Question: hello can you do number 2 . is a retirement analysis plan . 1. Detailed expense estimates for current lifestyle and for retirement lifestyle. 2.

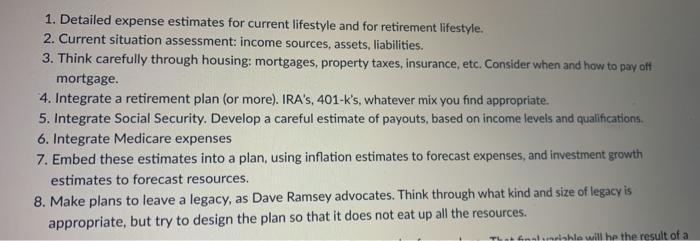

1. Detailed expense estimates for current lifestyle and for retirement lifestyle. 2. Current situation assessment: income sources, assets, liabilities. 3. Think carefully through housing: mortgages, property taxes, insurance, etc. Consider when and how to pay off mortgage. 4. Integrate a retirement plan (or more). IRA's, 401-k's, whatever mix you find appropriate 5. Integrate Social Security. Develop a careful estimate of payouts, based on income levels and qualifications. 6. Integrate Medicare expenses 7. Embed these estimates into a plan, using inflation estimates to forecast expenses, and investment growth estimates to forecast resources, 8. Make plans to leave a legacy, as Dave Ramsey advocates. Think through what kind and size of legacy is appropriate, but try to design the plan so that it does not eat up all the resources. siahle will be the result of a 1. Detailed expense estimates for current lifestyle and for retirement lifestyle. 2. Current situation assessment: income sources, assets, liabilities. 3. Think carefully through housing: mortgages, property taxes, insurance, etc. Consider when and how to pay off mortgage. 4. Integrate a retirement plan (or more). IRA's, 401-k's, whatever mix you find appropriate 5. Integrate Social Security. Develop a careful estimate of payouts, based on income levels and qualifications. 6. Integrate Medicare expenses 7. Embed these estimates into a plan, using inflation estimates to forecast expenses, and investment growth estimates to forecast resources, 8. Make plans to leave a legacy, as Dave Ramsey advocates. Think through what kind and size of legacy is appropriate, but try to design the plan so that it does not eat up all the resources. siahle will be the result of a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts