Question: Hello can anyone please help me with this question thanks 44 A company is considering buying a new piece of machinery. A 10% interest rate

Hello can anyone please help me with this question thanks

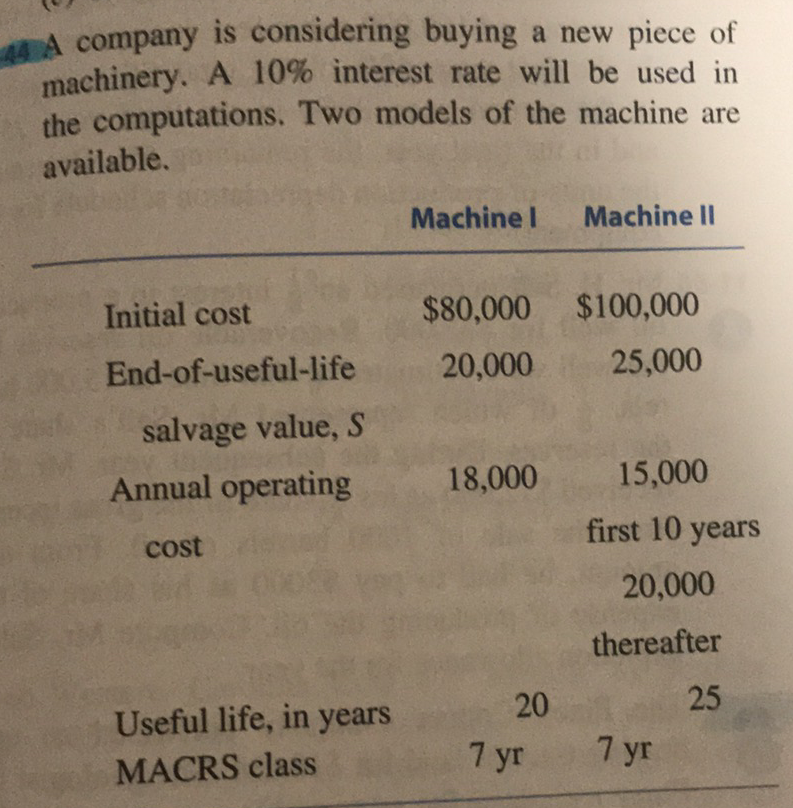

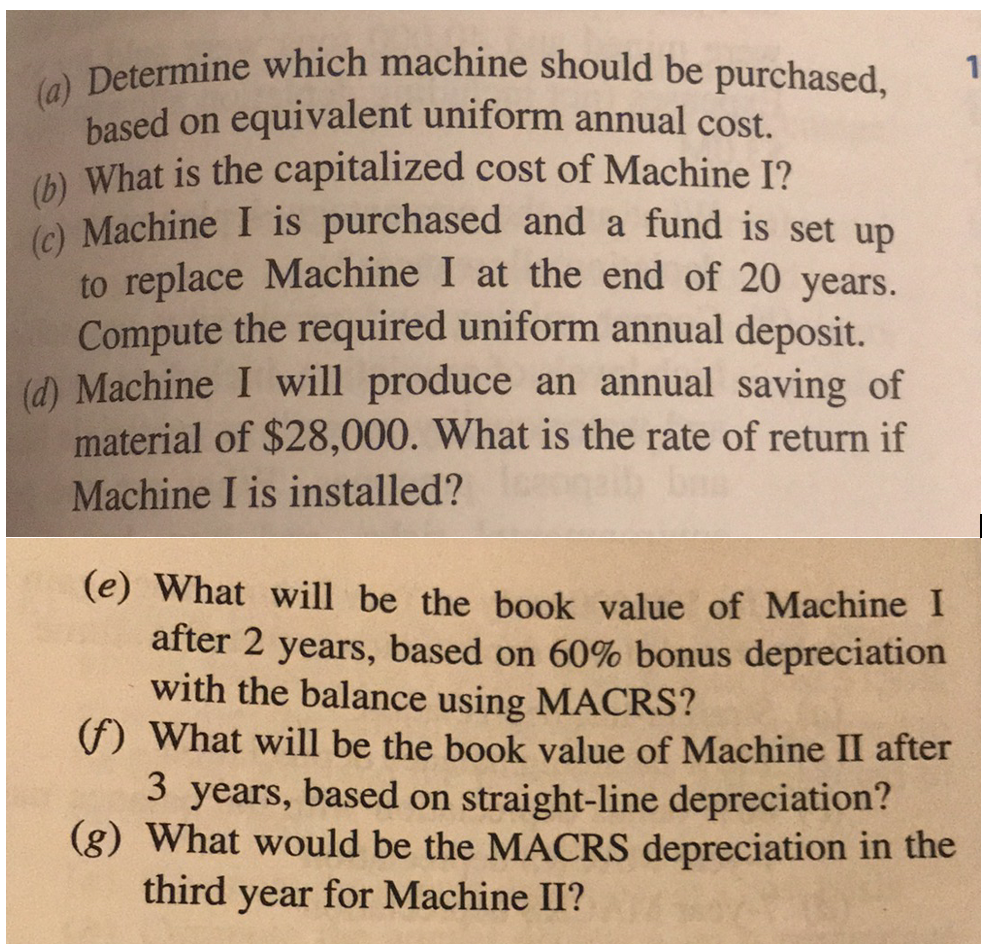

44 A company is considering buying a new piece of machinery. A 10% interest rate will be used in the computations. Two models of the machine are available. Machine | Machine II Initial cost $80,000 $100,000 End-of-useful-life 20,000 25,000 salvage value, S Annual operating 18,000 15,000 cost first 10 years 20,000 thereafter Useful life, in years 20 25 MACRS class 7 yr 7 yr(a) Determine which machine should be purchased, based on equivalent uniform annual cost. (b) What is the capitalized cost of Machine I? (c) Machine I is purchased and a fund is set up to replace Machine I at the end of 20 years. Compute the required uniform annual deposit. (d) Machine I will produce an annual saving of material of $28,000. What is the rate of return if Machine I is installed? (e) What will be the book value of Machine I after 2 years, based on 60% bonus depreciation with the balance using MACRS? (f) What will be the book value of Machine II after 3 years, based on straight-line depreciation? (g) What would be the MACRS depreciation in the third year for Machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts