Question: Hello can someone help me with 2.6 B-C please. I need steps to see how to solve it. Thank you b. $60,000 at year 1,

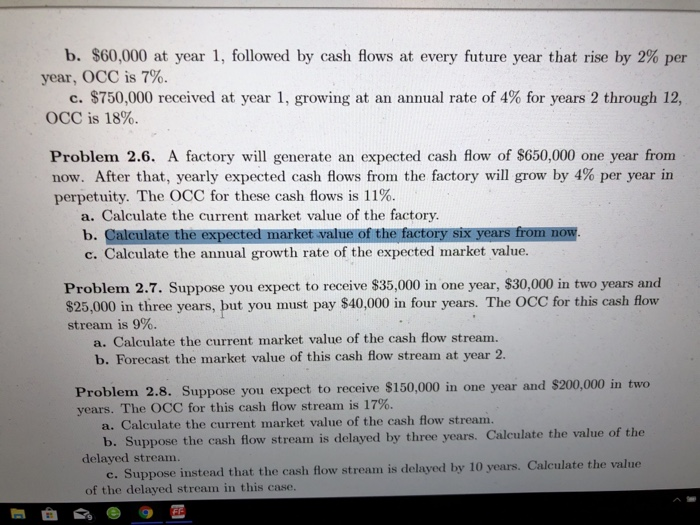

b. $60,000 at year 1, followed by cash flows at every future year that rise by 2% per year, OCC is 7%. c. $750,000 received at year 1, growing at an annual rate of 4% for years 2 through 12, OCC is 18%. Problem 2.6. A factory will generate an expected cash flow of $650,000 one year from now. After that, yearly expected cash flows frorn the factory will grow by 4% per year in perpetuity. The OCC for these cash flows is 11%. a. Calculate the current market value of the factory b. Calculate the expected market value of th c. Calculate the annual growth rate of the expected market value. the Problem 2.7. Suppose you expect to receive $35,000 in one year, $30,000 in two years and $25,000 in three years, but you must pay $40,000 in four years. The OCC for this cash flow stream is 9%. a. Calculate the current market value of the cash flow stream. b. Forecast the market value of this cash flow stream at year 2. Problem 2.8. Suppose you expect to receive $150,000 in one year and $200,000 in two years. The OCC for this cash flow stream is 17%. a. Calculate the current market value of the cash flow stream. b. Suppose the cash flow stream is delayed by three years. Calculate the value of the delayed stream. value c. Suppose instead that the cash flow stream is delayed by 10 years. Calculate the of the delayed stream in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts