Question: Hello can anyone make a calculation using a excel Question 4. (60 points) Evaluate the economics of renting versus buying a $150,000 home and living

Hello can anyone make a calculation using a excel

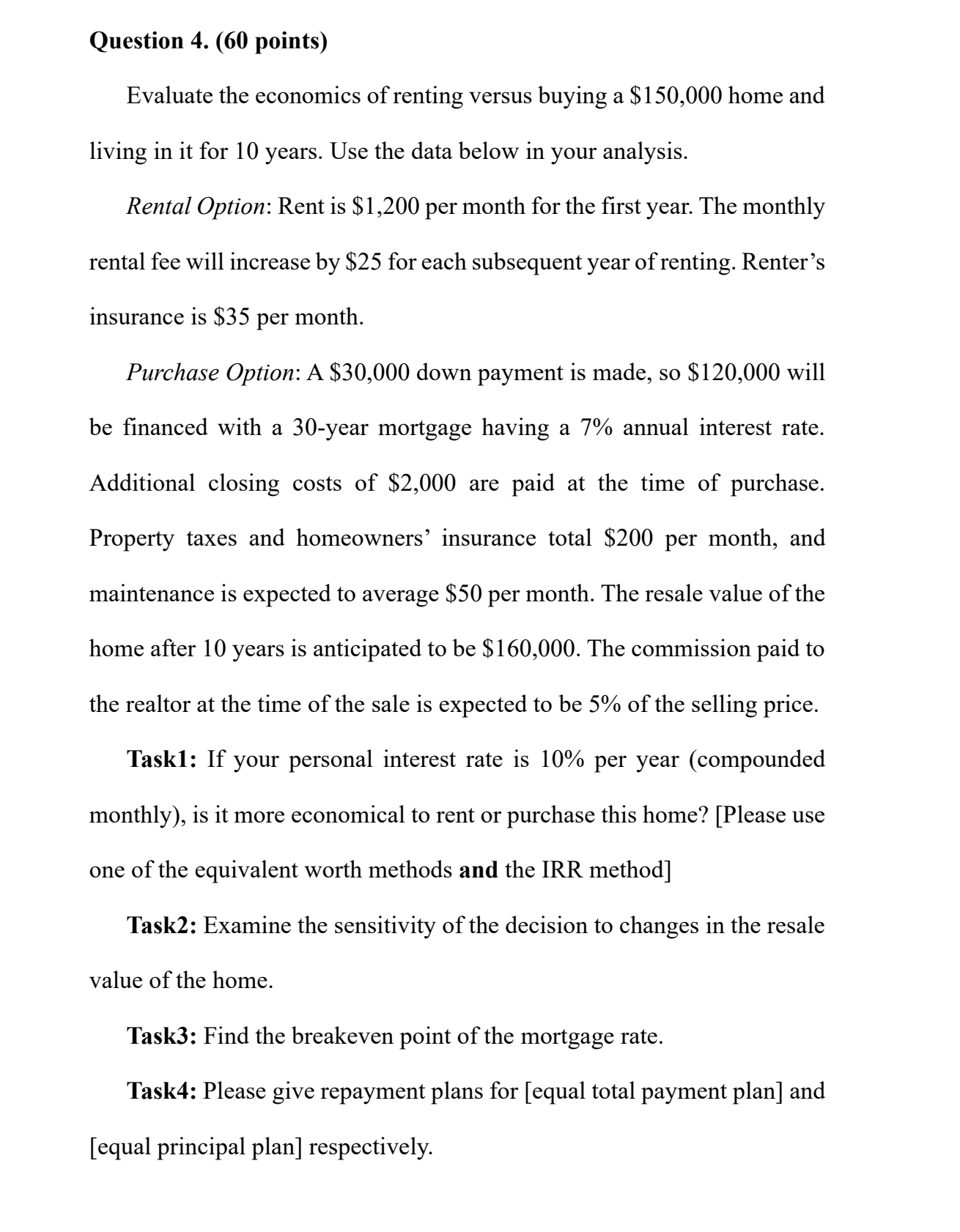

Question 4. (60 points) Evaluate the economics of renting versus buying a $150,000 home and living in it for 10 years. Use the data below in your analysis. Rental Option: Rent is $1,200 per month for the first year. The monthly rental fee will increase by $25 for each subsequent year of renting. Renter's insurance is $35 per month. Purchase Option: A $30,000 down payment is made, so $120,000 will be financed with a 30-year mortgage having a 7% annual interest rate. Additional closing costs of $2,000 are paid at the time of purchase. Property taxes and homeowners' insurance total $200 per month, and maintenance is expected to average $50 per month. The resale value of the home after 10 years is anticipated to be $160,000. The commission paid to the realtor at the time of the sale is expected to be 5% of the selling price. Task1: If your personal interest rate is 10% per year (compounded monthly), is it more economical to rent or purchase this home? [Please use one of the equivalent worth methods and the IRR method] Task2: Examine the sensitivity of the decision to changes in the resale value of the home. Task3: Find the breakeven point of the mortgage rate. Task4: Please give repayment plans for [equal total payment plan] and [equal principal plan] respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts