Question: Hello, Can anyone walk through the problem in the textbook Accounting What the Numbers Mean 11th edition . Chapter 8 Problem 34C. Thank you! Chapter

Hello, Can anyone walk through the problem in the textbook Accounting What the Numbers Mean 11th edition. Chapter 8

Problem 34C.

Thank you!

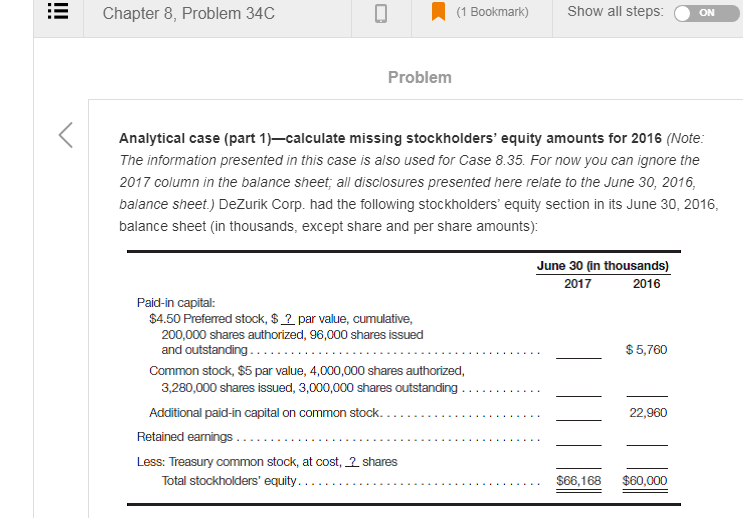

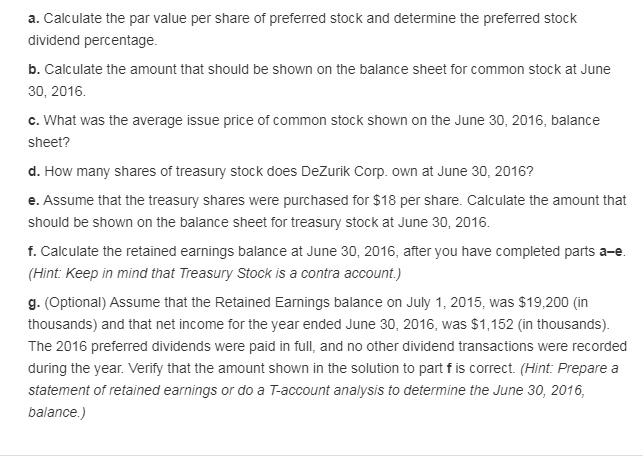

Chapter 8, Problem 34C 0 1 Bookmark)Show all steps: ON Problem Analytical case (part 1-calculate missing stockholders' equity amounts for 2016 (Note: The information presented in this case is also used for Case 8.35. For now you can ignore the 2017 column in the balance sheet, all disclosures presented here relate to the June 30, 2016, balance sheet) DeZurik Corp. had the following stockholders' equity section in its June 30, 2016, balance sheet (in thousands, except share and per share amounts): June 30 (0n thousands) 2017 2016 Paid-in capital: $4.50 Preferred stock, $ par value, cumulative, 200,000 shares authorized, 96,000 shares issued $ 5,760 Common stock, $5 par value, 4,000,000 shares authorized, 22,960 Less: Treasury common stock, at cost, shares .,000 a. Calculate the par value per share of preferred stock and determine the preferred stock dividend percentage. b. Calculate the amount that should be shown on the balance sheet for common stock at June 30, 2016. c. What was the average issue price of common stock shown on the June 30, 2016, balance sheet? How many shares of treasury stock does DeZunik Corp own at June 30, 2016? e. Assume that the treasury shares were purchased for $18 per share. Calculate the amount that should be shown on the balance sheet for treasury stock at June 30, 2016 f. Calculate the retained earnings balance at June 30, 2016, after you have completed parts a-e Hint: Keep in mind that Treasury Stock is a contra account.) g. (Optional) Assume that the Retained Earnings balance on July 1, 2015, was $19,200 (in thousands) and that net income for the year ended June 30, 2016, was $1,152 (in thousands). The 2016 preferred dividends were paid in full, and no other dividend transactions were recorded during the year. Verify that the amount shown in the solution to part f is correct. (Hint: Prepare a statement of retained earnings or do a T-account analysis to determine the June 30, 2016, balance.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts