Question: Hello can someone explain me how to do this question in the financial calculator ? In November 2017. Treasury 458 Bs of 2042 offered a

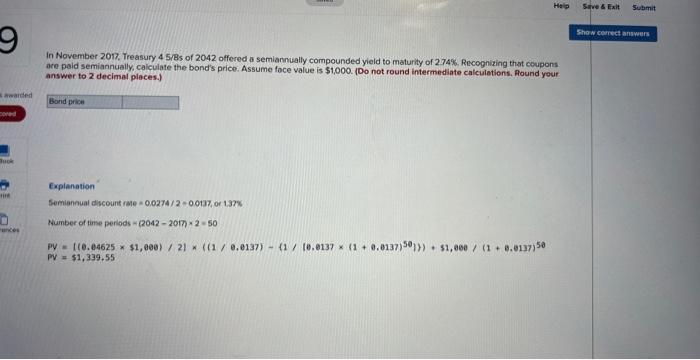

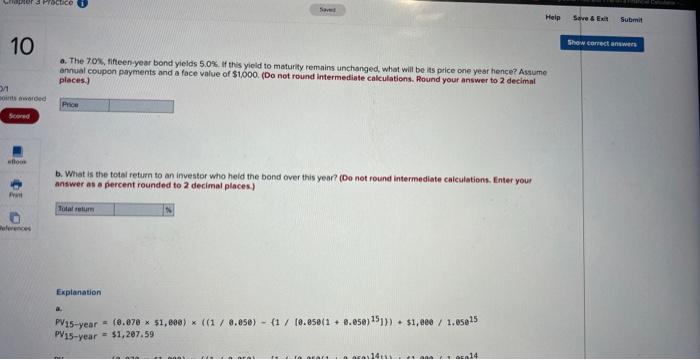

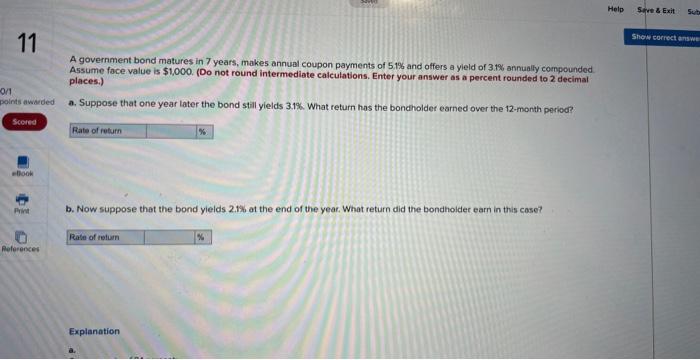

In November 2017. Treasury 458 Bs of 2042 offered a semiannually compounded yield to maturity of 274%. Recognizing that coupons are peid semiannually, calculate the bond's price. Assume foce value is $1,000. (Do not round intermediate calculations. Aound your answer to 2 decimal places.) Explanation Semiannual discount rate =0.0274/2=0.0137 or 137% Number of time periods (204220m)2=50 PY={(0,04625$1,000)/2}((1/0,0137){1/(0,0137(1+0,0137)50})}+51,060/(1+0,0137)50 PV=$1,339,55 a. The 705, fifieen year bond yields 5.0%. If this yield to maturity remains unchanged, what will be as price one year hence? Assume annual coupon payments and a face value of $1,000. (Do not round intermediate calculations. Round your answer to 2 decimat plectis.) b. What is the total return to an investor who held the bond over this year? (Do not round intermediate caiculations. Enter your answer as percent rounded to 2 decimal places.) Explanation a. P15-year=(0.07051,090)((1/0.058)(1/(0.050(1+8.050)15)})+$1,0e0/1,05e15P15-year=$1,207.59 A government bond matures in 7 years, makes annual coupon payments of 5.1% and offers a yield of 3.1% annually compounded Assume face value is $1,000. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) a. Suppose that one year Later the bond still yields 3.1%. What return has the bondholder earned over the 12 -month peried? b. Now suppose that the bond yields 2.1% of the end of the year. What return did the bondhoider earn in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts