Question: Hello, can you help me with this problem please? Use those five individual common stocks: Apple Inc.(AAPL), Johnson & Johnson(JNJ), Tesla Inc.(TSLA), Amazon.com, Inc(AMZN), The

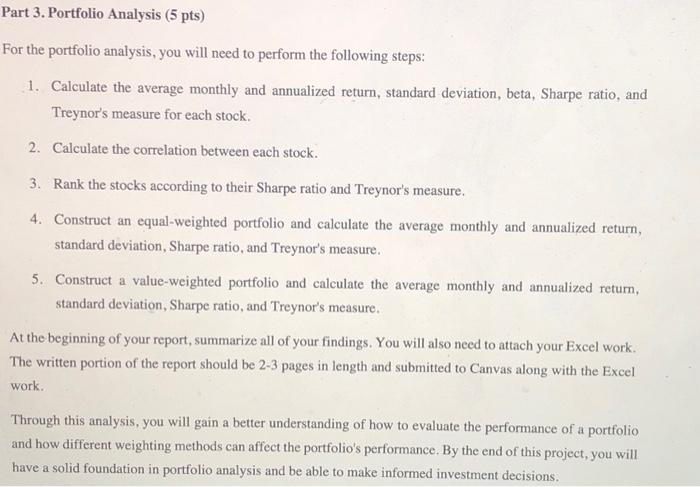

For the portfolio analysis, you will need to perform the following steps: 1. Calculate the average monthly and annualized return, standard deviation, beta, Sharpe ratio, and Treynor's measure for each stock. 2. Calculate the correlation between each stock. 3. Rank the stocks according to their Sharpe ratio and Treynor's measure. 4. Construct an equal-weighted portfolio and calculate the average monthly and annualized return, standard deviation, Sharpe ratio, and Treynor's measure. 5. Construct a value-weighted portfolio and calculate the average monthly and annualized return, standard deviation, Sharpe ratio, and Treynor's measure. At the beginning of your report, summarize all of your findings. You will also need to attach your Excel work. The written portion of the report should be 2-3 pages in length and submitted to Canvas along with the Excel work. Through this analysis, you will gain a better understanding of how to evaluate the performance of a portfolio and how different weighting methods can affect the portfolio's performance. By the end of this project, you will have a solid foundation in portfolio analysis and be able to make informed investment decisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts