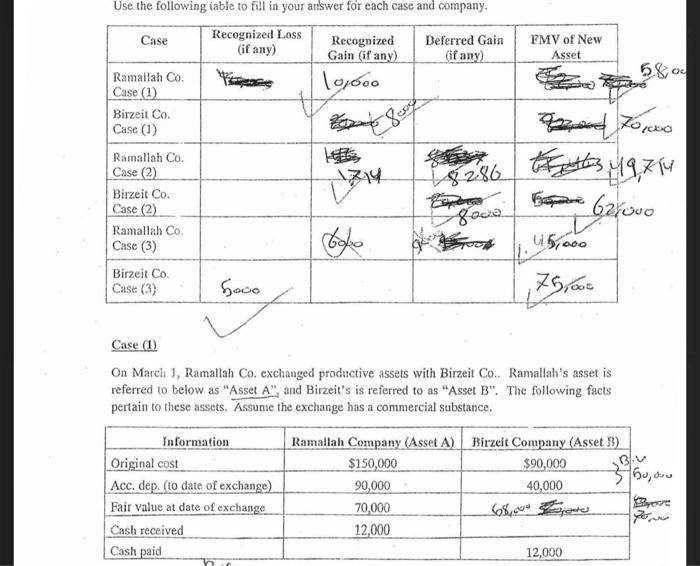

Question: Hello, could you explain me why in case 3 (6,000 and 9,000) is wrong and what is the correct answer FMV of New Asset 580

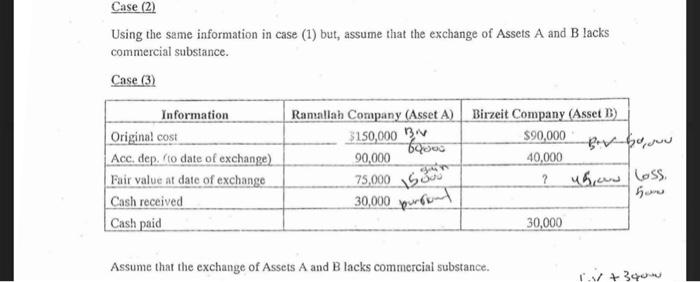

FMV of New Asset 580 O od 70,000 Use the following iable to fill in your answer for each case and company. Recognized Loss Case Recognized Deferred Gain (if any) Gain (if any) (if any) Ramallah Co. 10ooo Case (1) Birzeit Co. Case (1) Ramallah Co. Case (2) AZY Birzeit Co. pers Case (2) Ramallah Co. Case (3) Birzeit Co Case (3) hooo 48286 attes 19,714 5 621000 8.00 45,060 75,000 Case (1) On March 1, Ramallah Co. exchanged productive assets with Birzeit Co.. Ramallah's asset is referred to below as "Asset A", and Birzeit's is referred to as "Asset B". The following facts pertain to these assets. Assume the exchange has a commercial substance. . 150,dou Information Original cost Acc. dep. (to date of exchange) Fair value at date of exchange Cash received Cash paid Ramallah Company (Asset A) Birzeit Company (Asset }}) $150,000 $90,000 90,000 40,000 70,000 12,000 12,000 Case (2) Using the same information in case (1) but, assume that the exchange of Assets A and B lacks commercial substance. Case (3) Ramallah Company (Asset A) 3150,000 3 90,000 6406 Information Original cost Acc. dep. Ko date of exchange) Fair value at date of exchange Cash received Cash paid Birzeit Company (Asset D $90,000 Burbuje 40,000 2 45,ouw loss. how 75,000 30,000 burro 30,000 Assume that the exchange of Assets A and B lacks commercial substance. 1+340

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts