Question: Hello can someone help me answer this with steps please. The answers are: A. 0.1233 B. 0.0929 C. D+E: 1022, CCC=0.0975 Problem 5.1. The bonds

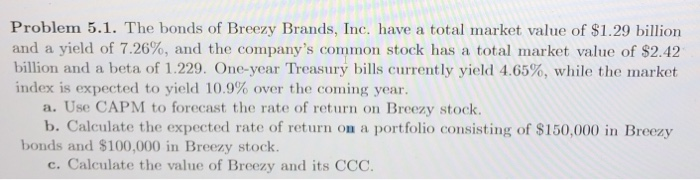

Problem 5.1. The bonds of Breezy Brands, Inc. have a total market value of $1.29 billion and a yield of 7.26%, and the company's common stock has a total market value of $2.42 billion and a beta of 1.229. One-year Treasury bills currently yield 4.65%, while the mlarket index is expected to yield 10.9% over the coming year. a. Use CAPM to forecast the rate of return on Breezy stock b. Calculate the expected rate of return on a portfolio consisting of S150,000 in Breezy bonds and $100,000 in Breezy stock c. Calculate the value of Breezy and its CCC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts