Question: Hello, can someone please help me solve this with explanation? Thanks 1. Presented below are the income statement items from Batcho Ball Inc. for the

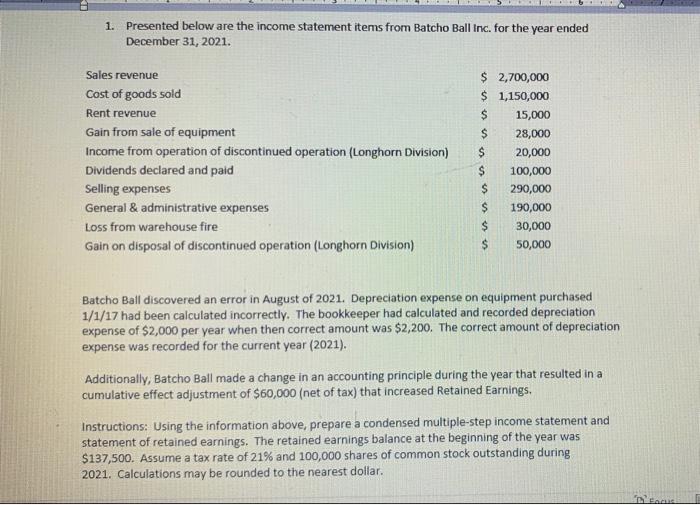

1. Presented below are the income statement items from Batcho Ball Inc. for the year ended December 31, 2021. Sales revenue Cost of goods sold Rent revenue Gain from sale of equipment Income from operation of discontinued operation (Longhorn Division) Dividends declared and paid Selling expenses General & administrative expenses Loss from warehouse fire Gain on disposal of discontinued operation (Longhorn Division) $ 2,700,000 $ 1,150,000 $ 15,000 $ 28,000 $ 20,000 $ 100,000 $ 290,000 $ 190,000 $ 30,000 50,000 Batcho Ball discovered an error in August of 2021. Depreciation expense on equipment purchased 1/1/17 had been calculated incorrectly. The bookkeeper had calculated and recorded depreciation expense of $2,000 per year when then correct amount was $2,200. The correct amount of depreciation expense was recorded for the current year (2021). Additionally, Batcho Ball made a change in an accounting principle during the year that resulted in a cumulative effect adjustment of $60,000 (net of tax) that increased Retained Earnings. Instructions: Using the information above, prepare a condensed multiple-step income statement and statement of retained earnings. The retained earnings balance at the beginning of the year was $137,500. Assume a tax rate of 21% and 100,000 shares of common stock outstanding during 2021. Calculations may be rounded to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts