Question: Hello, Can you help me answer these questions? Thanks! Question 7 3 pts Suppose you have two choices to pay for a proposed project: 1.

Hello,

Can you help me answer these questions?

Thanks!

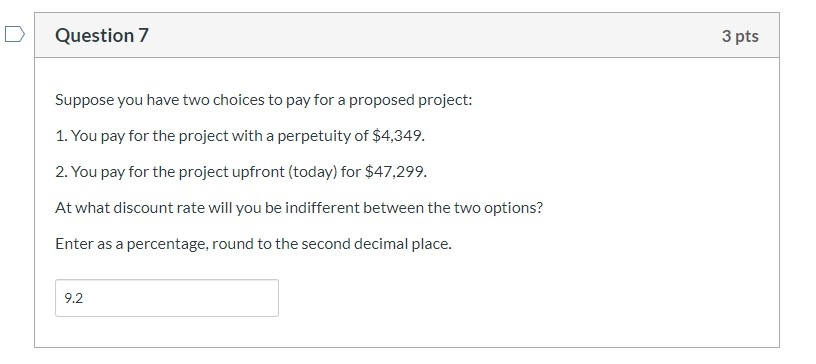

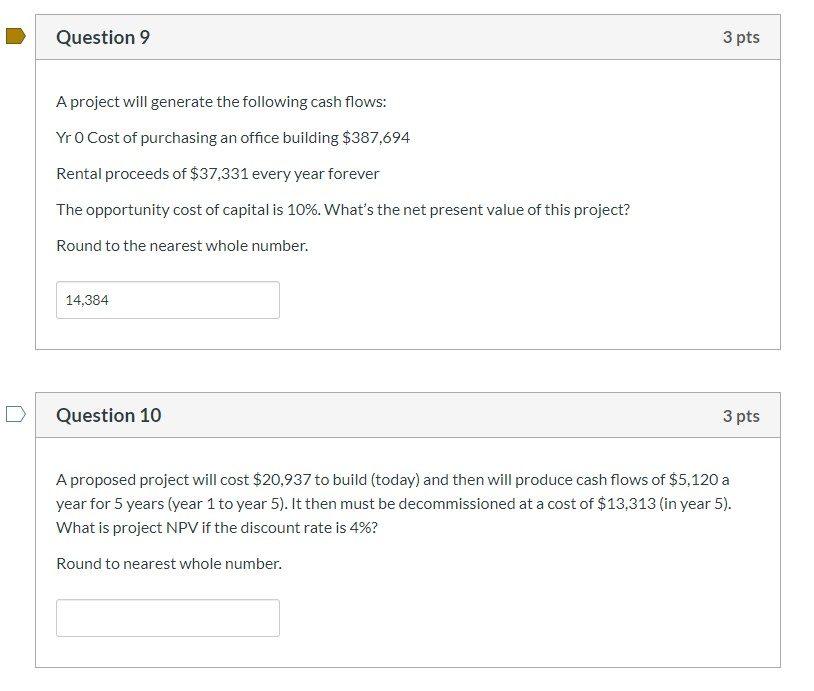

Question 7 3 pts Suppose you have two choices to pay for a proposed project: 1. You pay for the project with a perpetuity of $4,349. 2. You pay for the project upfront (today) for $47,299. At what discount rate will you be indifferent between the two options? Enter as a percentage, round to the second decimal place. 9.2 Question 9 3 pts A project will generate the following cash flows: Yr O Cost of purchasing an office building $387,694 Rental proceeds of $37,331 every year forever The opportunity cost of capital is 10%. What's the net present value of this project? Round to the nearest whole number. 14,384 Question 10 3 pts A proposed project will cost $20,937 to build (today) and then will produce cash flows of $5,120 a year for 5 years (year 1 to year 5). It then must be decommissioned at a cost of $13,313 (in year 5). What is project NPV if the discount rate is 4%? Round to nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts