Question: hello! can I have help with th3se MCQ? I know it may seem a lot of buy they are easy to answer and take very

hello! can I have help with th3se MCQ? I know it may seem a lot of buy they are easy to answer and take very little. I am just sure of the answers. thanks

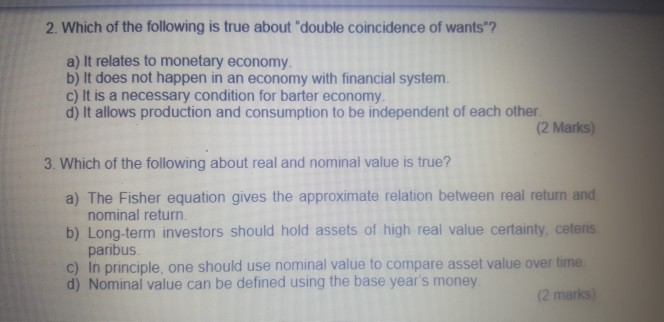

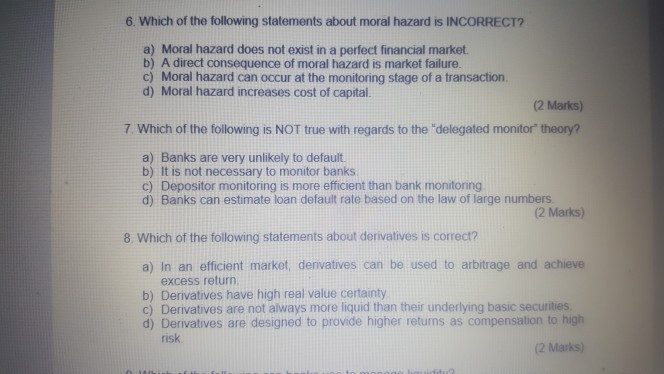

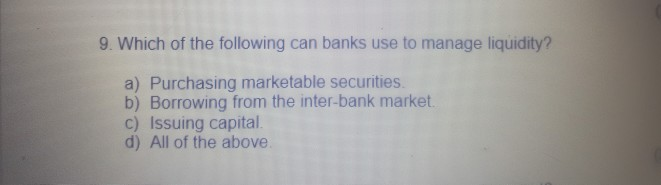

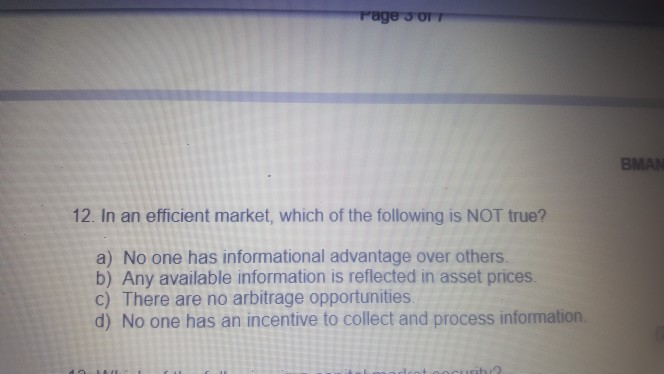

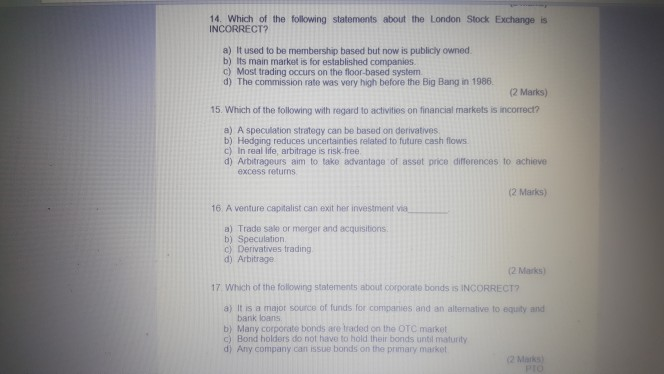

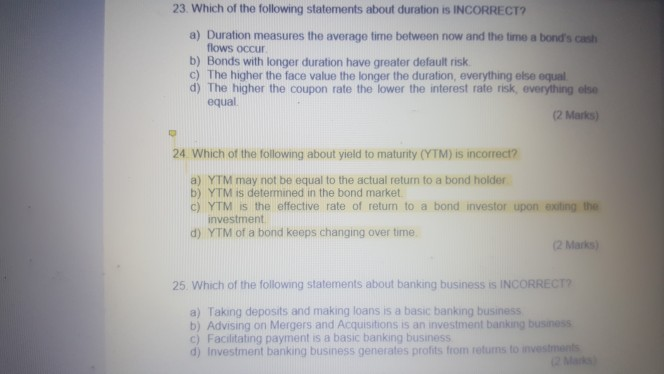

2. Which of the following is true about "double coincidence of wants"? a) It relates to monetary economy b) It does not happen in an economy with financial system. c) It is a necessary condition for barter economy d) It allows production and consumption to be independent of each other. (2 Marks) 3. Which of the following about real and nominal value is true? a) The Fisher equation gives the approximate relation between real return and nominal return. b) Long-term investors should hold assets of high real value certainty cetenis paribus c) In principle, one should use nominal value to compare asset value over time d) Nominal value can be defined using the base year's money (2 marks 6. Which of the following statements about moral hazard is INCORRECT? a) Moral hazard does not exist in a perfect financial market b) A direct consequence of moral hazard is market failure c) Moral hazard can occur at the monitoring stage of a transaction. d) Moral hazard increases cost of capital. 2 Marks) 7 Which of the following is NOT true with regards to the "delegated monitor" theory? a) Banks are very unlikely to default b) It is not necessary to monitor banks c) Depositor monitoring is more efficient than bank monitoring d) Banks can estimate loan default rate based on the law of large numbers (2 Marks) 8. Which of the following statements about derivatives is correct? a) In an efficient market, derivatives can be used to arbitrage and achieve excess return b) Derivatives have high real value certainty c) Derivatives are not always more liquid than their underlying basic securities d) Derivatives are designed to provide higher returns as compensation to high risk (2 Marks) 9. Which of the following can banks use to manage liquidity? a) Purchasing marketable securities. b) Borrowing from the inter-bank market c) Issuing capital d) All of the above BMAN 12. In an efficient market, which of the following is NOT true? a) No one has informational advantage over others b) Any available information is reflected in asset prices. c) There are no arbitrage opportunities d) No one has an incentive to collect and process information 14. Which of the following statements about the London Stock Exchange is INCORRECT? a) It used to be membership based but now is publicly owned b) Its main market is for established companies c) Most trading occurs on the floor-based system d) The commission rate was very high before the Big Bang in 1986. (2 Marks) 15. Which of the tollowing with regard to activities on financial markets is incorrect? a) A speculation strategy can be based on derivatives b) Hedging reduces uncertainties related to future cash flows c) In real ife, arbitrage is risk-free d) Arbitrageurs aim to take advantage of asset price differences to achieve excess returns (2 Marks) 16 A venture capitalist can exit her investment via a) Trade sale or merger and acquisitions b) Speculation c) Derivatives trading d) Arbitrage 2 Marks) 17 Which of the following statements about corporate bonds iS INCORRECT? a) It is a major source of funds for companies and an alternative to equity and bank loans b) Many corporate bonds are traded on the OTC market ) Bond holders do not have to hold their bonds until maturity d) Any company can issue bonds on the primary market 2 Marks 23 Which of the following statements about duration is INCORRECT a) Duration measures the average time between now and the time a bond's cash flows occur b) Bonds with longer duration have greater default risk c) The higher the face value the longer the duration, everything else equal d) The higher the coupon rate the lower the interest rate risk, everything else equal 2 Marks) 24 Which of the following about yield to maturity (YTM) is incorrect? a) YTM may not be equal to the actual return to a bond holder b) YTM is determined in the bond market c) YTM is the effective rate of return to a bond investor upon exting the investment d) YTM of a bond keeps changing over time 2 Marks) 25 Which of the following statements about banking business is INCORREC a) Taking deposits and making loans is a basic banking business b) Advising on Mergers and Acquisitions is an investment banking business c) Facilitating payment is a basic banking business d) Investment banking business generates profits from retuns to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts