Question: Hello can you provide a script on how to report these pictures below especially for each illustration and include explanation as possible. Chapter 11 -

Hello can you provide a script on how to report these pictures below especially for each illustration and include explanation as possible.

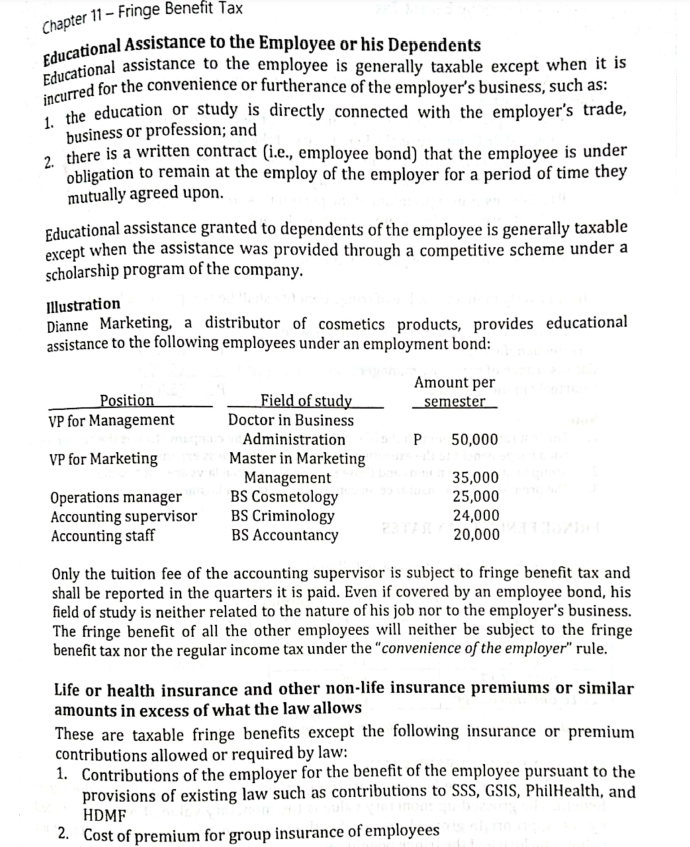

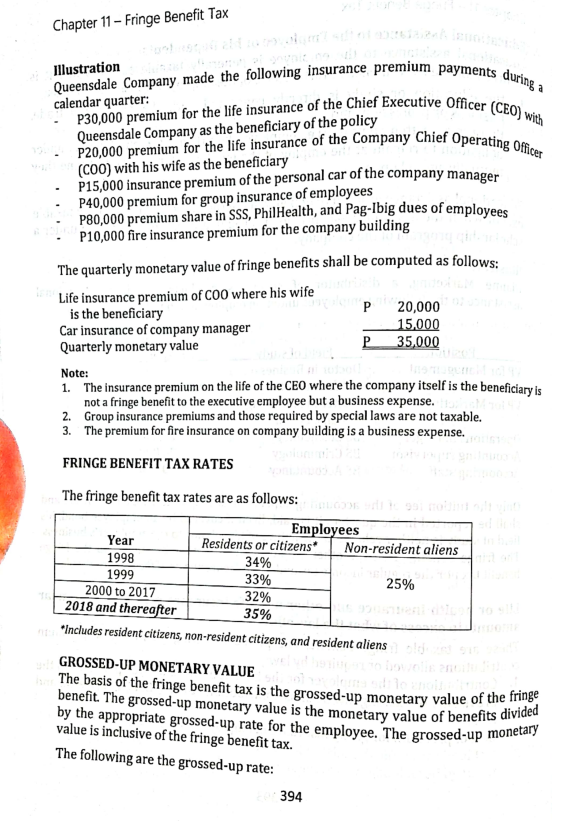

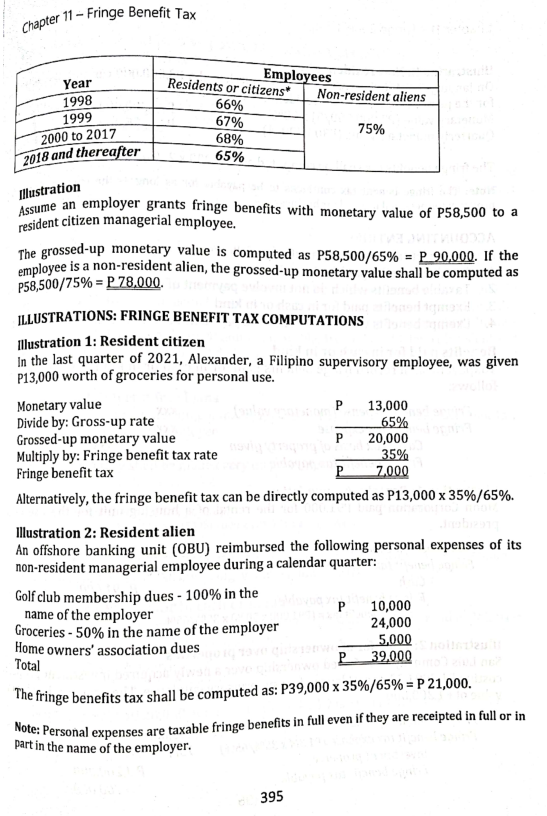

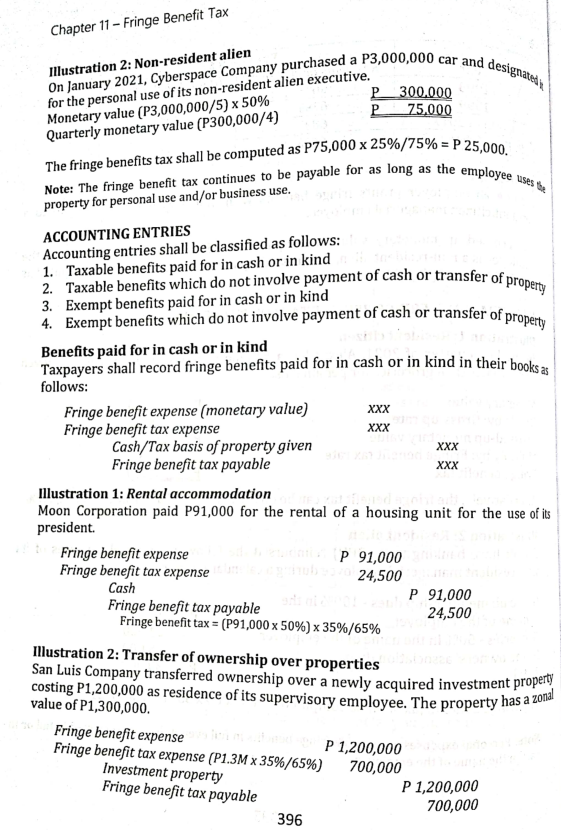

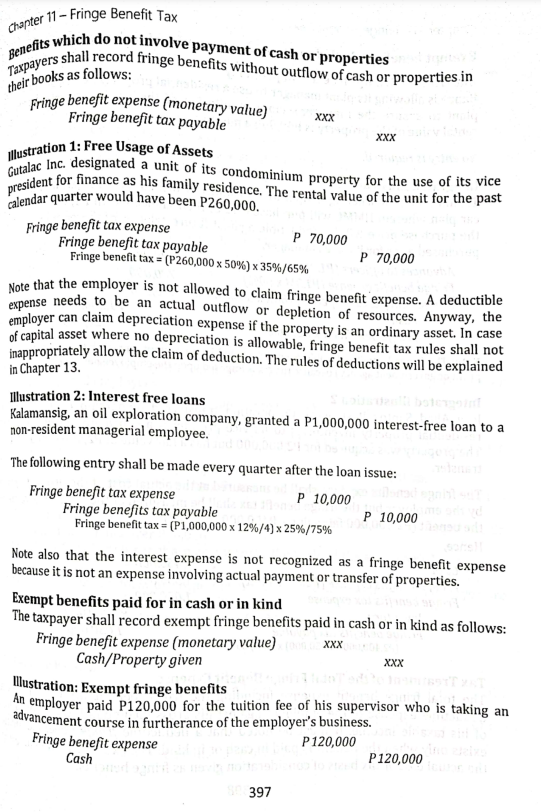

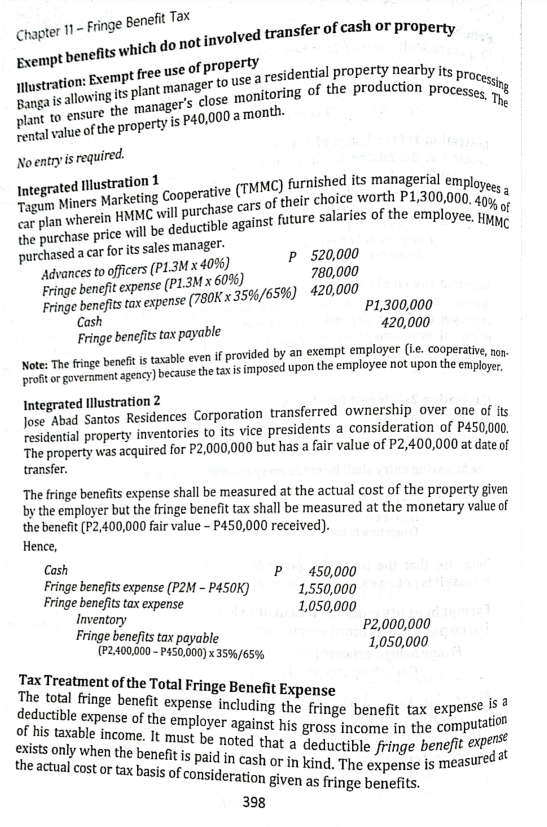

Chapter 11 - Fringe Benefit Tax Educational Assistance to the Employee or his Dependents Educational assistance to the employee is generally taxable except when it is incurred for the convenience or furtherance of the employer's business, such as: 1. the education or study is directly connected with the employer's trade, business or profession; and 2. there is a written contract (i.e., employee bond) that the employee is under obligation to remain at the employ of the employer for a period of time they mutually agreed upon. Educational assistance granted to dependents of the employee is generally taxable except when the assistance was provided through a competitive scheme under a scholarship program of the company. Illustration Dianne Marketing, a distributor of cosmetics products, provides educational assistance to the following employees under an employment bond: Amount per Position Field of study semester VP for Management Doctor in Business Administration P 50,000 VP for Marketing Master in Marketing Management 35,000 Operations manager BS Cosmetology 25,000 Accounting supervisor BS Criminology 24,000 Accounting staff BS Accountancy PATAN 20,000 Only the tuition fee of the accounting supervisor is subject to fringe benefit tax and shall be reported in the quarters it is paid. Even if covered by an employee bond, his field of study is neither related to the nature of his job nor to the employer's business. The fringe benefit of all the other employees will neither be subject to the fringe benefit tax nor the regular income tax under the "convenience of the employer" rule. Life or health insurance and other non-life insurance premiums or similar amounts in excess of what the law allows These are taxable fringe benefits except the following insurance or premium contributions allowed or required by law: 1. Contributions of the employer for the benefit of the employee pursuant to the provisions of existing law such as contributions to SSS, GSIS, PhilHealth, and HDMF 2. Cost of premium for group insurance of employeesChapter 11- Fringe Benefit Tax no 1 6 Illustration Queensdale Company made the following insurance premium payments during calendar quarter: P30,000 premium for the life insurance of the Chief Executive Officer (CEO) with Queensdale Company as the beneficiary of the policy P20,000 premium for the life insurance of the Company Chief Operating Officer (COO) with his wife as the beneficiary P15,000 insurance premium of the personal car of the company manager P40,000 premium for group insurance of employees P80,000 premium share in SSS, PhilHealth, and Pag-Ibig dues of employees P10,000 fire insurance premium for the company building The quarterly monetary value of fringe benefits shall be computed as follows; Life insurance premium of COO where his wife P 20,000 is the beneficiary Car insurance of company manager 15,000 Quarterly monetary value 35,000 Note: 1. The insurance premium on the life of the CEO where the company itself is the beneficiary is not a fringe benefit to the executive employee but a business expense. 2. Group insurance premiums and those required by special laws are not taxable. 3. The premium for fire insurance on company building is a business expense. FRINGE BENEFIT TAX RATES The fringe benefit tax rates are as follows: Employees ed rate Year Residents or citizens* In bail Non-resident aliens 1998 34% 1999 33% 2000 to 2017 25% 32% 2018 and thereafter 35% "Includes resident citizens, non-resident citizens, and resident aliens } old ed sun GROSSED-UP MONETARY VALUE The wage to howolls anoilu find ma sdi to anold The basis of the fringe benefit tax is the grossed-up monetary value of the fringe benefit. The grossed-up monetary value is the monetary value of e of benefits divided by the appropriate grossed-up rate for the employee. The grossed-up monetary value is inclusive of the fringe benefit tax. The following are the grossed-up rate: 394Chapter 11 - Fringe Benefit Tax Year Employees Residents or citizens' 1998 66% Non-resident aliens 1999 67% 2000 to 2017 75% 68% 2018 and thereafter 65% Illustration Assume an employer grants fringe benefits with monetary value of P58,500 to a resident citizen managerial employee. The grossed-up monetary value is computed as P58,500/65% = P 90,000. If the employee is a non-resident alien, the grossed-up monetary value shall be computed as P58,500/75% = P 78.000. Monod igmox! ILLUSTRATIONS: FRINGE BENEFIT TAX COMPUTATIONS Illustration 1: Resident citizen In the last quarter of 2021, Alexander, a Filipino supervisory employee, was given P13,000 worth of groceries for personal use. Monetary value P 13,000 Divide by: Gross-up rate 65% Grossed-up monetary value P 20,000 Multiply by: Fringe benefit tax rate 35% Fringe benefit tax P 7.000 Alternatively, the fringe benefit tax can be directly computed as P13,000 x 35%/65%. Illustration 2: Resident alien An offshore banking unit (OBU) reimbursed the following personal expenses of its non-resident managerial employee during a calendar quarter: Golf club membership dues - 100% in the name of the employer P 10,000 Groceries - 50% in the name of the employer 24,000 Home owners' association dues 5,000 Total P 39,000 The fringe benefits tax shall be computed as: P39,000 x 35%/65% = P 21,000. Note: Personal expenses are taxable fringe benefits in full even if they are receipted in full or in part in the name of the employer. 395Chapter 11 - Fringe Benefit Tax Illustration 2: Non-resident alien On January 2021, Cyberspace Company purchased a P3,000,000 car and designated, for the personal use of its non-resident alien executive. 300.000 Monetary value (P3,000,000/5) x 50% 75,000 Quarterly monetary value (P300,000/4) The fringe benefits tax shall be computed as P75,000 x 25%/75% = P 25,000. Note: The fringe benefit tax continues to be payable for as long as the employee uses property for personal use and/or business use. ACCOUNTING ENTRIES Accounting entries shall be classified as follows: 1. Taxable benefits paid for in cash or in kind 2. Taxable benefits which do not involve payment of cash or transfer of property 3. Exempt benefits paid for in cash or in kind 4. Exempt benefits which do not involve payment of cash or transfer of property Benefits paid for in cash or in kind Taxpayers shall record fringe benefits paid for in cash or in kind in their books as follows: Fringe benefit expense (monetary value) XXX Fringe benefit tax expense XXX Cash/Tax basis of property given XXX Fringe benefit tax payable XXx Illustration 1: Rental accommodation Moon Corporation paid P91,000 for the rental of a housing unit for the use of its president. Fringe benefit expense hewon. P 91,000 Fringe benefit tax expense . Club 3/0 24,500 Cash P 91,000 Fringe benefit tax payable 24,500 Fringe benefit tax = (P91,000 x 50%) x 35%/65% Illustration 2: Transfer of ownership over properties San Luis Company transferred ownership over a newly acquired investment property costing P1,200,000 as residence of its supervisory employee. The property has a zonal value of P1,300,000. Fringe benefit expense ahead on Fringe benefit tax expense (P1.3M x 35%/65%) P 1,200,000 Investment property 700,000 Fringe benefit tax payable P 1,200,000 700,000 396chapter 11 - Fringe Benefit Tax Benefits which do not involve payment of cash or properties maxpayers shall record fringe benefits without outflow of cash or properties In their books as follows: Fringe benefit expense ( monetary value) Fringe benefit tax payable XXX XXX Illustration 1: Free Usage of Assets cutalac Inc. designated a unit of its condominium property for the use of its vice president for finance as his family residence. The rental value of the unit for the past calendar quarter would have been P260,000 Fringe benefit tax expense P 70,000 Fringe benefit tax payable P 70,000 Fringe benefit tax = (P260,000 x 50%) x 35%/65% Note that the employer is not allowed to claim fringe benefit expense. A deductible expense needs to be an actual outflow or depletion of resources. Anyway, the employer can claim depreciation expense if the property is an ordinary asset. In case of capital asset where no depreciation is allowable, fringe benefit tax rules shall not inappropriately allow the claim of deduction. The rules of deductions will be explained in Chapter 13. Illustration 2: Interest free loans Kalamansig, an oil exploration company, granted a P1,000,000 interest-free loan to a non-resident managerial employee. The following entry shall be made every quarter after the loan issue: Fringe benefit tax expense P 10,000 Fringe benefits tax payable P 10,000 Fringe benefit tax = (P1,000,000 x 12%/4] x 25%/75% Note also that the interest expense is not recognized as a fringe benefit expense because it is not an expense involving actual payment or transfer of properties. Exempt benefits paid for in cash or in kind The taxpayer shall record exempt fringe benefits paid in cash or in kind as follows: Fringe benefit expense (monetary value) room XXX Cash/Property given XXX Mlustration: Exempt fringe benefits An employer paid P120,000 for the tuition fee of his supervisor who is taking an advancement course in furtherance of the employer's business. Fringe benefit expense P 120,000 P 120,000 Cash 397Chapter 11 - Fringe Benefit Tax Exempt benefits which do not involved transfer of cash or property Illustration: Exempt free use of property banga is allowing its plant manager to use a residential property nearby its processing plant to ensure the manager's close monitoring of the production processes, The rental value of the property is P40,000 a month. No entry is required. Integrated Illustration 1 Tagum Miners Marketing Cooperative (TMMC) furnished its managerial employees a car plan wherein HMMC will purchase cars of their choice worth P1,300,000. 40% of the purchase price will be deductible against future salaries of the employee. HMMC purchased a car for its sales manager. P 520,000 Advances to officers (P1.3M x 40%) Fringe benefit expense (P1.3M x 60%) 780,000 Fringe benefits tax expense (780K x 35%/65%) 420,000 P1,300,000 Cash Fringe benefits tax payable 420,000 Note: The fringe benefit is taxable even if provided by an exempt employer (i.e. cooperative, non- profit or government agency) because the tax is imposed upon the employee not upon the employer. Integrated Illustration 2 Jose Abad Santos Residences Corporation transferred ownership over one of its residential property inventories to its vice presidents a consideration of P450,000. The property was acquired for P2,000,000 but has a fair value of P2,400,000 at date of transfer. The fringe benefits expense shall be measured at the actual cost of the property given by the employer but the fringe benefit tax shall be measured at the monetary value of the benefit (P2,400,000 fair value - P450,000 received). Hence, Cash P 450,000 Fringe benefits expense (P2M - P450K) 1,550,000 Fringe benefits tax expense Inventory 1,050,000 Fringe benefits tax payable P2,000,000 (P2.400,000 - P450,000) x 35%/65% 1,050,000 Tax Treatment of the Total Fringe Benefit Expense The total fringe benefit expense including the fringe benefit tax expense is a deductible expense of the employer against his gross income in the computation of his taxable income. It must be noted that a deductible fringe benefit expense exists only when the benefit is paid in cash or in kind. The expense is measured at the actual cost or tax basis of consideration given as fringe benefits. 398

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts