Question: Hello can some help me with a detailed step by step analysis of the follow, so I can get my head around it please. thankyou.

Hello can some help me with a detailed step by step analysis of the follow, so I can get my head around it please. thankyou.

Analyse the financial statements that have been prepared by Improve Ltd. In particular, comment on the following aspects of the company:

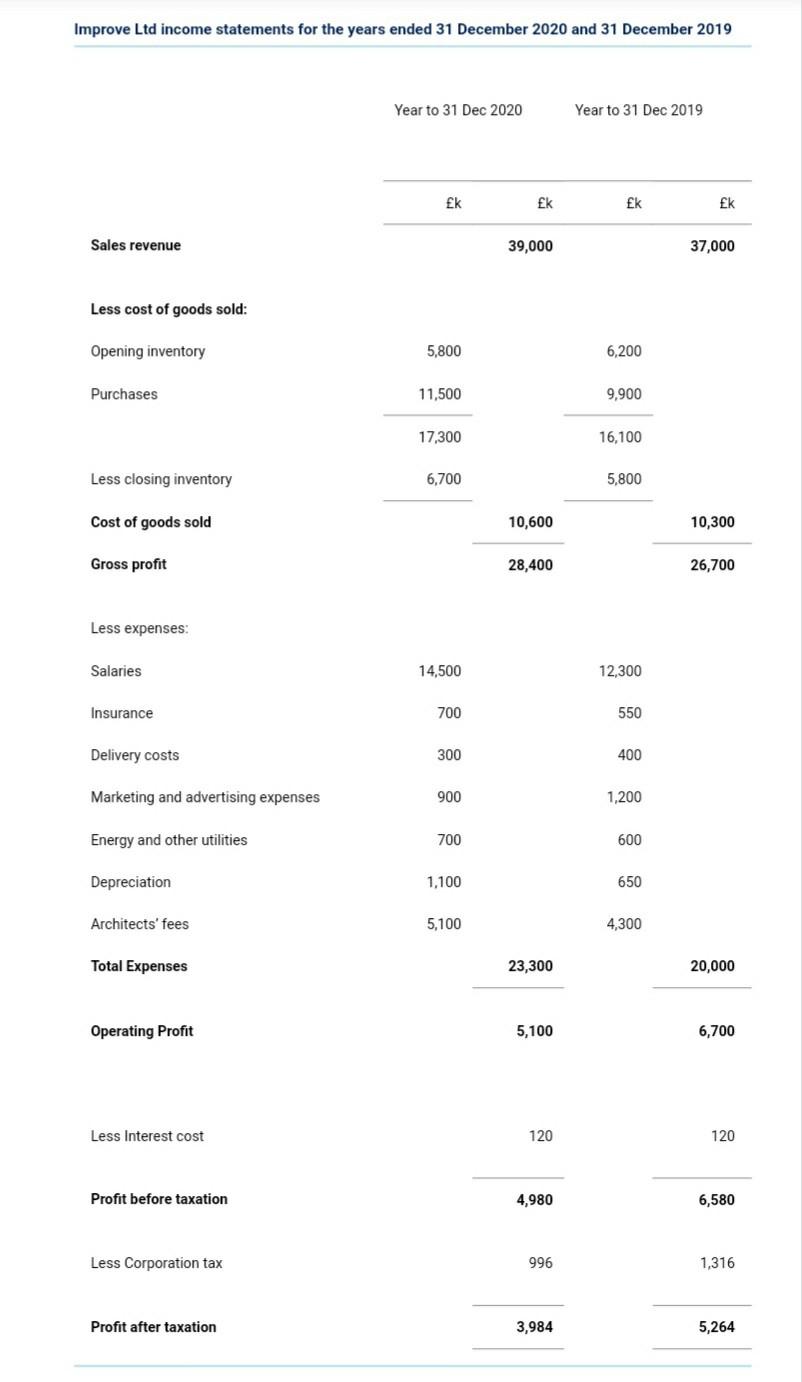

Areas of concern in financial performance, focussing mainly on information from the income statement.

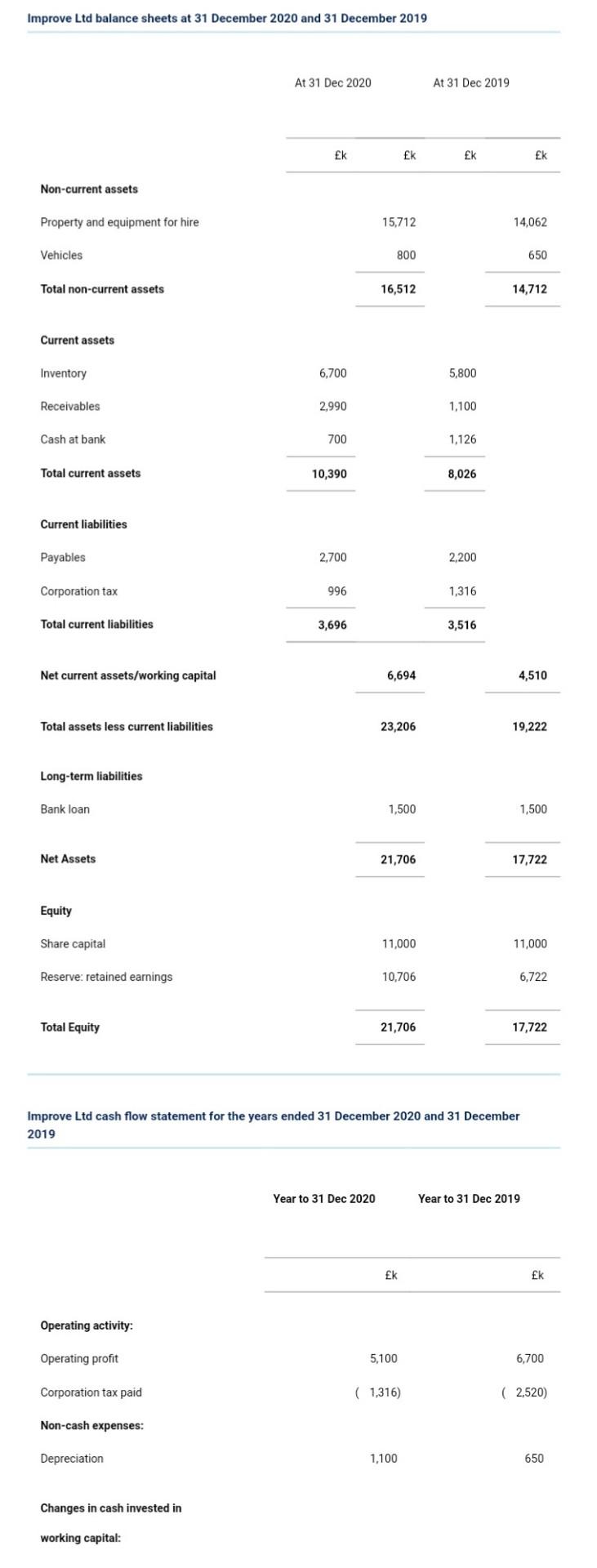

Areas of concern in financial health, focussing mainly on ratios dependent on the income statement and the balance sheet.

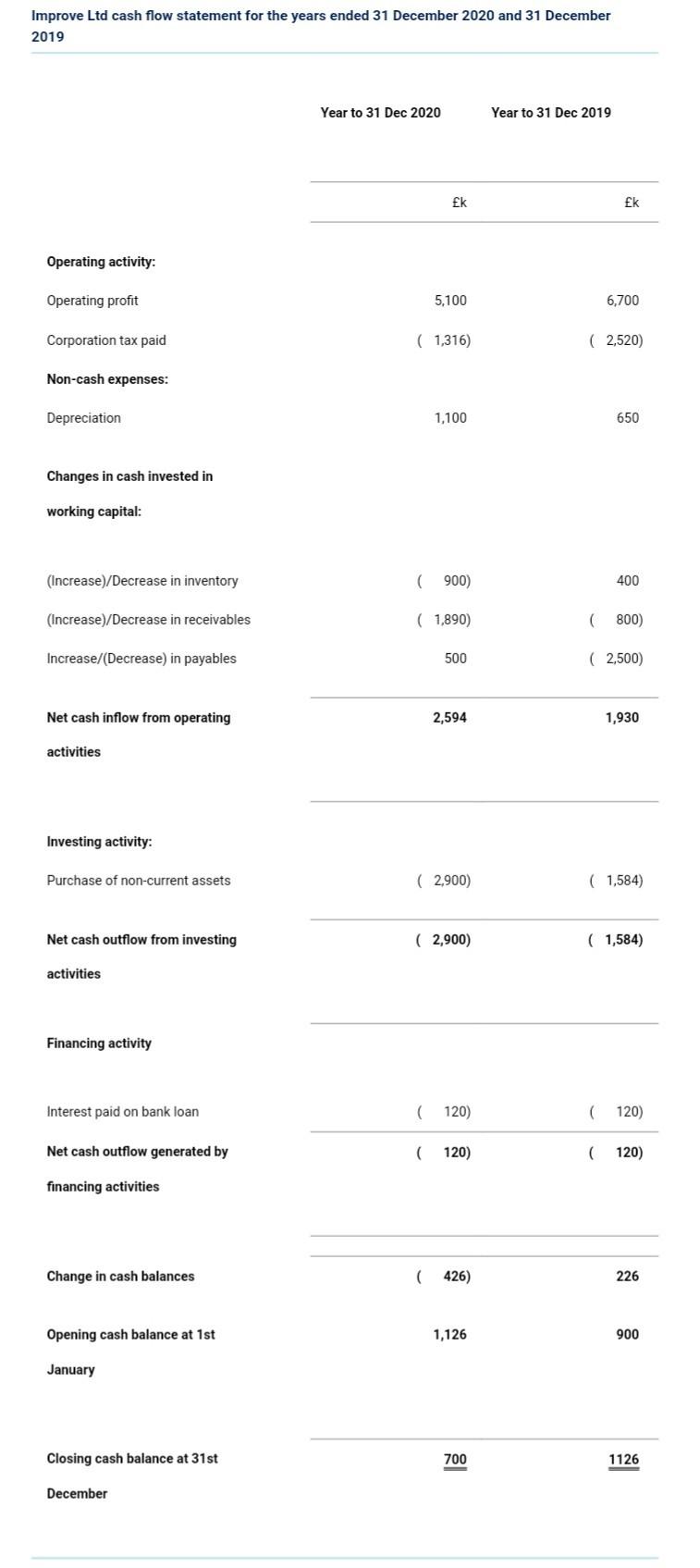

Areas of concern in cash flow management, focussing mainly on information available from the cash flow statement

Improve Ltd income statements for the years ended 31 December 2020 and 31 December 2019 Year to 31 Dec 2020 Year to 31 Dec 2019 Ek Ek Ek Ek Sales revenue 39,000 37,000 Less cost of goods sold: Opening inventory 5,800 6,200 Purchases 11,500 9,900 17,300 16,100 Less closing inventory 6,700 5,800 Cost of goods sold 10,600 10,300 Gross profit 28,400 26,700 Less expenses: Salaries 14,500 12,300 Insurance 700 550 Delivery costs 300 400 Marketing and advertising expenses 900 1,200 Energy and other utilities 700 600 Depreciation 1,100 650 Architects' fees 5,100 4,300 Total Expenses 23,300 20,000 Operating Profit 5,100 6,700 Less Interest cost 120 120 Profit before taxation 4,980 6,580 Less Corporation tax 996 1,316 Profit after taxation 3,984 5,264 Improve Ltd cash flow statement for the years ended 31 December 2020 and 31 December 2019 Year to 31 Dec 2020 Year to 31 Dec 2019 Ek Ek Operating activity: Operating profit 5,100 6,700 Corporation tax paid ( 1,316) || 2.520) Non-cash expenses: Depreciation 1,100 650 Changes in cash invested in working capital: (Increase)/Decrease in inventory (900) 400 (Increase)/Decrease in receivables ( 1,890) (800) Increase/Decrease) in payables 500 ( 2.500) Net cash inflow from operating 2,594 1,930 activities Investing activity: Purchase of non-current assets ( 2,900) ( 1,584) Net cash outflow from investing ( 2,900) ( 1,584) activities Financing activity Interest paid on bank loan ( 120) ( 120) Net cash outflow generated by ( 120) ( 120) financing activities Change in cash balances ( 426) 226 Opening cash balance at 1st 1,126 900 January Closing cash balance at 31st 700 1126 December Improve Ltd balance sheets at 31 December 2020 and 31 December 2019 At 31 Dec 2020 At 31 Dec 2019 Ek Ek Ek EK Non-current assets Property and equipment for hire 15,712 14,062 Vehicles 800 650 Total non-current assets 16,512 14,712 Current assets Inventory 6,700 5,800 Receivables 2,990 1,100 Cash at bank 700 1.126 Total current assets 10,390 8,026 Current liabilities Payables 2.700 2,200 Corporation tax 996 1,316 Total current liabilities 3,696 3,516 Net current assets/working capital 6,694 4,510 Total assets less current liabilities 23,206 19,222 Long-term liabilities Bank loan 1,500 1,500 Net Assets 21,706 17,722 Equity Share capital 11,000 11,000 Reserve: retained earnings 10,706 6,722 Total Equity 21,706 17,722 Improve Ltd cash flow statement for the years ended 31 December 2020 and 31 December 2019 Year to 31 Dec 2020 Year to 31 Dec 2019 K Ek Operating activity: Operating profit 5,100 6,700 Corporation tax paid (1,316) (2,520) Non-cash expenses: Depreciation 1,100 650 Changes in cash invested in working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts