Question: Hello, can you please help me with how to answer question c only? Thank you. Crane Company reported the following information in its general ledger

Hello, can you please help me with how to answer question c only? Thank you.

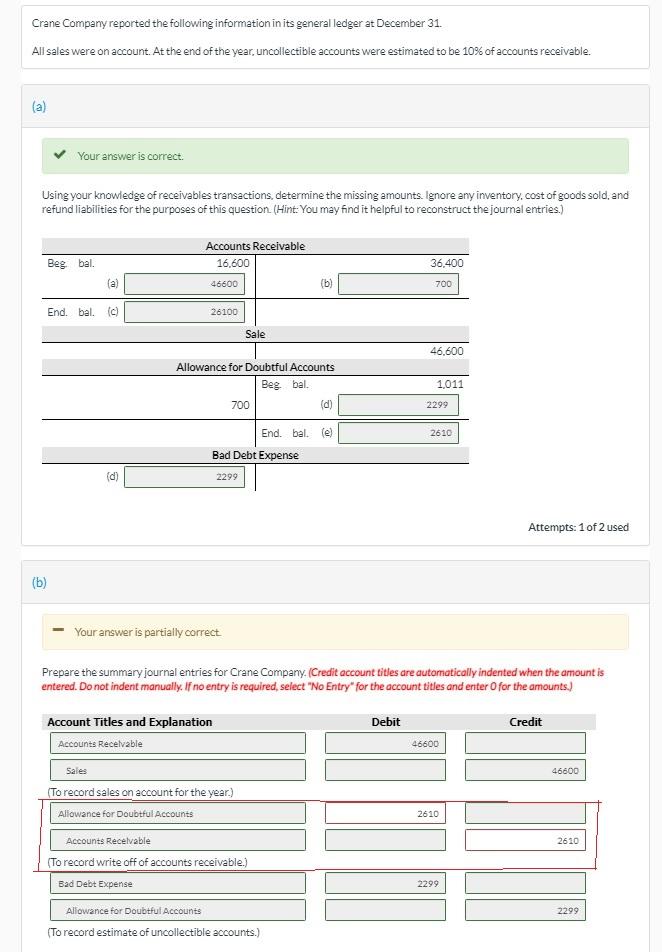

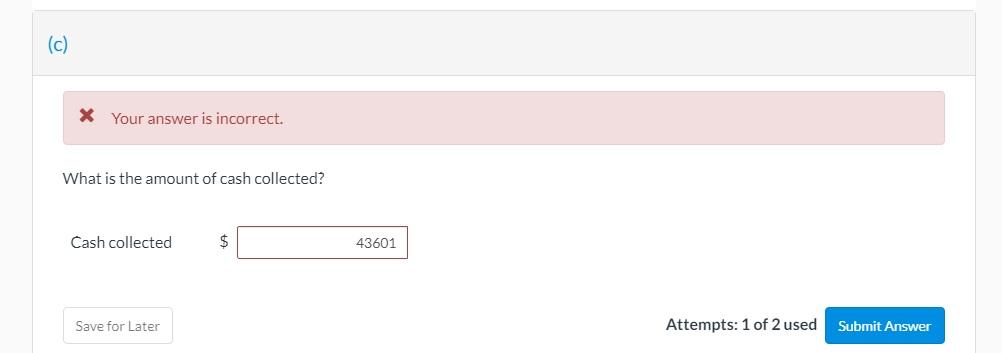

Crane Company reported the following information in its general ledger at December 31. All sales were on account. At the end of the year, uncollectible accounts were estimated to be 10% of accounts receivable. (a) Your answer is correct Using your knowledge of receivables transactions, determine the missing amounts. Ignore any inventory.cost of goods sold, and refund liabilities for the purposes of this question (Hint: You may find it helpful to reconstruct the journal entries.) Accounts Receivable 16.600 Beg bal. 36,400 (a) 46600 (b) 700 End. bal. ic) 26100 Sale 46.600 Allowance for Doubtful Accounts Beg bal. 700 (d) 1,011 2299 End. balle) 2610 Bad Debt Expense (d) 2299 Attempts: 1 of 2 used (b) Your answer is partially correct Prepare the summary journal entries for Crane Company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit 46600 46600 Account Titles and Explanation Accounts Receivable Sales (To record sales on account for the year.) Allowance for Doubtful Accounts Accounts Recevable (To record write off of accounts receivable.) Bad Debt Expense 2610 2610 2299 Allowance for Doubtful Accounts 2299 (To record estimate of uncollectible accounts.) (c) X Your answer is incorrect. What is the amount of cash collected? Cash collected $ 43601 Save for Later Attempts: 1 of 2 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts