Question: Hello! Asking help for adjusting entries. Will rate 5 high for correct answers, thank you. Use the following information to answer questions 17 to 21

Hello! Asking help for adjusting entries. Will rate 5 high for correct answers, thank you.

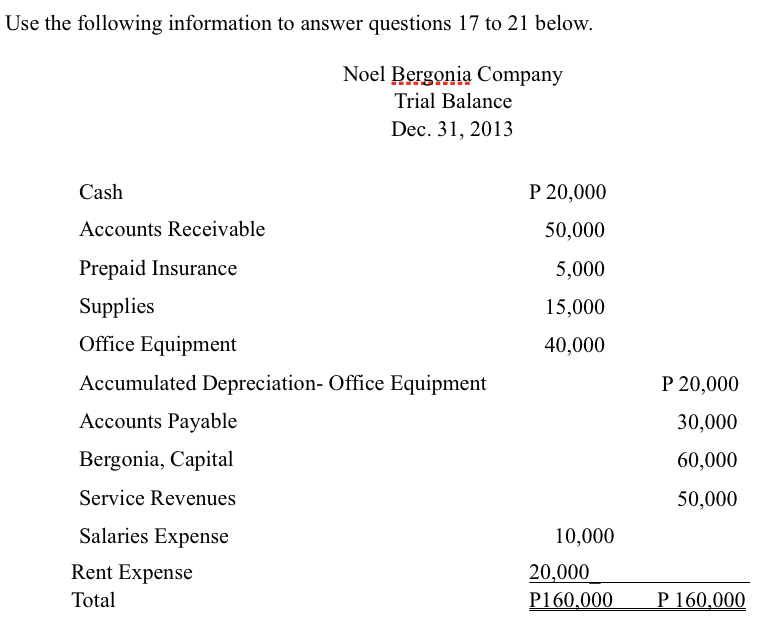

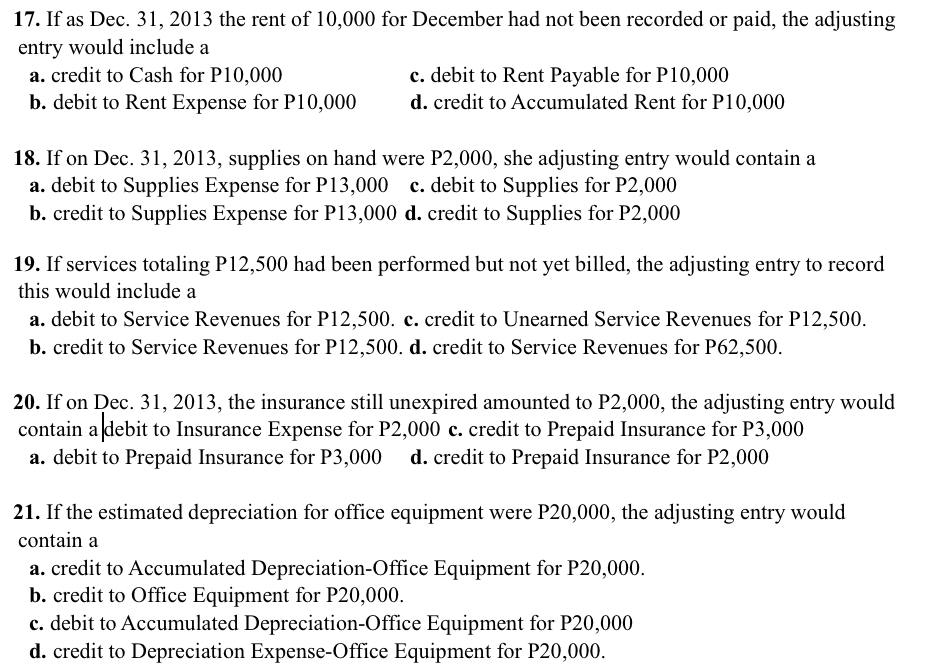

Use the following information to answer questions 17 to 21 below. Noel Bergonia Company Trial Balance Dec. 31, 2013 Cash P 20,000 50,000 Accounts Receivable Prepaid Insurance 5,000 15,000 40,000 Supplies Office Equipment Accumulated Depreciation- Office Equipment Accounts Payable Bergonia, Capital P 20,000 30,000 60,000 Service Revenues 50,000 10,000 Salaries Expense Rent Expense Total 20,000 P160,000 P 160,000 17. If as Dec. 31, 2013 the rent of 10,000 for December had not been recorded or paid, the adjusting entry would include a a. credit to Cash for P10,000 c. debit to Rent Payable for P10,000 b. debit to Rent Expense for P10,000 d. credit to Accumulated Rent for P10,000 18. If on Dec. 31, 2013, supplies on hand were P2,000, she adjusting entry would contain a a. debit to Supplies Expense for P13,000 c. debit to Supplies for P2,000 b. credit to Supplies Expense for P13,000 d. credit to Supplies for P2,000 19. If services totaling P12,500 had been performed but not yet billed, the adjusting entry to record this would include a a. debit to Service Revenues for P12,500. c. credit to Unearned Service Revenues for P12,500. b. credit to Service Revenues for P12,500. d. credit to Service Revenues for P62,500. 20. If on Dec. 31, 2013, the insurance still unexpired amounted to P2,000, the adjusting entry would contain a debit to Insurance Expense for P2,000 c. credit to Prepaid Insurance for P3,000 a. debit to Prepaid Insurance for P3,000 d. credit to Prepaid Insurance for P2,000 21. If the estimated depreciation for office equipment were P20,000, the adjusting entry would contain a a. credit to Accumulated Depreciation Office Equipment for P20,000. b. credit to Office Equipment for P20,000. c. debit to Accumulated Depreciation Office Equipment for P20,000 d. credit to Depreciation Expense-Office Equipment for P20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts