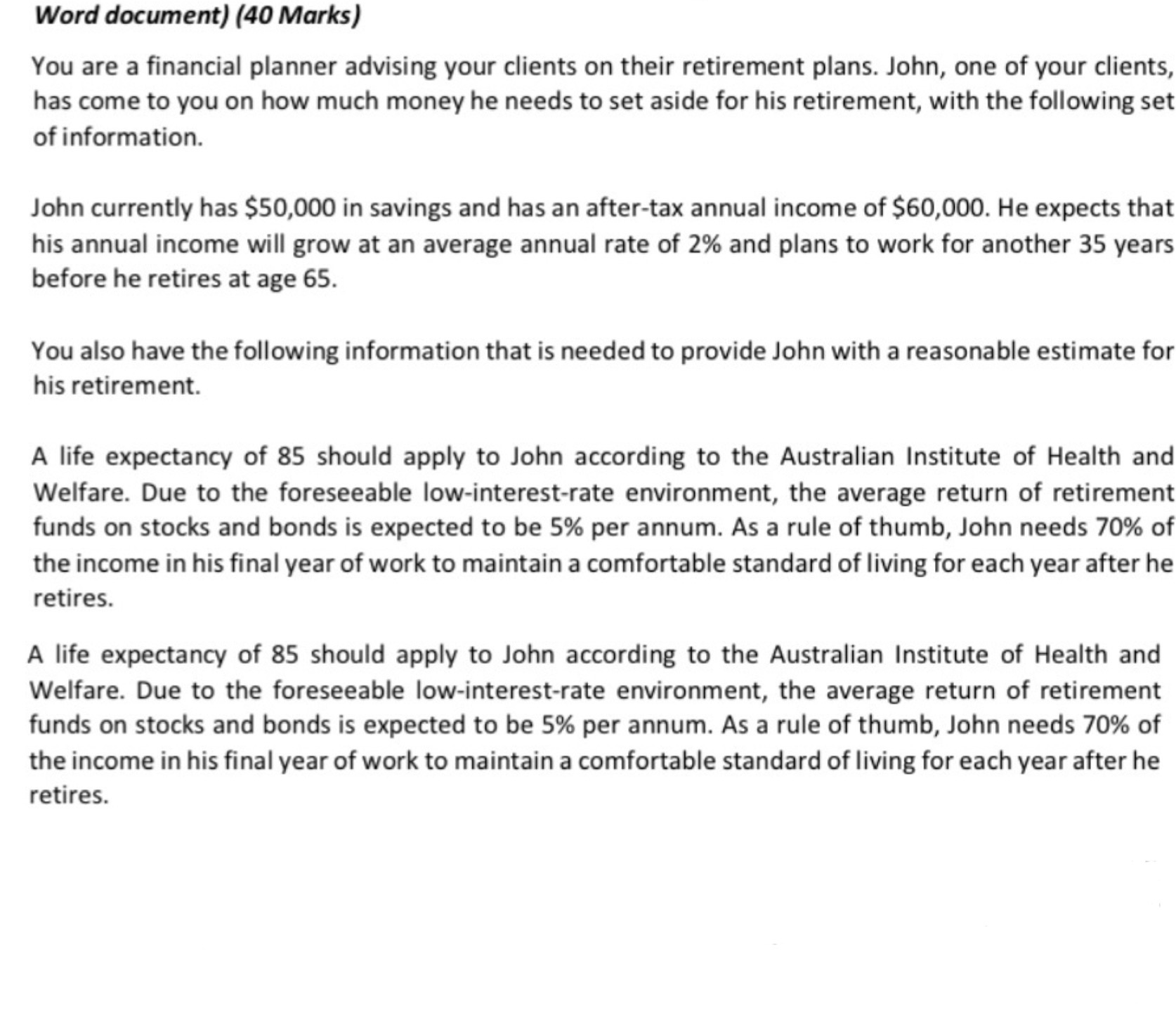

Question: Hello, can someone please help me with this question, I'm not sure which formulas I should be using to work it out:John thinks he can

Hello, can someone please help me with this question, I'm not sure which formulas I should be using to work it out:"John thinks he can comfortably skip a couple of coffees that cost him $10 a week and contributes to his retirement fund. By how much will his annual retirement income increase from his coffee sacrifice?"Thank you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts