Question: helllllpppp need an answer not guideline Analyzing financial leverage ratio and Companys operating leverage ratio for the 4 years writing example: If Fixed Cost will

helllllpppp need an answer not guideline

Analyzing financial leverage ratio and Companys operating leverage ratio for the 4 years writing

example: If Fixed Cost will decrease or Financial leverage will increate etc..

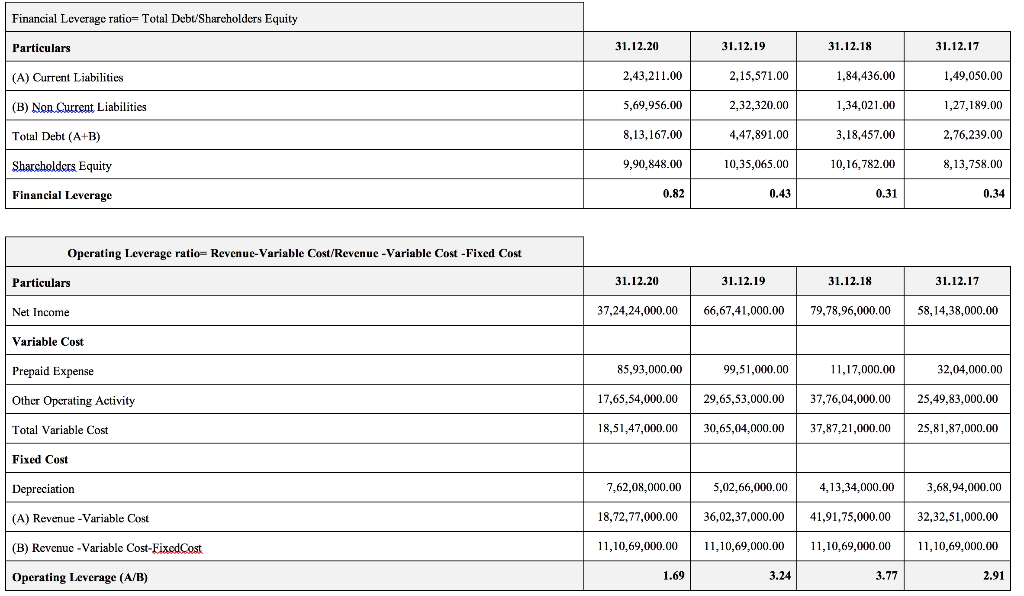

Financial Leverage ratio= Total Debt/Shareholders Equity Particulars 31.12.20 31.12.19 31.12.18 31.12.17 (A) Current Liabilities 2,43,211.00 2,15,571.00 1,84,436.00 1,49,050.00 (B) Non Current Liabilities 5,69,956.00 2,32,320.00 1,34,021.00 1,27,189.00 Total Debt (A+B) 8,13,167.00 4,47,891.00 3,18,457.00 2,76,239.00 Shareholders Equity 9,90,848.00 10,35,065.00 10,16,782.00 8,13,758.00 Financial Leverage 0.82 0.43 0.31 0.34 Operating Leverage ratio=Revenue-Variable Cost/Revenue - Variable Cost - Fixed Cost Particulars 31.12.20 31.12.19 31.12.18 31.12.17 Net Income 37,24,24,000.00 66,67,41,000.00 79,78,96,000.00 58,14,38,000.00 Variable Cost Prepaid Expense 85,93,000.00 99,51,000.00 11,17,000.00 32,04,000.00 Other Operating Activity 17,65,54,000.00 29.65,53,000.00 37,76,04,000.00 25,49,83,000.00 Total Variable Cost 18,51,47,000.00 30,65,04,000.00 37,87,21,000.00 25,81,87,000.00 Fixed Cost Depreciation 7,62,08,000.00 5,02,66,000.00 4,13,34,000.00 3,68,94,000.00 (A) Revenue - Variable Cost 18,72,77,000.00 36,02,37,000.00 41,91,75,000.00 32,32,51,000.00 (B) Revenue - Variable Cost-Fixed Cost 11,10,69,000.00 11,10,69,000.00 11,10,69,000.00 11,10,69,000.00 Operating Leverage (A/B) 1.69 3.24 3.77 2.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts