Question: hello! can someone help me with this question l. thank you Frost PART 2. Problems x + and Help Save & Exit Submit Final Test

hello! can someone help me with this question l. thank you

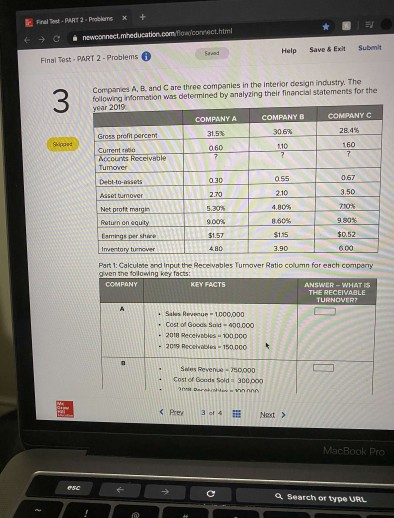

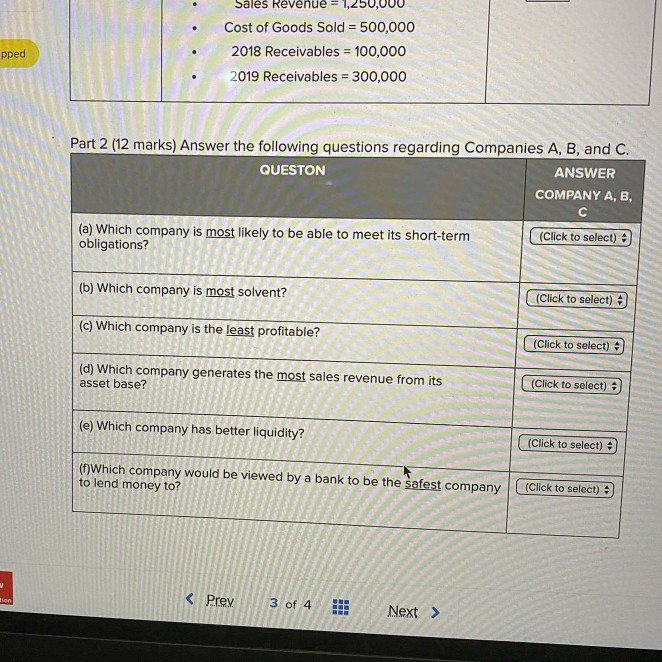

Frost PART 2. Problems x + and Help Save & Exit Submit Final Test - PART 2 - Problems 30.6% Companies A, B and C are three companies in the interior design industry. The following information was determined by analyzing their financial statements for the year 2019 COMPANY A COMPANY B COMPANY C Gross profit percent 31.5% 28.4% Current 060 10 160 Accounts Receivable Tumover Debt-to- 055 0.67 Aliset tumower 3,50 Net prott margin 5.30% 7105 Ratun on equity 9.00% Lamins pershire $1.57 $135 $0.52 Inventory turnover 4.80 2.10 8.00% 9 30% 600 Part 1: Calculate and input the Receivables Tumover Ratio column for each company given the following key facts: COMPANY KEY FACTS ANSWER - WHAT IS THE RECEIVABLE Sales Revenue - 1000,000 . Cost of Good Son - 100.000 2016 Receivables-100 DOO - 2019 Rece -150.000 Swes Revenue - 750,000 Cost of Good Sold = 300.000 Next > MacBook Pro esc o Search or type URL Sales Revenue = 1,250,000 Cost of Goods Sold = 500,000 2018 Receivables = 100,000 2019 Receivables = 300,000 pped Part 2 (12 marks) Answer the following questions regarding Companies A, B, and C. QUESTON ANSWER COMPANY A, B, (a) Which company is most likely to be able to meet its short-term obligations? (Click to select) (b) Which company is most solvent? (Click to select) - (c) Which company is the least profitable? (Click to select) (d) Which company generates the most sales revenue from its asset base? (Click to select) (e) Which company has better liquidity? (Click to select) (Which company would be viewed by a bank to be the safest company to lend money to? (Click to select) Frost PART 2. Problems x + and Help Save & Exit Submit Final Test - PART 2 - Problems 30.6% Companies A, B and C are three companies in the interior design industry. The following information was determined by analyzing their financial statements for the year 2019 COMPANY A COMPANY B COMPANY C Gross profit percent 31.5% 28.4% Current 060 10 160 Accounts Receivable Tumover Debt-to- 055 0.67 Aliset tumower 3,50 Net prott margin 5.30% 7105 Ratun on equity 9.00% Lamins pershire $1.57 $135 $0.52 Inventory turnover 4.80 2.10 8.00% 9 30% 600 Part 1: Calculate and input the Receivables Tumover Ratio column for each company given the following key facts: COMPANY KEY FACTS ANSWER - WHAT IS THE RECEIVABLE Sales Revenue - 1000,000 . Cost of Good Son - 100.000 2016 Receivables-100 DOO - 2019 Rece -150.000 Swes Revenue - 750,000 Cost of Good Sold = 300.000 Next > MacBook Pro esc o Search or type URL Sales Revenue = 1,250,000 Cost of Goods Sold = 500,000 2018 Receivables = 100,000 2019 Receivables = 300,000 pped Part 2 (12 marks) Answer the following questions regarding Companies A, B, and C. QUESTON ANSWER COMPANY A, B, (a) Which company is most likely to be able to meet its short-term obligations? (Click to select) (b) Which company is most solvent? (Click to select) - (c) Which company is the least profitable? (Click to select) (d) Which company generates the most sales revenue from its asset base? (Click to select) (e) Which company has better liquidity? (Click to select) (Which company would be viewed by a bank to be the safest company to lend money to? (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts