Question: Hello, could I please get some help with this question! Thank you!! A company is considering a project that will last for 4 years with

Hello, could I please get some help with this question! Thank you!!

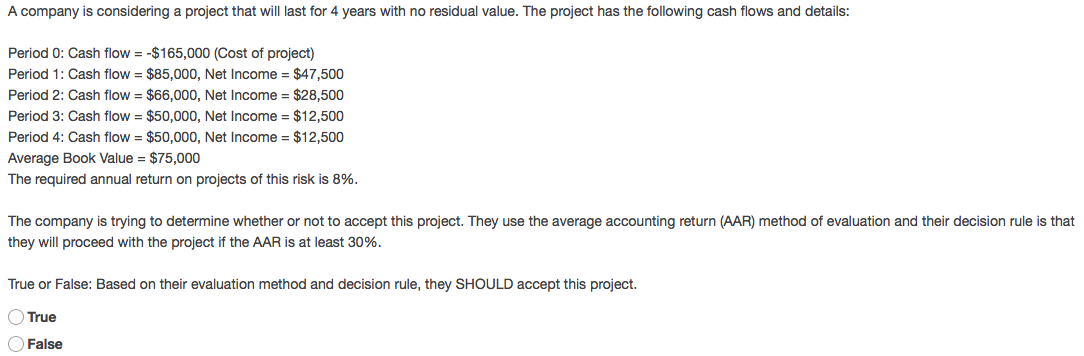

A company is considering a project that will last for 4 years with no residual value. The project has the following cash flows and details: Period 0: Cash flow = -$165,000 {Cost of project) Period 1: Cash flow = $35,000, Net Income = $47,500 Period 2: Cash flow = $66,000, Net Income = $28,500 Period 3: Cash flow = $50,000, Net Income = $12,500 Period 4: Cash flow = $50,000, Net Income = $12,500 Average Book Iil'alue = $26,000 The required annual return on projects of this risk is 8%. The company' Is trying to determine whether or not to accept this project. They use the average accounting return {AAR} method of evaluation and their decision rule is that they will proceed with the project if the MR is at least 80%. True or False: Based on their evaluation method and decision mle, the}:r SHOULD accept this project. (Z) \"\"3 (Z) False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts