Question: Hello, can you please help me with this assignment? X402 Math for Management: Problem Set 8 Table 1 Years 0 through 10 30, you would

Hello, can you please help me with this assignment?

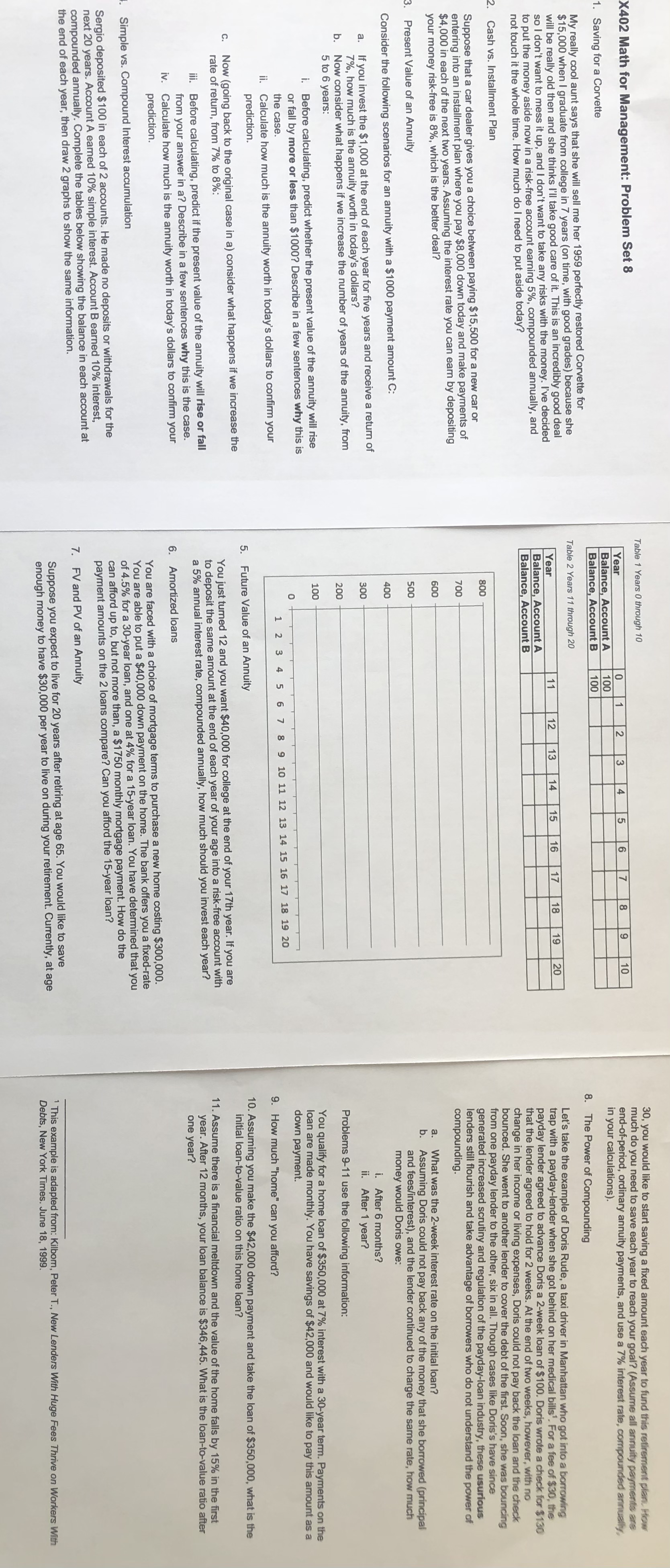

X402 Math for Management: Problem Set 8 Table 1 Years 0 through 10 30, you would like to start saving a fixed amount each year to fund this retirement plan. How Year 0 2 3 4 5 6 9 10 much do you need to save each year to reach your goal? (Assume all annuity payments are Saving for a Corvette Balance, Account A 100 end-of-period, ordinary annuity payments, and use a 7% interest rate, compounded annually, in your calculations). Balance, Account B 100 My really cool aunt says that she will sell me her 1959 perfectly restored Corvette for 8. The Power of Compounding $15,000 when I graduate from college in 7 years (on time, with good grades) because she Table 2 Years 11 through 20 will be really old then and she thinks I'll take good care of it. This is an incredibly good deal so I don't want to mess it up, and I don't want to take any risks with the money. I've decided Year 11 12 13 14 15 16 17 18 19 Let's take the example of Doris Rude, a taxi driver in Manhattan who got into a borrowing to put the money aside now in a risk-free account earning 5%, compounded annually, and Balance, Account A trap with a payday-lender when she got behind on her medical bills'. For a fee of $30, the not touch it the whole time. How much do I need to put aside today? Balance, Account B payday lender agreed to advance Doris a 2-week loan of $100. Doris wrote a check for $130 that the lender agreed to hold for 2 weeks. At the end of two weeks, however, with no Cash vs. Installment Plan change in her income or living expenses, Doris could not pay back the loan and the check bounced. She went to another lender to cover the debt of the first. Soon, she was bouncing Suppose that a car dealer gives you a choice between paying $15,500 for a new car or 300 from one payday lender to the other, six in all. Though cases like Doris's have since entering into an installment plan where you pay $8,000 down today and make payments of generated increased scrutiny and regulation of the payday-loan industry, these usurious $4,000 in each of the next two years. Assuming the interest rate you can earn by depositing 700 lenders still flourish and take advantage of borrowers who do not understand the power of compounding. your money risk-free is 8%, which is the better deal? 600 Present Value of an Annuity What was the 2-week interest rate on the initial loan? 500 Assuming Doris could not pay back any of the money that she borrowed (principal Consider the following scenarios for an annuity with a $1000 payment amount C: and fees/interest), and the lender continued to charge the same rate, how much 400 money would Doris owe: a. If you invest the $1,000 at the end of each year for five years and receive a return of 7%, how much is the annuity worth in today's dollars? 300 i. After 6 months? ii. After 1 year? Now consider what happens if we increase the number of years of the annuity, from 5 to 6 years: 200 Problems 9-11 use the following information: i. Before calculating, predict whether the present value of the annuity will rise 100 You qualify for a home loan of $350,000 at 7% interest with a 30-year term. Payments on the or fall by more or less than $1000? Describe in a few sentences why this is loan are made monthly. You have savings of $42,000 and would like to pay this amount as a the case. down payment. ii. Calculate how much is the annuity worth in today's dollars to confirm your 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 9. How much "home" can you afford? prediction. 5. Future Value of an Annuity C. Now (going back to the original case in a) consider what happens if we increase the 10. Assuming you make the $42,000 down payment and take the loan of $350,000, what is the rate of return, from 7% to 8%: You just turned 12 and you want $40,000 for college at the end of your 17th year. If you are initial loan-to-value ratio on this home loan? ii. Before calculating, predict if the present value of the annuity will rise or fall to deposit the same amount at the end of each year of your age into a risk-free account with a 5% annual interest rate, compounded annually, how much should you invest each year? 11. Assume there is a financial meltdown and the value of the home falls by 15% in the first from your answer in a? Describe in a few sentences why this is the case. year. After 12 months, your loan balance is $346,445. What is the loan-to-value ratio after one year? iv. Calculate how much is the annuity worth in today's dollars to confirm your Amortized loans prediction. You are faced with a choice of mortgage terms to purchase a new home costing $300,000. Simple vs. Compound Interest accumulation You are able to put a $40,000 down payment on the home. The bank offers you a fixed-rate of 4.5% for a 30-year loan, and one at 4% for a 15-year loan. You have determined that you Sergio deposited $100 in each of 2 accounts. He made no deposits or withdrawals for the can afford up to, but not more than, a $1750 monthly mortgage payment. How do the next 20 years. Account A earned 10% simple interest. Account B earned 10% interest, payment amounts on the 2 loans compare? Can you afford the 15-year loan? compounded annually. Complete the tables below showing the balance in each account at the end of each year, then draw 2 graphs to show the same information. 7. FV and PV of an Annuity Suppose you expect to live for 20 years after retiring at age 65. You would like to save enough money to have $30,000 per year to live on during your retirement. Currently, at age This example is adapted from: Kilbom, Peter T., New Lenders With Huge Fees Thrive on Workers With Debts, New York Times. June 18, 1999