Question: Hello, Can you walk me through the step by step solution to question #10 on 'Connect' Questions and Problems? I having a hard time calculating

Hello,

Can you walk me through the step by step solution to question #10 on 'Connect' Questions and Problems? I having a hard time calculating Operating Cash Flow.

Update:

It is question #10 of Chapter 2 in the Corporate Finance 11E textbook.

I need help with 8, 9, and 10. thanks

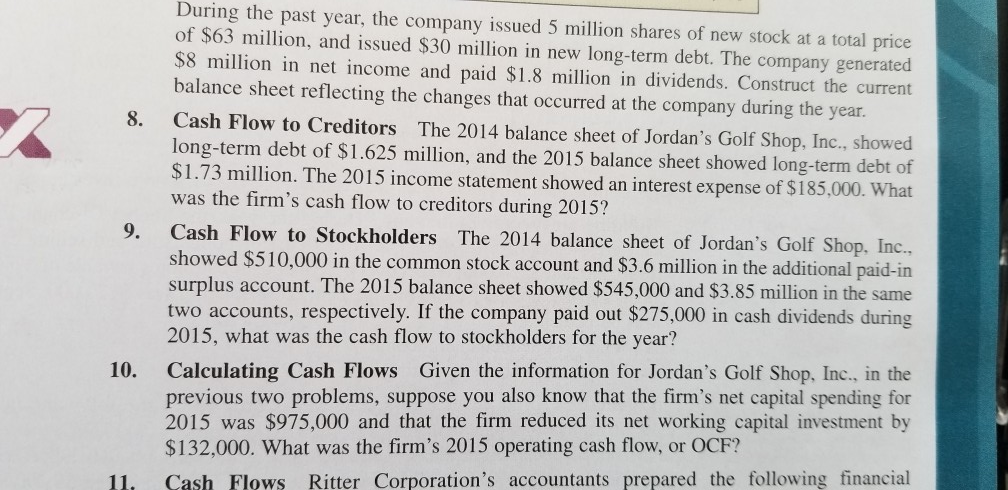

During the past year, the company issued 5 million shares of new stock at a total price of $63 million, and issued $30 million in new long-term debt. The company generated $8 million in net income and paid $1.8 million in dividends. Construct the current balance sheet reflecting the changes that occurred at the company during the year. Cash Flow to Creditors The 2014 balance sheet of Jordan's Golf Shop, Inc., showed long-term debt of $1.625 million, and the 2015 balance sheet showed long-term debt of $1.73 million. The 2015 income statement showed an interest expense of $185,000. What was the firm's cash flow to creditors during 2015? Cash Flow to Stockholders The 2014 balance sheet of Jordan's Golf Shop, Inc., showed $510,000 in the common stock account and $3.6 million in the additional paid-in surplus account. The 2015 balance sheet showed $545,000 and $3.85 million in the same two accounts, respectively. If the company paid out $275,000 in cash dividends during 2015, what was the cash flow to stockholders for the year? Calculating Cash Flows Given the information for Jordan's Golf Shop, Inc., in the previous two problems, suppose you also know that the firm's net capital spending for 2015 was $975,000 and that the firm reduced its net working capital investment by $132,000. What was the firm's 2015 operating cash flow, or OCF? Cash Flows Ritter Corporation's accountants prepared the following financial 10. 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts