Question: hello :) could somebody please answer the question and please with every formular and all steps so I understand the concept thank you!! A mutual

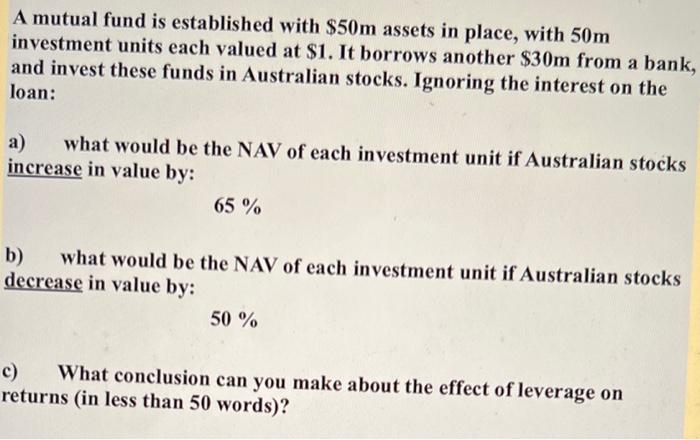

A mutual fund is established with $50m assets in place, with 50m investment units each valued at $1. It borrows another $30m from a bank, and invest these funds in Australian stocks. Ignoring the interest on the loan: a) what would be the NAV of each investment unit if Australian stocks increase in value by: 65 % b) what would be the NAV of each investment unit if Australian stocks decrease in value by: 50 % c) What conclusion can you make about the effect of leverage on returns (in less than 50 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts