Themes Times Bold A U And ABE Styles Text Box Themes 12:13 October 10 Purchased 100 prirs of shoes on account at a cost of $5.945 per pair In addition Miller paid $405 in cash on each pair of shoes to have the inventory shipped from the vendor's warehouse to the Miller's showroom October 30 During the month 90 pairs were sold at a unit selling price of $8,255 November 1 A new batch of 60 pairs was purchased on account at a total cost of $406,500 November 14 5 pairs of the sneakers purchased on November 1 were found to be of the wrong description and returned to the supplier November 30 The sales for November were 60 pairs of sneakers which yielded total sales revenue of $430,000. December 2 Peter Fuller, a customer to whom 10 pairs were sold at the close of business on November 30, returned 4 pairs of the sneakers, as they were of the wrong colour What is the accounting treatment if we are using the FIFO method for the transaction on December 2, 2014? Select one: A. 4 pairs would be taken out of COGS at the LIYO rate and inventory ending balance would be increased B. 4 pairs would be taken out of purchases at a rate of $6.775 per pair and the inventory ending balance would be decreased. C. 4 pairs would be taken out of COGS at a rate of 56,775 per pair and inventory balance would he increased D 4 pairs would be taken out of COGS at a rate of 56,250 per pair and Inventory Batance be increased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts