Question: Hello can someone help me do 2.4d please. The answer is 0.0791. I need to know how to get it . Thank you DI OCCs

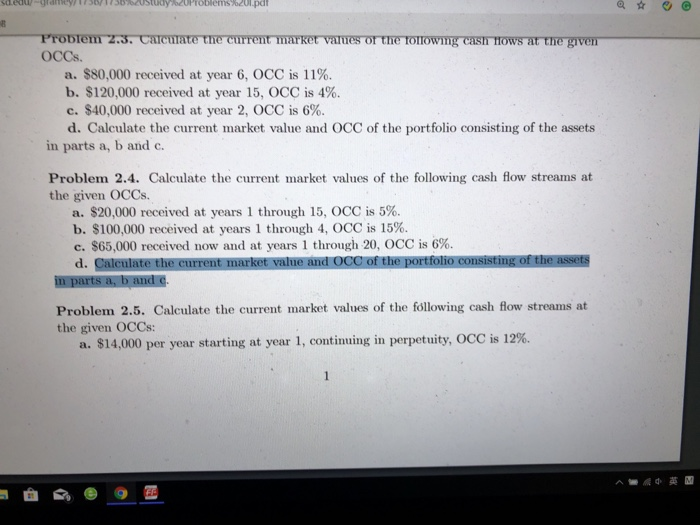

DI OCCs a. $80,000 received at year 6, OCC is 11%. b. $120,000 received at year 15, OCC is 4%. c. $40,000 received at year 2, OCC is 6%. d. Calculate the current market value and OCC of the portfolio consisting of the assets in parts a, b and c. Problem 2.4. Calculate the current market values of the following cash flow streams at the given OCCs. a. $20,000 received at years l through 15, OCC is 5%. b. $100,000 received at years 1 through 4, 0CC is 15%. c. $65,000 received now and at years l through 20, OCC is 6%. d. Problem 2.5. Calculate the current market values of the following cash flow streams at the given OCCs: a. $14,000 per year starting at year 1, continuing in perpetuity, OCC is i 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts