Question: Hello can you answer this. If possible can you explain how did you get the answer. So Im able to understand this topic. Thank youu.

Hello can you answer this. If possible can you explain how did you get the answer. So Im able to understand this topic.

Thank youu. I only rate helpful ?

(Given, formula used, solution) and if possible please put explanation

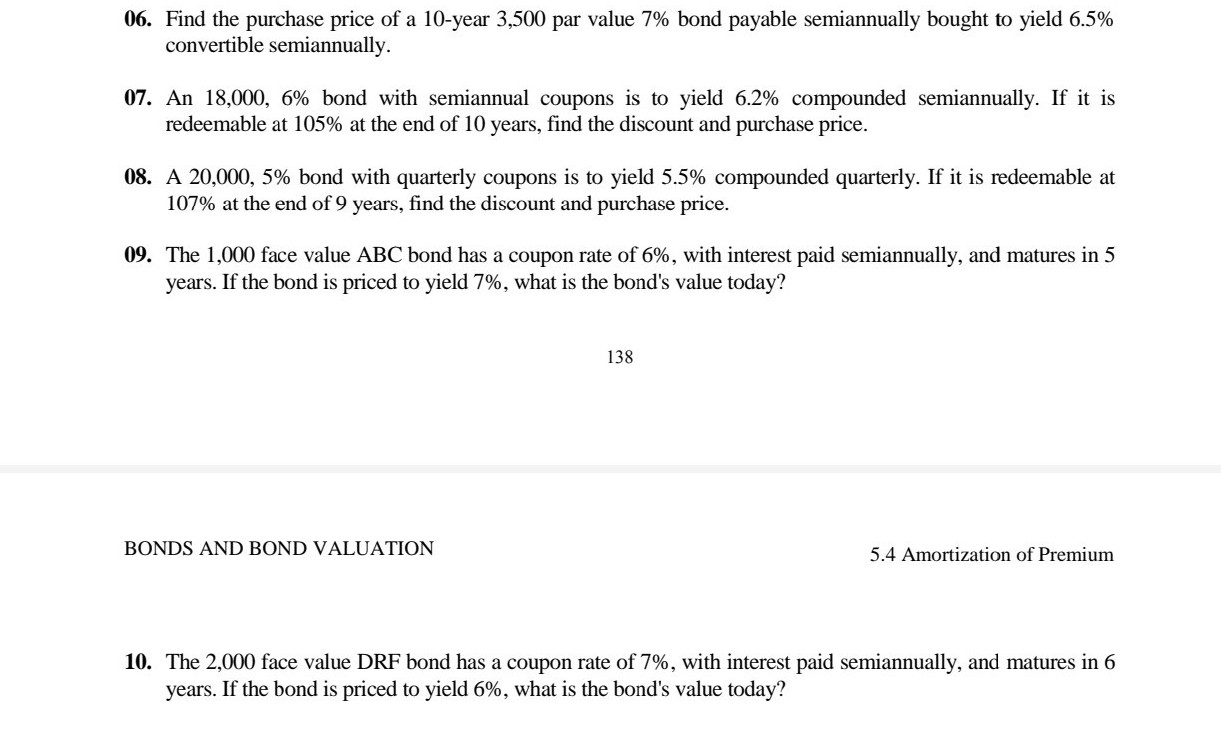

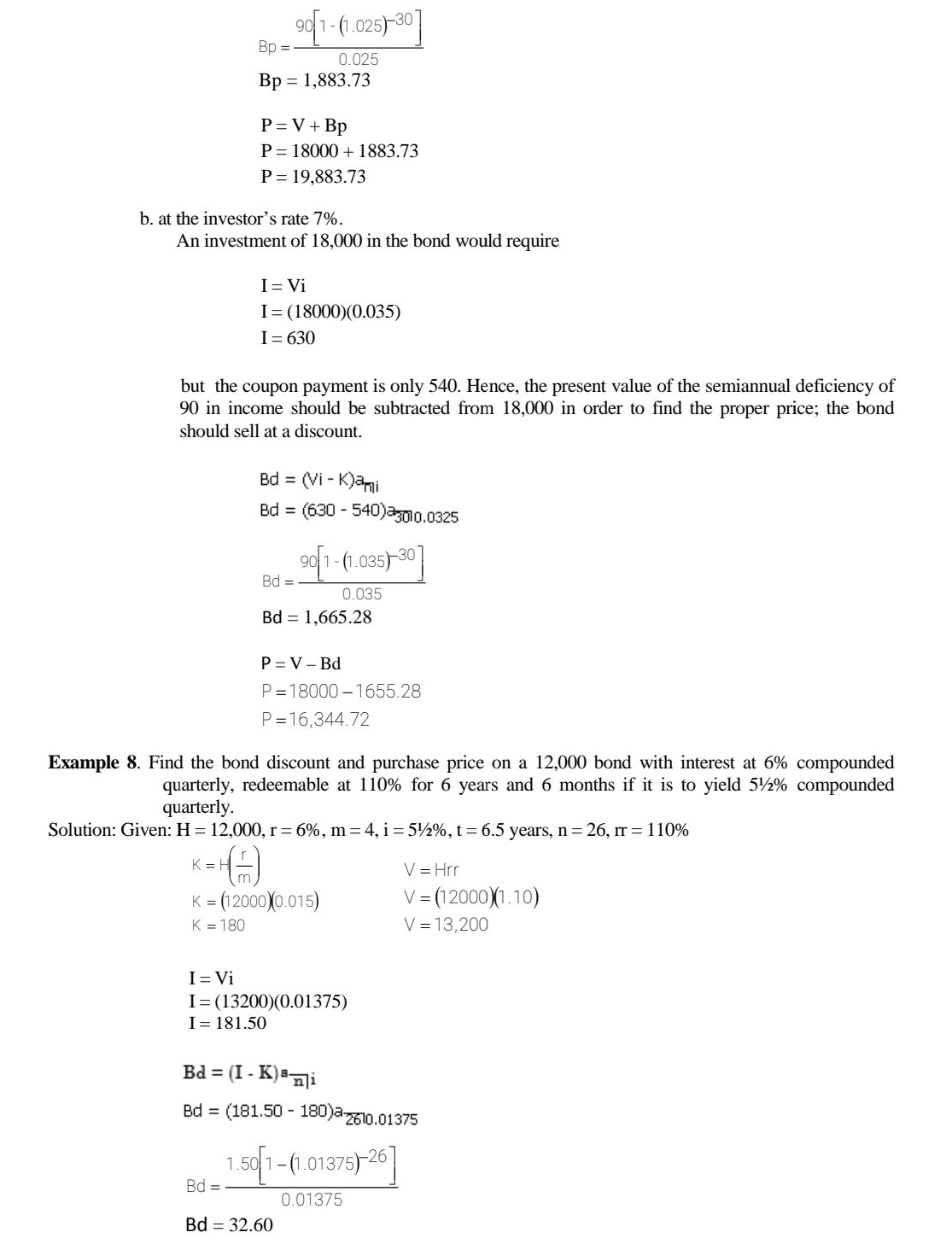

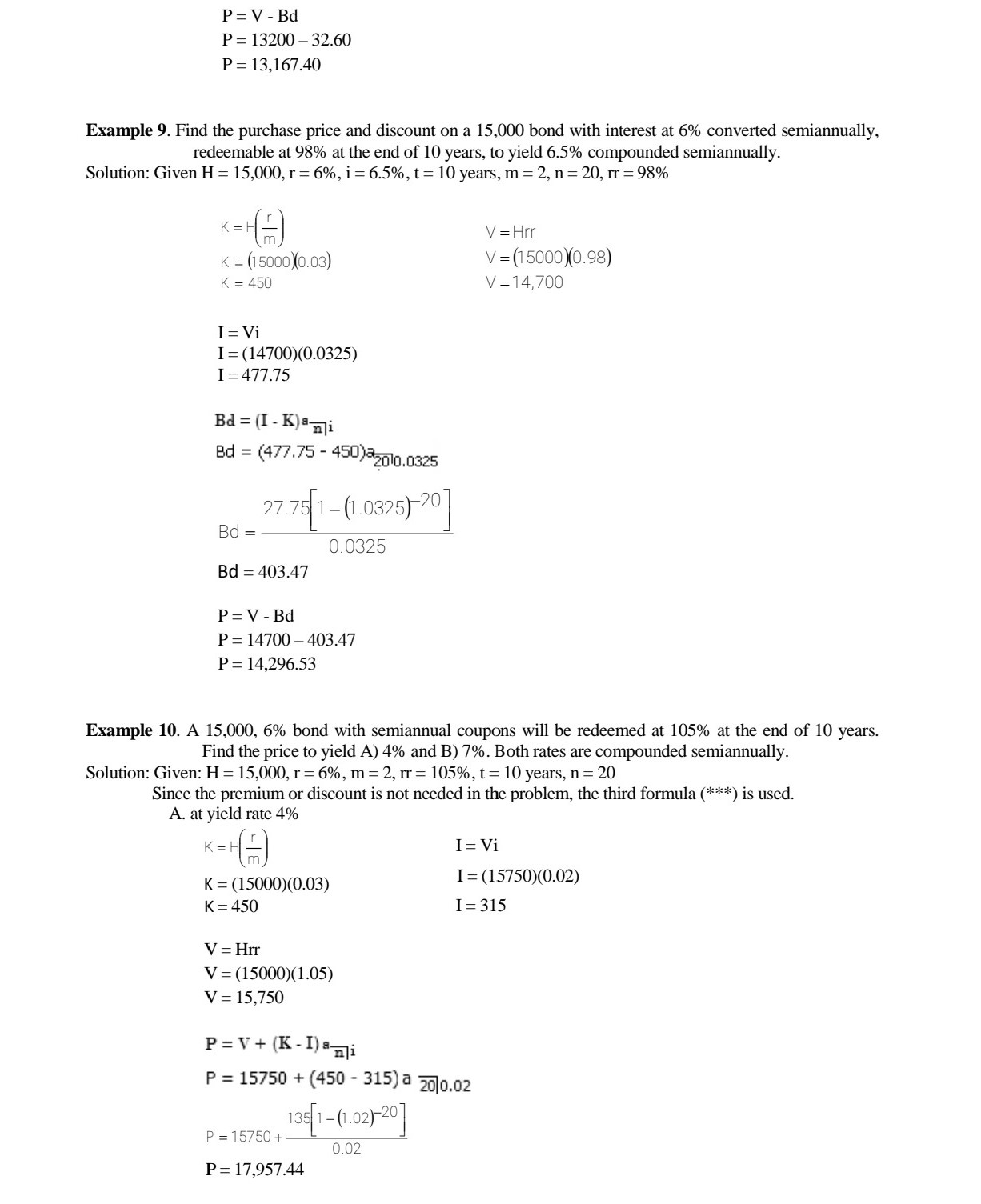

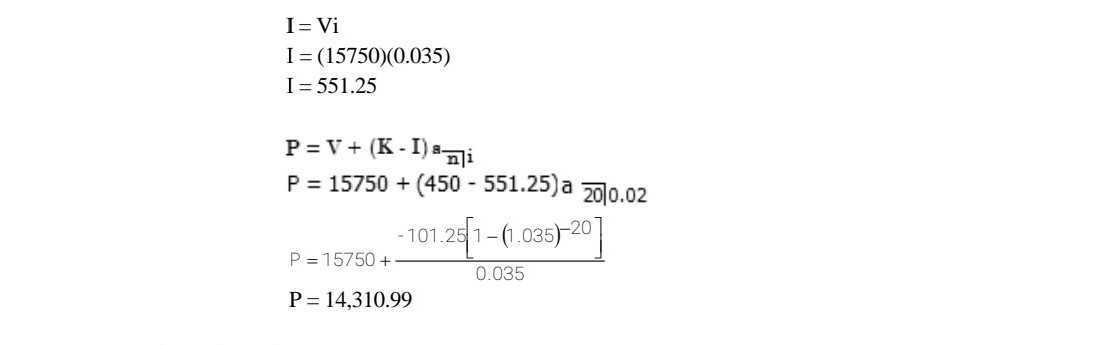

06. Find the purchase price of a 10-year 3,500 par value 7% bond payable semiannually bought to yield 6.5% convertible semiannually. 0'7. An 18,000, 6% bond with semiannual eoupons is to yield 6.2% compounded semiannualiy. If it is redeemable at 105% at the end of 10 years, nd the discount and purchase price. 08. A 20,000, 5% bond with quarterly coupons is to yield 5.5% compounded quarterly. If it is redeemable at 107% at the end of 9 years, nd the discount and purchase price. 09. The 1,000 face value ABC bond has a coupon rate of 6%, with interest paid semiannually, and matures in 5 years. If the bond is priced to yield 7%, what is the band's value today? 138 BONDS AND BOND VALUATION 5.4 Amortization of Premium 10. The 2,000 face value DRF bond has a coupon rate of 7%, with interest paid semiannually, and matures in 6 years. If the bond is priced to yield 6%, what is the band's value today? 5.3 BOND VALUATION BY PREMIUM OR DISCOUNT FORMULA An issuer nomally records the bond obligations at its face value. Hence, when bonds are issued at an amount other than the face value, a bond discount or premium is recognized for the difference between the cash received and the bond face value. If the investor's rate per period is i, then any investment of V requires I : Vi as interest at the end of each period. Suppose that this investor pays V for the bond and the bond rate is greater than the investor's rate, then there is an excess of K I in the payment at the end of each coupon period, and the investor should pay an added premium for the bond. If the investor's rate is greater than the bond rate, there is a deciency of I K when a coupon payment is made; here the investor should get the bond at a discount. PREMIUM OR DISCOUNT FORNIULA '; If the coupon is greater than the investor's interest, the investor pays premium where, Premium : present value of excess of coupons over interest on V or By = (K - mm . P : V + Bp * _ If the coupon is less than the investor's interest, the investor obtain the bond at a discount, " -' where " Discount : present value of deciency of coupons under interest on v or Bd=(I-K)-Eli P:VBd ** Formulas * and ** can be written in just one formula, called the the premium or discount '- formula Pawns1).?\" *3\"? Example '7. An 18,000, 6% bond with semiannual coupons will be redeemed at the end of 15 years. Find the price by premium or discount formula, to yield a) 5% and b) 3'96. Both yield rates are compounded semiannually. Solution: Given: H : V: 18,000 , r : 6%, m : 2, t: 15 years, a) 5% b) 7% a. at investment rate 5%. The expected semiannual interest is I : Vi I : (18000)\").025) I : 450 while the semiannual coupon payment is I K : \"[5] K : (13000)(0.03) K : 540. There is an excess of 90 semiannually for 15 years. Hence, a price of 18,000 was too small; the investor should pay a premium equal to the present value of the excess income: Hp = (K - View, Bp = (540 - memom 90 1 - (1.025)-30 Bp = 0.025 Bp = 1,883.73 P = V+Bp P = 18000 + 1883.73 P = 19,883.73 b. at the investor's rate 7%. An investment of 18,000 in the bond would require I = Vi I = (18000)(0.035) I= 630 but the coupon payment is only 540. Hence, the present value of the semiannual deficiency of 90 in income should be subtracted from 18,000 in order to find the proper price; the bond should sell at a discount. Bd = (Vi - K)ami Bd = (630 - 540)35010.0325 30 1 - (1.035)-301 Bd = 0.035 Bd = 1,665.28 P = V-Bd P =18000 - 1655.28 P =16,344.72 Example 8. Find the bond discount and purchase price on a 12,000 bond with interest at 6% compounded quarterly, redeemable at 110% for 6 years and 6 months if it is to yield 51/2% compounded quarterly. Solution: Given: H = 12,000, r = 6%, m =4, i =51/2%, t = 6.5 years, n = 26, rr = 110% V = Hrr K = (12000 )(0.015) V = (12000)(1.10) K = 180 V =13,200 I = Vi I= (13200)(0.01375) I = 181.50 Bd = (I - K) = mi Bd = (181.50 - 180)3-2610.01375 1.50 1 - (1.01375 )- 26 Bd = 0.01375 Bd = 32.60P :V - Bd P :1320032.60 P: 13,167.40 Example 9. Find the purchase price and discount on a 15,000 bond with interest at 6% convened semiannually, redeemable at 93% at the end of 10 years, to yield 6.5% compounded semiannually. Solution: Given H : 15,000, r : 6%, i: 6.5%, t: 10 years, In : 2, n : 20, rr : 98% K = H[%] V : Hrr K = (150001003) V 4150001098) K = 450 v214,700 I : Vi I : (14700)(0.0325) I : 477.75 Ed = [I - Win Bd = (477.75 - 45)320Iu 0325 27.75[1 _ (1 032020] 0.0325 8d = Bd : 403.47 P : V - Bd P : 14700 - 403.47 P : 14,295.53 Example 10. A 15,000, 6% bond with semiannual coupons will be redeemed at 105% at the end of 10 years. Find the price to yield A) 4% and B) 7%. Both rates are compounded semiannually. Solution: Given: H : 15,000, r : 6%, m : 2, rr : 105%, t: 10 years, n : 20 Since the premium or discount is not needed in the problem, the third formula (***) is used. A. at yield rate 4% K = H[i] I: Vi m K = (15000)(0.03) I = (15750)(0.02) K = 450 I : 315 V : HIT V = (15000)(l.05) V = 15,750 1>=v+(K.I).Eli 135p \"(102)-20] P =15750+ 0.02 P : 17,957.44 \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts