Question: HELLO :), COULD SOMEONE PLEASEEE EXPLAIN TO ME IN A DETAILED AND EASY WAY WHY IS THE OPTION HIGHLITED IN YELLOW THE CORRECT ANSWER. I

HELLO :), COULD SOMEONE PLEASEEE EXPLAIN TO ME IN A DETAILED AND EASY WAY WHY IS THE OPTION HIGHLITED IN YELLOW THE CORRECT ANSWER. I AM HAVING A HARD TIME ON UNDERSTANDING AND SOLVING THIS. I AM STUCKED BECAUSE I DONT KNOW HOW TO CONTINUE. THE SOLUTION IN RED IS WHAT I HAVE SO FAR. PLEASE, HELP ME! THANK YOU SO MUCH IN ADVANCE!!!

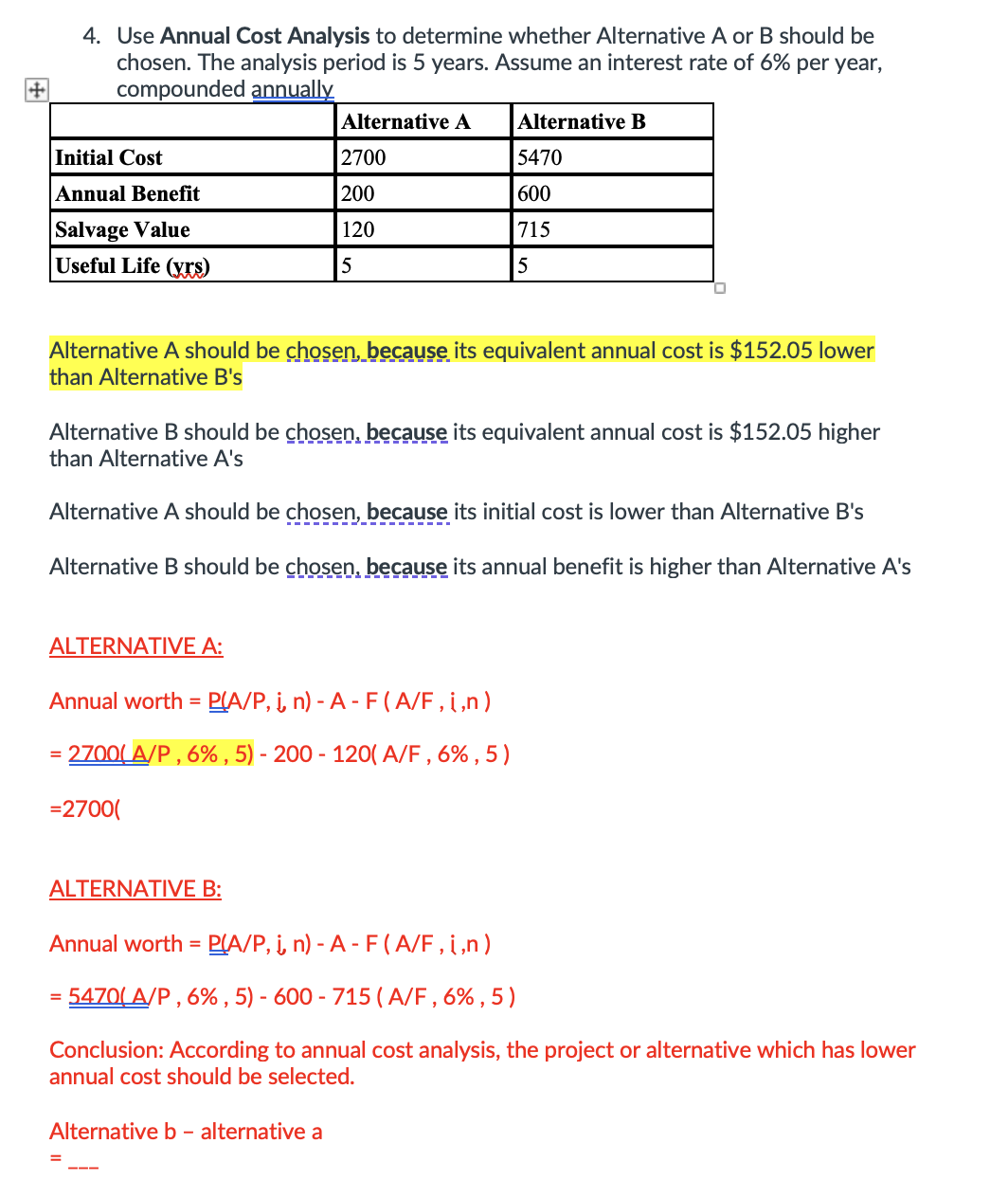

4. Use Annual Cost Analysis to determine whether Alternative A or B should be chosen. The analysis period is 5 years. Assume an interest rate of 6% per year, combounded annuallv Alternative A should be chosen, because its equivalent annual cost is $152.05 lower than Alternative B's Alternative B should be chosen, because its equivalent annual cost is $152.05 higher than Alternative A's Alternative A should be chosen, because its initial cost is lower than Alternative B's Alternative B should be chosen, because its annual benefit is higher than Alternative A's ALTERNATIVE A: Annualworth=P(A/P,in)AF(A/F,i,n)=2700(A/P,6%,5)200120(A/F,6%,5)=2700 ALTERNATIVE B: Annualworth=P(A/P,i,n)AF(A/F,i,n)=5470(A/P,6%,5)600715(A/F,6%,5) Conclusion: According to annual cost analysis, the project or alternative which has lower annual cost should be selected. Alternative b - alternative a =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts