Question: Hello, Can someone please help me with this question and also add in the steps and formulas? Thank you so much, greatly appreciated :) Fultz

Hello,

Can someone please help me with this question and also add in the steps and formulas?

Thank you so much, greatly appreciated :)

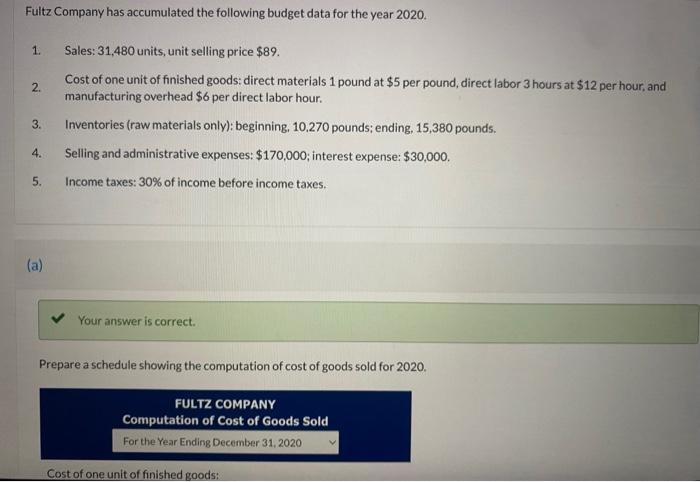

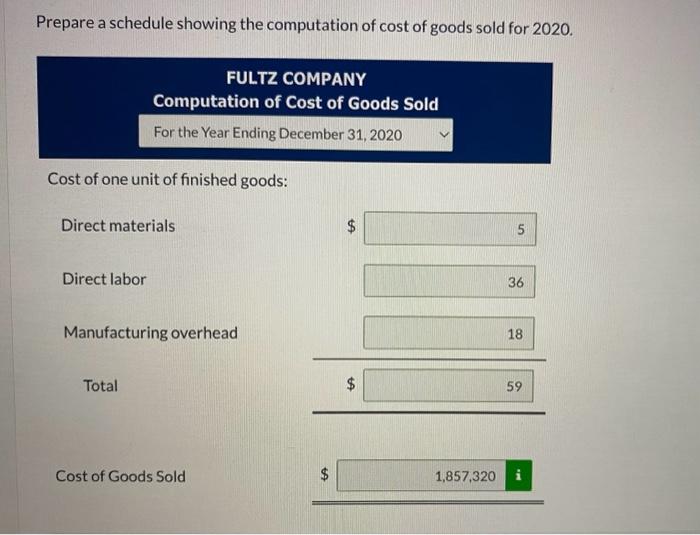

Fultz Company has accumulated the following budget data for the year 2020 . 1. Sales: 31,480 units, unit selling price $89. 2. Cost of one unit of finished goods: direct materials 1 pound at $5 per pound, direct labor 3 hours at $12 per hour, and manufacturing overhead $6 per direct labor hour. 3. Inventories (raw materials only): beginning, 10,270 pounds; ending, 15,380 pounds. 4. Selling and administrative expenses: $170,000; interest expense: $30,000. 5. Income taxes: 30% of income before income taxes. (a) Your answer is correct. Prepare a schedule showing the computation of cost of goods sold for 2020 . 0. Prepare a budgeted multiple-step income statement for 2020. FULTZ COMPANY Budgeted Income Statement For the Year Ending December 31, 2020 \begin{tabular}{|l|l|} \hline Sales & v \\ \hline Cost of Goods Sold & v \\ \hline \end{tabular} Gross Profit 753840 \begin{tabular}{l} Selling and Administrative Expenses \\ \hline Income from Operations \end{tabular} \begin{tabular}{l} \hline Interest Expense \\ \hline Income before Income Taxes \\ \hline \end{tabular} Income Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts